SYGNIA 4TH INDUSTRIAL REVOLUTION GLOBAL EQUITY FUND

The global equity fund aims to provide investors access to new technology and innovation stocks and deliver long-term capital growth.

Fund manager insights

At the inception of global lockdowns intended to curb the rapid spread of the coronavirus in the first quarter of 2020, Intel’s CEO Bob Swan penned a letter to the multinational tech company’s customers, saying “we are witnessing what will surely be remembered as a historic deployment of remote work and digital access to services across every domain”.

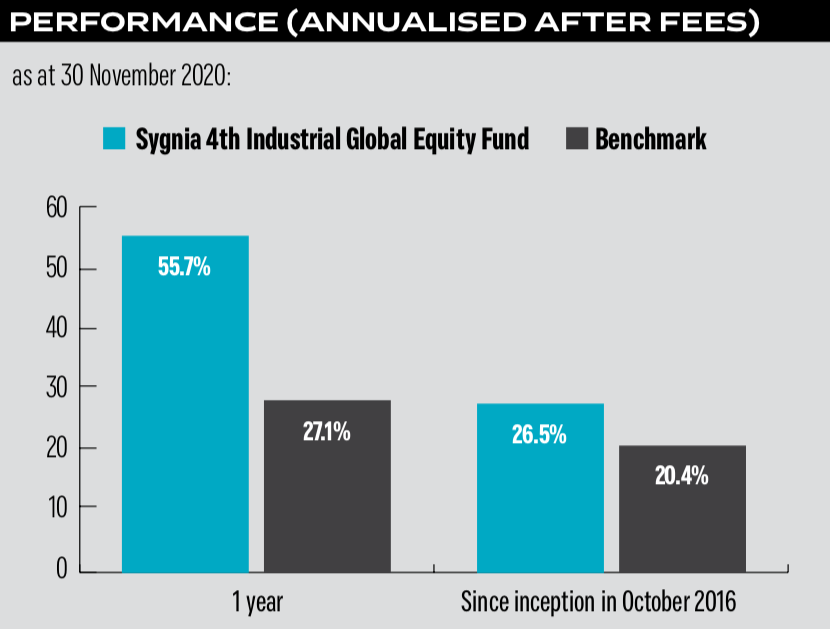

Throughout 2020, a multiplicity of data continuously indicated that the world had leaped years forward in consumer and business digital adoption, which was also witnessed in the overperformance of tech stocks.

Sygnia Asset Management’s 4th Industrial Revolution (4IR) Global Equity Fund, a high-risk, passively-managed fund, offers investors access to global companies positioned to benefit from new technologies and innovations.

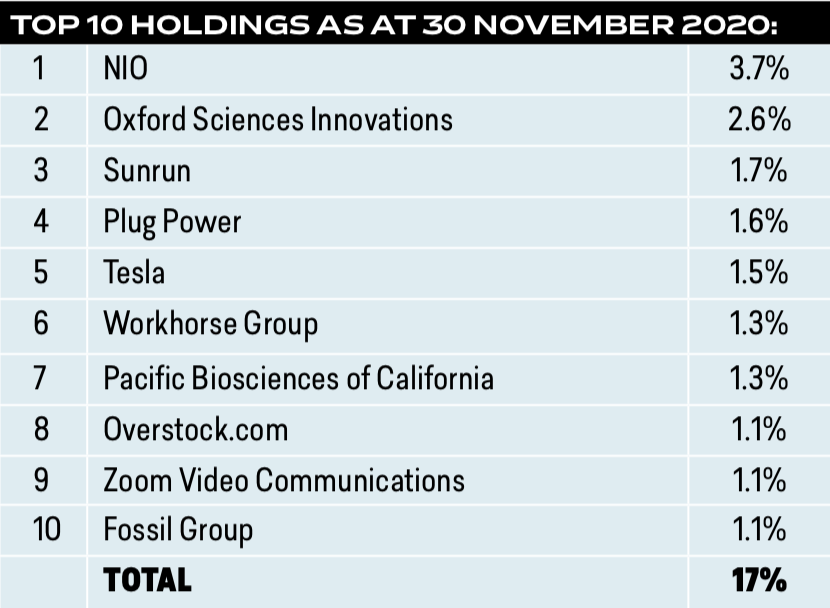

Its current holdings comprise new kid on the block Zoom (listed April 2019, with one-year returns of 374.72%), Oxford Sciences Innovations (OSI) and Tesla, among others. The fund invests into shares as prescribed by S&P Kensho, the index most involved with the shaping of the future and 4IR, explains Kyle Hulett, head of investments, and Wessel Brand, one of the fund’s managers.

Covid-19 forced a step-change in the acceptance of new technologies, benefitting several companies, they say. The S&P Kensho New Economies Composite Index is designed to measure the performance of companies involved in the 21st century new economies sectors such as clean power, human evolution (think wearables, robotics and 3D printing) and smart transportation (electric vehicles).

The fund’s second-largest holding, OSI – a joint venture between Oxford University and private sector asset managers – has produced two Covid-19 vaccine candidates, for example. The venture is closely linked to the Oxford/ AstraZeneca vaccine through OSI’s portfolio company Vaccitech.

Inasmuch as the fund is exposed to prospects not available in the local market for SA investors, Hulett and Brand note that it is a long-term investment, and that “investors should not try to time entry into the fund”.

Why finweek would consider adding it

The strengthening of the rand since the second half of 2020 and at the time of publication makes the current period an opportune time to build up a portfolio with offshore exposure to tech companies involved in pioneering products and services.

Publications

Publications

Partners

Partners