IN REACTION to an article in Fin24's Personal Finance section on how to save on tax by diversifying on retirement savings, Fin24 user Johann Kassier raised some aspects with which he did not agree.

He wrote:

I refer to your article Save on tax by diversifying your retirement savings. This article is misleading.

If you do the calculations, you will find exactly the opposite to what is being concluded in the article.

The only benefit of not investing in retirement annuities (RAs) is that you can choose to invest offshore, and thus limit exposure to South Africa.

However, in terms of less tax or more net wealth, the conclusion reached is "nonsense". I suggest Fin24 quickly corrects this before it misleads too many readers as they make their retirement decisions come February 2018.

Danie Venter, a Certified Financial Planner and advisory partner at Citadel Investment Services (who is the expert quoted in the original story) responds:

I agree with you that the conclusion and the heading should have been made more accurately and I apologise for that.

The heading only focuses on the fact illustrated below, whereas the net of tax income is similar as addressed in the article.

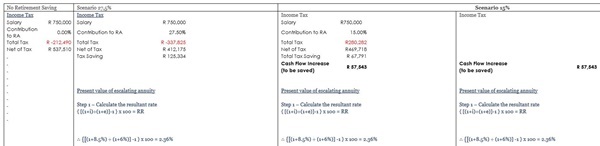

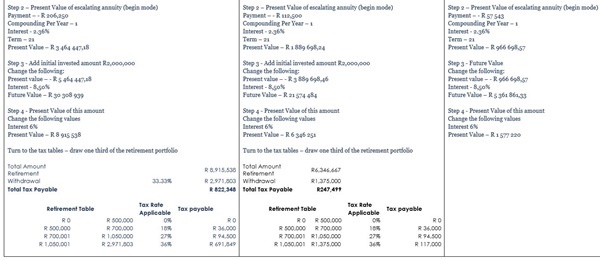

Scenario 1 – 27.5% contribution to RA

Applying the retirement table investors pay away at retirement R822 348.

Scenario 2 – 15% saving and R57 543

Applying the retirement table investors pay away R247 499.

The conclusion should have highlighted and drawn more attention to the restrictions applicable to retirement vehicles and the potential that global investments would provide higher returns given the currency impact.

Bear in mind that these models are based on fixed assumptions and cannot include all differentials such as splitting discretionary capital between spouses and using other structures to reduce the tax impact:

* Sign up to Fin24's top news in your inbox: SUBSCRIBE TO FIN24 NEWSLETTER

Publications

Publications

Partners

Partners