Nothing in life is certain, except death and taxes, is the oft-quoted (or paraphrased) line originally written by Benjamin Franklin in 1789.

In between paying taxes and the finality of shuffling off this mortal coil, life will hit most of us with a host of uncertainties.

And it’s exactly these uncertainties that we try to avoid through, for example, taking out insurance products or medical aid – often at what feels like astronomical costs.

“Keeping a budget feasible can be complicated,” warns head of research and development at Discovery Health, Deon Kotzé. This is particularly true “when it comes to the assessment of overall insurance arrangements (including life insurance and motor and household insurance) relative to other priorities.”

finweek spoke to some industry experts about weighing up your priorities and the costs associated with them when it comes to your medical aid and insurance coverage.

MEDICAL AID

Arguably one of the most important aspects of your life that needs to be covered is your and your family’s health.

In South Africa, the cost of private healthcare – for those in a position to afford it – is a non-negotiable line item in the monthly budget.

At present, about 8.8m South Africans are in a position to afford private healthcare, according to Jillian Larkan, head of health consulting at GTC.

But budgets are being stretched to the limit in the current economic climate – and medical aid doesn’t come cheap.

Consumers that are already feeling the effects of a 1% VAT increase and runaway fuel prices will likely feel the pressure of having to meet their monthly expenditure requirements.

So, as consumers review their medical aid contributions for 2019, now is as good a time as any to take a holistic view of your overall life coverage to make sure you are not going to fall short financially.

Calculating the costs

Advising consumers on how much of your income to put towards medical aid is difficult, says Larkan, but “for the general South African on medical aid, I would say up to 10% of your salary, for the whole family…

This is a huge expense for many households, and remains a grudge purchase, with many people reaching the end of the year having not been hospitalised, feeling as though they have wasted their money for another year.”

Larkan’s advice for selecting cover is to choose a plan which suits your lifestyle right now. “Cover what is required. Don’t try to take out a plan which covers every eventuality which might happen to you. These are expensive and you will most likely not require all of the benefits available.”

A hospital plan, for example, is suitable for a single, healthy, younger individual “for as long as the member continues to take care of themselves, eats healthy and follows an active lifestyle, while at the same time remaining single.

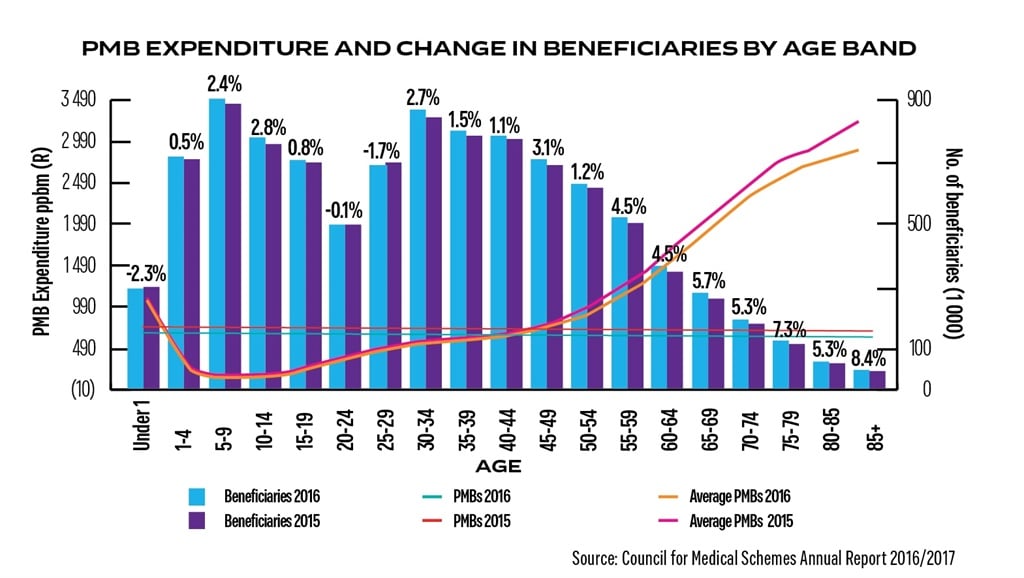

I would say somewhere between 45 and 49 is the time when [the level of cover] will require more attention, and the single member may need to consider upgrading their out-of-hospital cover to take into account the increase in spend in the latter years of their life.

The upgrade which the member would or could consider may be to a savings plan, or all the way to the top of the scale, being a comprehensive plan,” says Larkan. (See graph on p.33.)

Tony Singleton, CEO of Turnberry Risk Management Solutions, explains that medical aid contributions need to form part of your overall financial planning.

“You get what you pay for,” says Singleton. “If you are taking a low-cost medical aid option, for whatever reason, the chances are that you are going to be exposed to some additional costs. For example, a hospital plan covers in-hospital expenses and typically comes cheaper than other options. But you are going to be exposed to the costs of all your GP visits and other incidental costs.”

Singleton reiterates that you don’t want to be forced into making a financial decision when you are dealing with your or a family member’s health.

You don’t want to be put into a situation where you need to look at taking a personal loan or cashing in an investment to cover medical costs.

In this vein, it is essential to assess your health status and choose a medical aid option that will make provision for your and your family’s healthcare needs, says Bafihlile Mokoena, communication specialist: public relations & corporate social investment at Bestmed.

If you are looking to reassess your coverage, now is a good time. Towards the end of the calendar year, medical schemes offer members the opportunity to upgrade to plans with greater benefits, an opportunity that doesn’t typically exist at any other time during the year, says Discovery’s Kotzé.

If you do decide to take up the opportunity to upgrade, you will not be subject to waiting periods, adds Larkan.

Mind the gap

According to Mokoena, gap cover is designed to pay the shortfall between what your medical scheme pays and what service providers charge.

“There are so many instances which are limited by the medical aid networks and costs due by members for using service providers outside of these networks that members are left out of pocket on many occasions,” explains Larkan.

“Members then revert to their brokers, wondering why they were sold products which purport to cover 100%, only to find they misunderstood the concept and have 100% of scheme rate covered, and not 100% of costs covered.”

To illustrate, Singleton explains that your medical aid plan might, for example, provide you with in-hospital cover, but would require that you need to go to a designated service provider (DSP) that is part of the medical scheme’s network.

“If you go to the DSP, the scheme will pay 100% of the scheme’s rate, but if you do not go to a DSP, your medical practitioner will typically charge three or four times that rate.”

Kotzé adds that gap cover is not a medical scheme product. “It is an insurance policy that is sold separately from medical schemes, and provides the policyholder and their family with defined cover for medical expenses that are not covered in full by their medical scheme.”

The most common expense shortfalls relate to hospital admission, he says.

According to Larkan and Mokoena, you should consider a top-up/gap policy immediately after joining a medical aid as a support structure for in-hospital medical expense shortfalls to avoid being left out of pocket.

Many of these policies, says Larkan, “provide benefits such as enhancements on biological drug benefits, first-time cancer diagnosis lump sums, emergency ward, casualty room and trauma counselling benefits.”

Your private healthcare and NHI

While it has been suggested that the implementation of the National Health Insurance (NHI) could result in stabilising healthcare costs, there has been concern about government’s ability to efficiently implement NHI.

The important question for many consumers, however, is whether they will still have the financial responsibility of private medical healthcare once the NHI has been implemented.

The short answer: yes.

According to Larkan, the department of health has made it clear that private healthcare will continue to be required, as a top-up to the benefits which it provides in the public sector.

“I believe there will continue to be a place for private healthcare in South Africa, just like in many other developing countries around the world, at least until such time as all private healthcare members are satisfied with the level and quality of care, and benefit available in the public system is at least equal to or exceeds that available in the private sector.”

Shreekanth Sing, technical legal adviser at PSG Wealth, agrees that medical schemes will continue after the introduction of NHI. On whether they would be required “would greatly depend on two aspects: how the final implemented version of NHI would look and what your personal circumstances would be.”

Life insurance

Over and above taking care of your health and medical expenses you may face, it is also important to consider that there are certain events that may affect your ability to earn an income and meet your financial obligations.

It’s worth starting young

“When buying risk cover, and especially when you’re young and healthy and very insurable, you would want to maximise cover on offer if you have the affordability – even if it is more than what your needs analysis indicates, as it is so easy to become uninsurable or have health problems which would mean health loadings or exclusions,” says Kobus Kleyn, certified financial planner at Liberty.

Sing agrees, adding that “obtaining life cover is likely to be cheaper when you are younger and healthier, compared to the cost of doing so later on in life (this is based on the risk and likelihood of mortality assessment – your risk of death increases the older you become).”

Kleyn does point out that once you have settled on the product and cover, it is critical “to be wide awake to what is referred to as premium patterns and escalations”.

Depending on your objectives, he explains that the manner in which your policy will increase annually due to benefit increases could end up making your policy unaffordable – and you may not need those benefits.

“Be very careful and make sure there are flexible options.”

Making sure you stay covered

Both Sing and Kleyn emphasise the importance of annual financial reviews on your long-term financial plans, including life cover.

“This does not mean you need to adjust or amend benefits annually, but it could just confirm that there are no obvious benefit shortfalls,” says Kleyn.

“In my opinion, it is not about how often, but rather with consideration to life-changing events like career changes, matrimonial changes, addition or loss of dependents, promotions etc. If you do not have annual reviews, then I would reckon at least every five years would require a good look at the suitability of the cover in place,” according to Kleyn.

Car and home insurance

As loathe as many consumers are to spend money on protecting the material things in their lives, it’s important to ensure your car and home are insured.

Shop around

When budgetary constraints are experienced, consumers can be tempted to slash insurance costs.

But Natasha Kawulesar, head of client relations at OUTsurance, advises that you should rather first “shop around before you consider reducing cover… Many consumers may be overpaying for insurance which they could replace at a significant monthly saving.”

When looking to buy short-term insurance, it’s understandable that consumers will place emphasis on the premium charged, but there are other important considerations, according to Kawulesar.

“While we agree that it doesn’t make sense to pay more than you should for quality cover, consumers must consider the product benefits such as excess structures, no-claims bonuses, roadside assistance and, importantly, the insurer’s reputation for handling claims.”

Your risk premium

As with medical aid and life insurance, you need to be sure that your short-term insurance coverage matches your needs and that you adjust your insurance accordingly.

When it comes to the regularity of valuing your house and contents insurance, this is very dependent on each individual’s aversion to risk, says Kawulesar.

“Some consumers may want this done annually, which is a good checkpoint. Not being adequately insured exposes you to risk and, in the event of a total loss, will mean you are unable to replace all your assets, which may impact your standard of living post-loss.”

It’s important to be very well-versed on your policy, and to ensure you understand exactly what is covered and what isn’t.

For example, with building insurance, there are exclusions such as a lack of maintenance of a property, says Kawulesar.

“The cost of private healthcare in South Africa is reported to be the highest in the world, with medical aid increases driven by medical aid and inflation,” says Bafihlile Mokoena, communication specialist: public relations & corporate social investment at Bestmed.

Tony Singleton, CEO of Turnberry Risk Management Solutions, says that some of the key drivers of medical inflation at this moment include:

1. The 1% VAT increase and its knock-on effect throughout the medical industry

2. Shortages of specialist doctors

3. New medical appliances and technologies coming at high cost to hospitals and specialists

4. Increase in the costs of medical supplies and pharmaceuticals

5. Increase in doctors’ indemnity insurance costs

“In South Africa, the problem is further aggravated by the rand-dollar exchange rate,” he adds.

According to Shreekanth Sing, technical legal adviser at PSG Wealth, medical aid schemes are expected to increase premiums for 2019 by an average of between 8% and 10%, compared to inflation of 4.9%.

This was in line with Discovery Health – SA’s largest open medical aid scheme – announcing between 8.9% and 9.9% increases, and Bestmed announcing an increase in its premiums of 8.9%.

Should wellness programmes play a role in your choice of medical aid?

The Medical Schemes Act of 1998 prohibits the provision of services other than that of medical aid, says Bafihlile Mokoena, communication specialist: public relations & corporate social investment at Bestmed.

In other words, wellness programmes are not administered by medical schemes. Simply put, by joining a medical aid, you don’t automatically become part of a wellness programme – you join it separately at a monthly fee.

For example, in the case of Discovery Health Medical Scheme, members can join Vitality, Discovery’s (not the scheme’s) wellness programme.

“It seems obvious, but people often overlook the fact that by looking after their health, they can reduce their healthcare costs in the long term,” says head of research & development at Discovery Health, Deon Kotzé.

Although loyalty programmes can encourage healthy living, being a member will not reduce your monthly medical aid contributions.

As Shreekanth Sing, technical legal adviser at PSG Wealth, points out, loyalty programmes can add many benefits with regards to lifestyle, but “start with medical cover to ensure you have the best plan you can afford, keeping in mind that paying for a loyalty programme so that you can have cheap flights won’t help you if your medical cover isn’t enough.”

This is an extract of the story that originally appeared in the 8 November edition of finweek. For the full story you can buy and download the magazine here. To receive weekly finweek stories, subscribe to our newsletter here.

Publications

Publications

Partners

Partners