A Fin24 user who has about R5m to invest wants to know how he can maintain a lifestyle which requires R60k. He writes:

We're about to sell our one property, and after having settled all debts should have around R5m to invest. I've been playing around with the idea of investing half in a higher risk type unit trust and the other half in something "safer".

We need around R60k per month to maintain our present lifestyle. What can you suggest?

Matthew Chapman and Mike Estment, a CFP® Professional and CEO at NFB Financial Services Group, respond:

As is always the case when providing financial advice, it is important to look at an investment recommendation in terms of the client’s entire portfolio. However, for the purpose of this exercise we will use the R5m in isolation and discuss the income requirement from this number.

The first thing to note is that a monthly drawing of R60 000 on a R5m portfolio represents a 14.4% annual drawing rate. Adding on the costs involved in investing, as well as annual inflation (6% plus at present) you would need your portfolio to return well over 20% per annum to sustainably draw such an amount, increasing annually in line with inflation.

The most important consideration you should take when investing in an income generating portfolio is the longevity of your money. We would therefore recommend a more cautious approach than the strategy you have suggested due to the income requirement.

Investing an amount of R5m when there is no income requirement is a completely different story. Splitting the allocation between growth (higher risk) and defensive (safer) assets may well prove a successful strategy, as you can ride out any potential market volatility and weakness, which may well be the case in the short term.

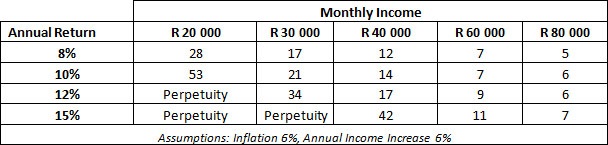

You may well need to drastically alter your income drawing rate or source income from other avenues, as at the drawing rate of R60 000 per month in an investment yielding a net 12% (which is a reasonably moderately-aggressive assumption) you would run out of income within ten years. See the matrix below for comparative longevity estimations.

Also again without full knowledge of your circumstances (age, tax profile, liquidity needs, other assets) it would be difficult to provide succinct advice. That being said, what we would typically look at is a split in the orientation of the assets with an income providing a portion and a ringfenced growth portion.

The income generating assets would be more defensively positioned in cautious to moderate type funds while the growth assets would typically be allocated to a more aggressive local and foreign equity-orientated funds/share portfolios, allowing maximum growth uncompromised by drawings.

You may also want to consider alternative investment products (as opposed to linked unit trusts) as well, which would provide varying tax and estate efficiencies, but any discussion over such recommendations would require an in-depth analysis of your full financial circumstances.

As this cannot be construed as formal financial advice, it would be in your interests to contact a professional, properly accredited and independent adviser who can tailor-make an investment plan for you.

- Fin24

Consider yourself a savings hero? Or just have something on your mind? Add your voice to our Savings Issue:

* Write a guest post

* Share a personal story

* Ask the experts

Disclaimer: Fin24 cannot be held liable for any investment decisions made based on the advice given by independent financial service providers.

Under the ECT Act and to the fullest extent possible under the applicable law, Fin24 disclaims all responsibility or liability for any damages whatsoever resulting from the use of this site in any manner.

We're about to sell our one property, and after having settled all debts should have around R5m to invest. I've been playing around with the idea of investing half in a higher risk type unit trust and the other half in something "safer".

We need around R60k per month to maintain our present lifestyle. What can you suggest?

Matthew Chapman and Mike Estment, a CFP® Professional and CEO at NFB Financial Services Group, respond:

As is always the case when providing financial advice, it is important to look at an investment recommendation in terms of the client’s entire portfolio. However, for the purpose of this exercise we will use the R5m in isolation and discuss the income requirement from this number.

The first thing to note is that a monthly drawing of R60 000 on a R5m portfolio represents a 14.4% annual drawing rate. Adding on the costs involved in investing, as well as annual inflation (6% plus at present) you would need your portfolio to return well over 20% per annum to sustainably draw such an amount, increasing annually in line with inflation.

The most important consideration you should take when investing in an income generating portfolio is the longevity of your money. We would therefore recommend a more cautious approach than the strategy you have suggested due to the income requirement.

Investing an amount of R5m when there is no income requirement is a completely different story. Splitting the allocation between growth (higher risk) and defensive (safer) assets may well prove a successful strategy, as you can ride out any potential market volatility and weakness, which may well be the case in the short term.

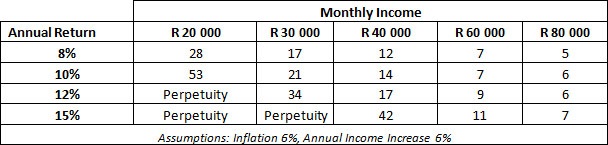

You may well need to drastically alter your income drawing rate or source income from other avenues, as at the drawing rate of R60 000 per month in an investment yielding a net 12% (which is a reasonably moderately-aggressive assumption) you would run out of income within ten years. See the matrix below for comparative longevity estimations.

Also again without full knowledge of your circumstances (age, tax profile, liquidity needs, other assets) it would be difficult to provide succinct advice. That being said, what we would typically look at is a split in the orientation of the assets with an income providing a portion and a ringfenced growth portion.

The income generating assets would be more defensively positioned in cautious to moderate type funds while the growth assets would typically be allocated to a more aggressive local and foreign equity-orientated funds/share portfolios, allowing maximum growth uncompromised by drawings.

You may also want to consider alternative investment products (as opposed to linked unit trusts) as well, which would provide varying tax and estate efficiencies, but any discussion over such recommendations would require an in-depth analysis of your full financial circumstances.

As this cannot be construed as formal financial advice, it would be in your interests to contact a professional, properly accredited and independent adviser who can tailor-make an investment plan for you.

- Fin24

Consider yourself a savings hero? Or just have something on your mind? Add your voice to our Savings Issue:

* Write a guest post

* Share a personal story

* Ask the experts

Disclaimer: Fin24 cannot be held liable for any investment decisions made based on the advice given by independent financial service providers.

Under the ECT Act and to the fullest extent possible under the applicable law, Fin24 disclaims all responsibility or liability for any damages whatsoever resulting from the use of this site in any manner.

Publications

Publications

Partners

Partners