- The first five months of 2020 appear to replicate a market cycle that would normally take five to seven years.

- When markets are unstable, establish your own stability.

- Keep a balanced mix of assets.

“You have to know you don’t know... and you have to know that you don’t know better than the market.”

I said this on the radio a few days ago when discussing investment markets and the futility of trying to predict events when making an investment decision. When the world is in a state of chaos and markets are changing direction faster than Donald Trump can Tweet, you need to establish your own stability. The best way to do this is to follow some basic investment principles.

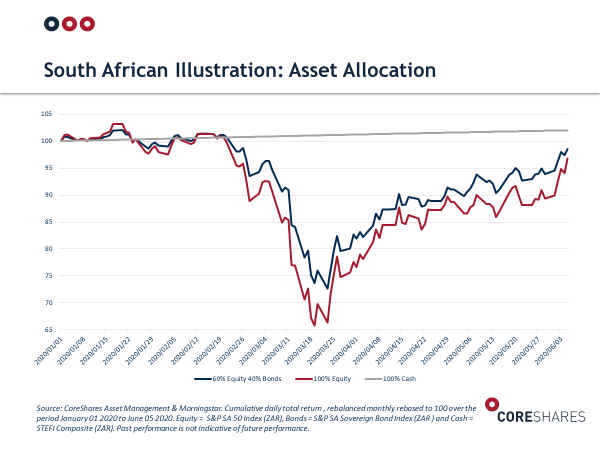

Have the correct asset mixI asked CoreShares to do some number crunching for me, to see what happened if I started 2020 with 100% of my money in cash and left it there till Friday 5 June. Then I looked at what happened if I had 100% in shares. I also wanted to see what happened if I had 60% invested in shares and 40% in bonds. The aim was to compare how a typical balanced portfolio would have performed during the crash and how it recovered during the first bounce.

No one knows if the markets have bottomed yet, so this is a live review of a market cycle. Astonishingly, the first five months of 2020 appear to replicate a market cycle that would normally take 5 to 7 years. The graphs below show what happened in this time. In summary, the balanced portfolio (blue line) lost less than the stock market (red line) and ended the period higher than the market. Cash (grey line) did almost nothing.

The point about a balanced portfolio is that it is simple to implement, it provides a good capital growth when markets are rising and it provides protection against some of the losses when markets are falling. You will still lose money in a down market, but your losses will be limited, and your recovery will be good. Investors who tried to anticipate markets by selling out during the crash have probably missed out on the massive recovery that we saw in April.

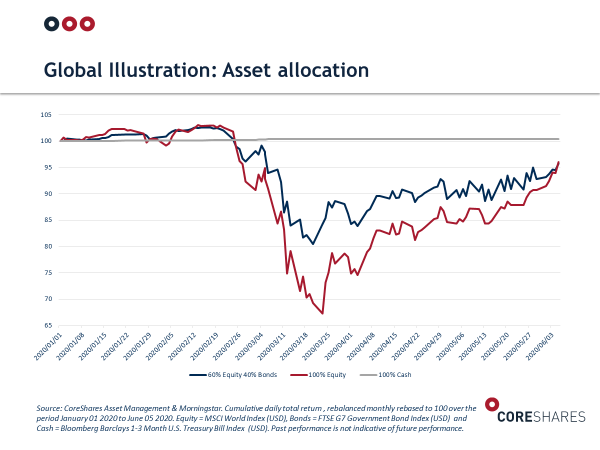

I also wanted to know if this pattern applies to overseas markets. We can see the results below, where the pattern looks similar. A balanced portfolio delivered about the same return as a pure equity portfolio, but the losses were also a lot less with the balanced portfolio.

You might wonder if there is any point in a balanced asset mix if the end result is going to be the same. I think there is a huge difference, especially if you need an income from your investments. It is important to remember that you would be drawing money from your portfolio every month and so if you can draw from a portfolio that loses a bit less than the stock market, you are giving your capital the best chance to recover from the losses.

That is why it is always better to sacrifice some potential growth if you can protect yourself from the worst losses of a market crash. With perfect hindsight, cash would have been the best investment since the start of 2020, but it was only marginally better than the other portfolios.

Unfortunately, cash will not be useful in protecting your capital against inflation when interest rates are likely to stabilize at 5% by the end of 2020. When markets are crazy and investors are panicking, it is often best to stick to the basics. That means, avoid timing the market, keep a balanced mix of assets and stop talking to your friends about investing.

The truth is that no one knows what is going on and they certainly do not know how things are going to pan out in the months ahead. What we do know, is that markets recover in the long term and investors who have good diversification and stay invested, generally perform better than almost everyone else.

Warren Ingram is a Director of Galileo Capital and hosts the HonestMoney Podcast.

Publications

Publications

Partners

Partners