A Fin24 user who is working on contract wants to know if she can belong to a provident fund.

Soré Cloete, senior legal advisor at Old Mutual, responds:

The short answer to your question is that you cannot belong to a provident fund, but you may belong to another retirement vehicle, namely a retirement annuity.

In answering the question, we will look at the different retirement funding vehicles.

We have three different retirement funding vehicles in South Africa, namely pension funds, provident funds and retirement annuities. These funds are governed by the rules of these funds, the Income Tax Act and the Pension Funds Act.

Employers may provide pension and provident funds to their employees and you need to be permanently employed to belong to one of these funds. While you do not have to be employed to be a member of a retirement annuity, it can be seen as a private pension fund that you purchase from an insurance company.

Benefits/features of the different retirement vehicles:

Pension funds:

* Currently your contributions are tax deductible up to certain limits. The higher of R1 750 or 7.5% of your retirement funding salary is tax deductible.

* Upon retirement you receive a third in cash and the balance must be used to purchase a compulsory income.

Provident funds:

* Currently only the employer’s contributions are tax deductible, but should an employee contribute such deductions will be used to increase their tax-free portion upon retirement.

* Until March 1 2015, you will be able to receive the full amount in cash upon retirement. After March 1 2015, the same rules will apply as with pension funds, which means you would only be able to take a third of the provident fund value in cash after that date.

The old rules (that is taking everything in cash) would however apply to the fund value accumulated before March 1 2015.

Retirement annuities:

* Currently your contributions are tax deductible up to certain limits. The higher of R1 750, R3 500 less allowable pension fund contributions or 15% of non-retirement funding income is tax deductible.

* Upon retirement/vesting of the retirement annuity you may receive a third in cash and the balance must be used to purchase a compulsory annuity.

* Retirement annuities have no maximum retirement age.

Other benefits:

* All the above funds are protected in the event of insolvency.

* Upon death, the full fund value may be paid in cash from all of the above funds and no estate duty is levied on these funds.

* No income tax or capital gains tax is payable on the growth in these funds, therefore the return is not influenced by these taxes.

* These funds are protected by legislation in terms of the type of underlying investments they should be placed in to avoid risky fund investments.

Tax implications upon death/retirement and withdrawal

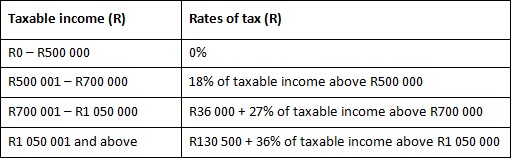

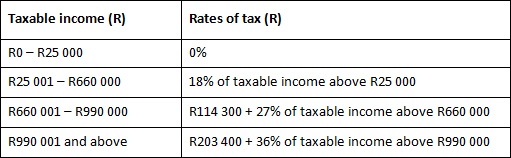

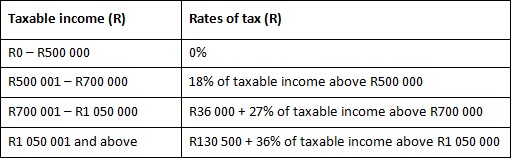

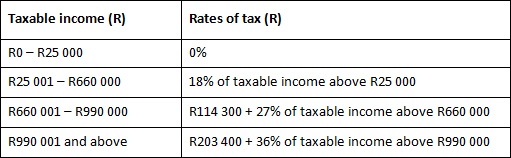

* Lump sums received from these funds are currently taxed according to the following tables:

(a) Death and Retirement:

(b) Withdrawal or resignation:

Where the taxpayer has made contributions that were not deducted for purposed of income tax, the net amount (after such deduction) will be taxed at the above tables. The above tables are aggregated with each event, which means that you would only be able to receive the R500 000 benefit (i e the first R500 000 being taxed at 0%) once.

The first R1 000 000 of your lump sum upon retirement is effectively taxed at just under 12%.

New proposals in terms contributions to retirement funds

As from March 1 2015, the current allowable tax deduction for member contributions to retirement funds will be amended. From that date, the maximum allowable contribution to all retirement funds (pension, provident and retirement annuity funds) will be the lesser of:

(a) R350 000 or

(b) 27.5% of the higher of a taxpayer’s remuneration or taxable income.

It is always a good idea to seek the advice of a professional and independent financial planner, registered with the FSB, to look at your specific circumstances and assist you with your retirement savings.

- Fin24

Do you have a pressing financial question? Post it on our Money Clinic section and we will get an expert to answer your query.

Disclaimer: Fin24 cannot be held liable for any investment decisions made based on the advice given by independent financial service providers.

Under the ECT Act and to the fullest extent possible under the applicable law, Fin24 disclaims all responsibility or liability for any damages whatsoever resulting from the use of this site in any manner.

Soré Cloete, senior legal advisor at Old Mutual, responds:

The short answer to your question is that you cannot belong to a provident fund, but you may belong to another retirement vehicle, namely a retirement annuity.

In answering the question, we will look at the different retirement funding vehicles.

We have three different retirement funding vehicles in South Africa, namely pension funds, provident funds and retirement annuities. These funds are governed by the rules of these funds, the Income Tax Act and the Pension Funds Act.

Employers may provide pension and provident funds to their employees and you need to be permanently employed to belong to one of these funds. While you do not have to be employed to be a member of a retirement annuity, it can be seen as a private pension fund that you purchase from an insurance company.

Benefits/features of the different retirement vehicles:

Pension funds:

* Currently your contributions are tax deductible up to certain limits. The higher of R1 750 or 7.5% of your retirement funding salary is tax deductible.

* Upon retirement you receive a third in cash and the balance must be used to purchase a compulsory income.

Provident funds:

* Currently only the employer’s contributions are tax deductible, but should an employee contribute such deductions will be used to increase their tax-free portion upon retirement.

* Until March 1 2015, you will be able to receive the full amount in cash upon retirement. After March 1 2015, the same rules will apply as with pension funds, which means you would only be able to take a third of the provident fund value in cash after that date.

The old rules (that is taking everything in cash) would however apply to the fund value accumulated before March 1 2015.

Retirement annuities:

* Currently your contributions are tax deductible up to certain limits. The higher of R1 750, R3 500 less allowable pension fund contributions or 15% of non-retirement funding income is tax deductible.

* Upon retirement/vesting of the retirement annuity you may receive a third in cash and the balance must be used to purchase a compulsory annuity.

* Retirement annuities have no maximum retirement age.

Other benefits:

* All the above funds are protected in the event of insolvency.

* Upon death, the full fund value may be paid in cash from all of the above funds and no estate duty is levied on these funds.

* No income tax or capital gains tax is payable on the growth in these funds, therefore the return is not influenced by these taxes.

* These funds are protected by legislation in terms of the type of underlying investments they should be placed in to avoid risky fund investments.

Tax implications upon death/retirement and withdrawal

* Lump sums received from these funds are currently taxed according to the following tables:

(a) Death and Retirement:

(b) Withdrawal or resignation:

Where the taxpayer has made contributions that were not deducted for purposed of income tax, the net amount (after such deduction) will be taxed at the above tables. The above tables are aggregated with each event, which means that you would only be able to receive the R500 000 benefit (i e the first R500 000 being taxed at 0%) once.

The first R1 000 000 of your lump sum upon retirement is effectively taxed at just under 12%.

New proposals in terms contributions to retirement funds

As from March 1 2015, the current allowable tax deduction for member contributions to retirement funds will be amended. From that date, the maximum allowable contribution to all retirement funds (pension, provident and retirement annuity funds) will be the lesser of:

(a) R350 000 or

(b) 27.5% of the higher of a taxpayer’s remuneration or taxable income.

It is always a good idea to seek the advice of a professional and independent financial planner, registered with the FSB, to look at your specific circumstances and assist you with your retirement savings.

- Fin24

Do you have a pressing financial question? Post it on our Money Clinic section and we will get an expert to answer your query.

Disclaimer: Fin24 cannot be held liable for any investment decisions made based on the advice given by independent financial service providers.

Under the ECT Act and to the fullest extent possible under the applicable law, Fin24 disclaims all responsibility or liability for any damages whatsoever resulting from the use of this site in any manner.

Publications

Publications

Partners

Partners