Simon Brown believes the worldwide low-inflation environment is here to stay.

I have been trying to understand where inflation has gone, especially in a world awash with cheap stimulus money. Many readers will be thinking that they have plenty of inflation in their monthly budgets.

On top of that, medical inflation is well ahead of general household inflation. This is the current reality because nobody spends according to the perfect Stats SA inflation basket. But a lot of things are also cheaper.

Consider the cost of internet access, which typically includes your data bill and the price of the device with which you access the web. The costs of both have been decreasing since we first started using the internet.

My first computer in 1995 cost me over R10 000. Today I can get a decent mobile phone, many times more powerful than that first computer, for the same price.

My internet dial-up bill in the late 1990s was over R3 000 per month; today I can get high-speed, always-on, uncapped fibre internet access for under R1 000. Twenty years ago, a flight to Cape Town cost me almost R4 000.

Now I can get on the plane for about R1 000, if I snag a special. The evidence is also clear. Inflation in developed markets – even in South Africa and some other emerging markets – has been on the wane.

Even the US had double-digit inflation in the 1970s and into the early 1980s. Yet now, it’s below 2% and, in SA, we have inflation at the lower end of the central bank’s target of 3% to 6% per year.

Back in 2008, when Ben Bernanke, then chair of the US Federal Reserve, was proposing massive stimulus to combat the global financial crisis, he said that inflation was the likely response and risk.

Yet, here we are: After three rounds of US quantitative easing and a pandemic stimulus package, there is still no inflation. So where has it gone, and is it likely to return? Where it went, is largely answered by productivity, technological advances and global supply chains. As workers got more productive, things became cheaper.

The risk to this is potential deflation. Cheaper goods mean there is more money to spend on other things. So, while some goods are cheaper, we have new ones to buy with the unspent money. Clothing became cheaper, as it is manufactured for less in the East. This brings me to supply chains.

Previously, goods we bought were mostly made relatively close to where we lived. Now they’re made relatively close to where we lived. Now they’re made anywhere in the world where the required quality can be produced at the cheapest price. Even our food is not all locally produced anymore.

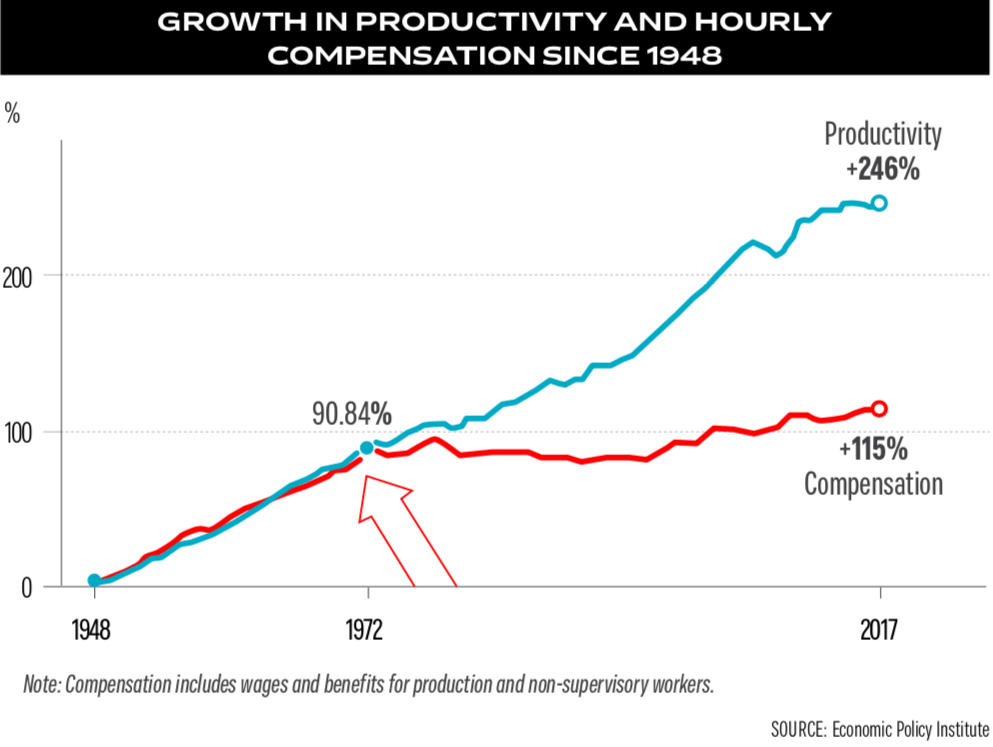

There is another important point to consider: As productivity has increased markedly over the last 40 years, wages have not increased by the same amount (see graph).

So, the amount of money chasing the cheaper goods remained constant and is not fuelling inflation. We have, however, seen some inflation during the last decade. But that has been in stock markets, as the 2008 bailout money went into markets rather than being spent by consumers.

Cash from the aforementioned pandemic stimulus package is, however, largely being spent; but this is replacing lost income for many, so it is again not adding to inflation. This leaves us in this odd situation of low global inflation. Inflation may rise a little, but I don’t think we’re likely to see double-digit inflation any time soon, if ever.

This is a difficult concept to wrap one’s head around, but the more I dig, the less likely high inflation seems. And this has implications.

Firstly: Low interest rates are here to stay and, equally, negative yields on sovereign bonds are also likely to remain. Secondly: We’ve also got to adjust our expectations for salary increases and portfolio returns. It’s a new world and, truthfully, mostly abetter one.

Publications

Publications

Partners

Partners