Why aren’t more local fund managers focusing on stocks elsewhere in Africa? The continent holds much potential, but governments must get one or two things right for a surge in local listings.

Africa is a continent rich in mineral resources, agricultural potential and human capital. Particularly the latter should be an enticing fact to set off an investment boom. According to a note published last year, the World Economic Forum indicated that by 2050, it is expected that two out of every five children born worldwide, will be in Africa. The continent is noticably somewhat of a last frontier for companies, ranging from consumer staples, finance, property and agriculture to mining and clean energy, for instance.

Unfortunately, the last decade has proven the opposite, since illiquidity on the continent (excluding South Africa in this article) stands in the way of luring large money managers from the US, UK, Japan and Europe to snap up stocks.

This situation is evident by only three specialist SA funds focussing on African equities outside SA. Government is also keen for more SA retirement savings finding its way into stock markets on the rest of the continent. Regulation 28 of the Pension Funds Act stipulates that 25% of funds can be invested offshore, excluding Africa, and 5% in Africa. With a retirement savings pool of about R2.99tr at the end of September 2020, according to the central bank’s Quarterly Bulletin, the potential allocation to African equities, should pension fund trustees reckon it is a good investment, would be R149.4bn.

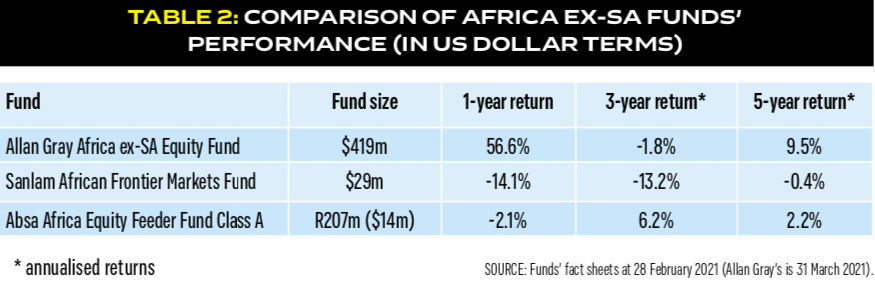

But this is not happening. “Africa ex-SA fund managers have become an endangered species with many funds closing in the past five years as global investors became disenchanted,” says Rory Kutisker- Jacobson, co-manager of the Allan Gray Africa ex-SA Equity Fund, with $419m under its management at the end of March. “The redemption and withdrawal of these funds have further exacerbated the liquidity issues in Africa ex-SA, and as in many shares, there is a dearth of buyers and a long list of sellers.”

Liquidity issues

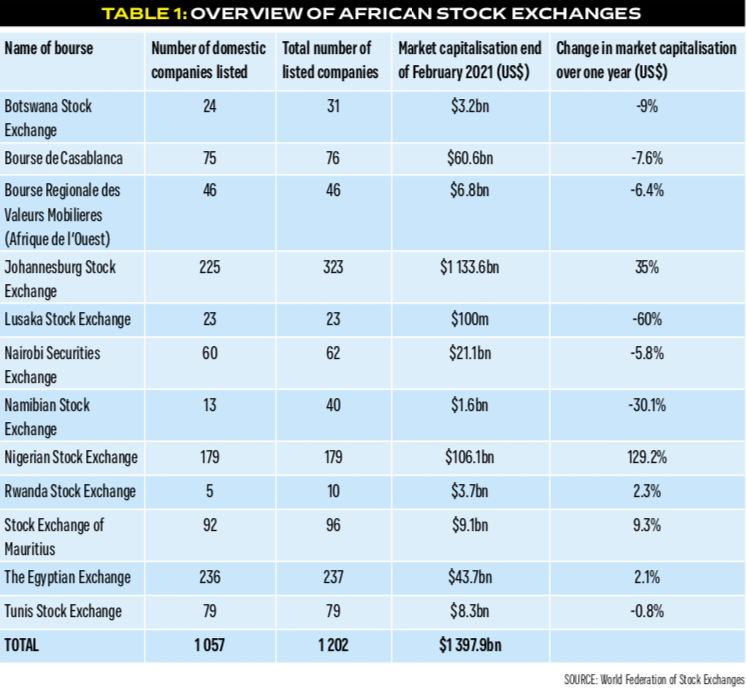

Godfrey Mwanza, head of Absa’s Africa equity franchise at Absa Asset Management, and manager of the Absa Africa Equity Feeder Fund, says that high interest rates, lack of product innovation and fixed exchange rates are the main reasons for low liquidity on African bourses ex-SA, particularly in Sub- Saharan Africa (see table 1 for an overview).

“Nigeria, for example, has close to $30bn in

pension assets and is growing,” Mwanza says.

“However, the stock exchange trades $10m on a

good day. This is because, historically, interest rates

have been so high that being in fixed income rather

than stocks has made more sense.”

When interest rates fall, he says, pension funds’ participation liquidity in the stock market increases. “Across the continent, fixed-income markets are more liquid than their equity counterparts.”

Mwanza uses Egypt as an example of how alack of product innovation can hamper liquidity. “In 2014, the Egyptian government used investment certificates (and nationalist rhetoric) to raise $8.4bn in one week from retail savers. The money was used to build the second Suez Canal. This country has very low bank penetration, so a lot of that money came from ‘under the mattresses’.” That showed there is “latent” savings available for investment in stock markets, if the right products are introduced to the market, Mwanza says.

Finally, fixed exchange rates contribute to illiquidity. “If you want consistent, albeit volatile, liquidity inflows and outflows of foreign portfolio investors, it helps to have a freely tradable exchange rate all the time,” says Mwanza. Fixed exchange rates, like you have in Nigeria, go through periods, like now or when oil prices crashed in 2014, when they are not freely tradable, he says. “And this keeps some foreign investors away, even in good times.”

A small pool

Low liquidity may also be the reason for the dearth of Africa ex-SA funds available to SA investors. The only ones are Allan Gray, Absa Asset Management and Sanlam’s $29m-under-management African Frontier Markets Fund (see table 2).

“Unit trusts require daily liquidity,” says Mwanza.

“Africa ex-SA markets can be illiquid, so there is a

mismatch that exists. Resultantly, the products (funds)

are more suited to institutions rather than individuals.”

Kutisker-Jacobson says the decline in the number of funds has opened opportunities for the remaining players in this field. “This sentiment and uncertainty also create massive opportunity for those with a longer-term perspective and the capacity to remain invested,” he says. “Valuations in many African markets are undemanding, with companies trading on single- digit multiples of depressed earnings. Ten years ago, investors were actively paying up for African exposure. Today, it is the reverse.”

Nevertheless, sentiment towards African markets governments fail to realise that it is these very controls that are actively discouraging foreign investors from entering and materially reducing the liquidity on their local markets.”

Performance and outlook

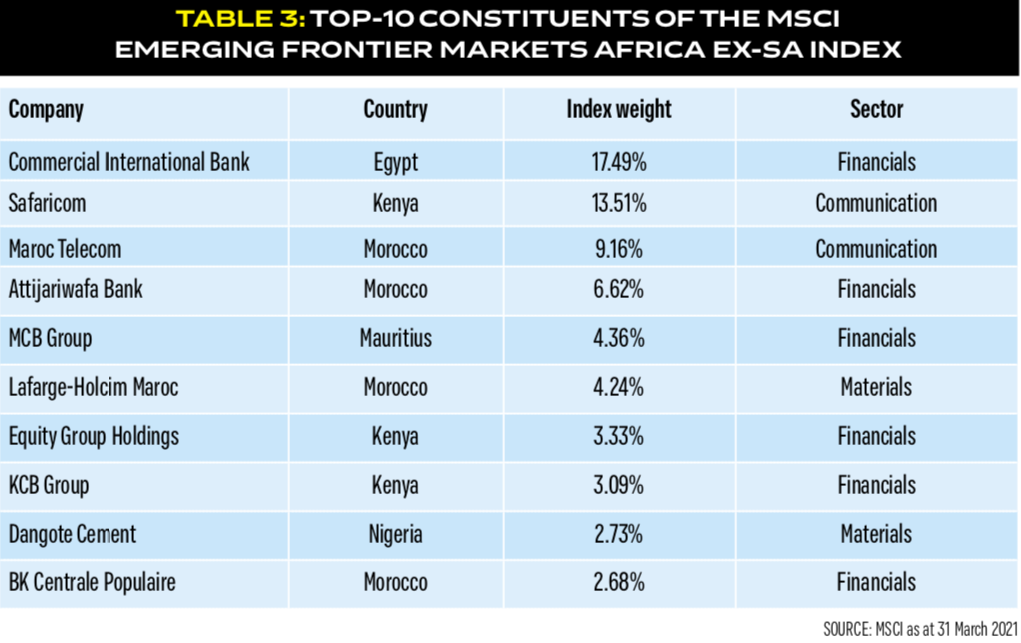

The MSCI Emerging Frontier Markets Africa ex-SA Index has returned 9.9% annualised since inception in May 2002 through the end of March 2021. Over a one-year term, it returned 30.2%, over three years an annualised -3.4%, and over five years an annualised 2.6% in dollar terms. The index tracks 32 companies from the continent, excluding SA, with their market caps ranging between $121.5m and $5.16bn (see table 3).

The index’s total market cap was $29.5bn at the end of March. The geographical spread sees

most assets allocated to Morocco (32.7%), Kenya

(21.9%), Egypt (21.5%) and Nigeria (13.8%). Financial

stocks dominate the index with an allocation of 48.5%,

followed by communication services at 26.5% and

consumer staples at 11.7%. Interestingly, for a resource-

rich continent, materials and energy constitute a

combined 10.4% of the index.

Why did this index perform so badly over the three- and five-year periods? “The answer is Nigeria,” says Mwanza. “Over five years, for instance, the broad markets for Morocco, Egypt and Kenya are all up relative to the benchmark [MSCI index]. The problem is Nigeria, which is down relative to the benchmark by close to 25%. These four markets make up over 90% of the benchmark.”

These lacklustre returns may have prompted questions about the attractiveness of African equity as an asset class, says Mwanza, and led to a shift towards “hard-currency African ex-SA bonds”. He says the index tracking these bonds returned 9.2% annualised over five years and 6.3% over three years.

Mwanza says going forward, the outlook for African ex-SA stocks is mixed. “We expect Egypt and Kenya to recover as we come out of the Covid-19 pandemic, while we expect Morocco to continue to do well.” Nigeria, according to him, is the “wild card” and its performance will be a function of exchange rate policy and, of course, oil prices, which “are both unpredictable”.

Kutisker-Jacobson says, given current valuations of African ex-SA stocks, “we are cautiously optimistic for the long-term return prospects of our African funds, particularly in comparison to many developed markets”.

The MVIS GDP Africa Index has about $55m of assets tracking this gauge. It includes 71 companies. The index is “designed to reflect the size of a country’s economy instead of the size of its equity market,” according to the index fact sheet. It also includes non-local companies that generate “at least 50% of their revenues in Africa”.

This means the exposure to SA stocks are 35.86%, while the rest of the continent constitutes 64.14%

of the index.

To be included in the index, companies must have a full market capitalisation of at least $150m, at least 250 000 shares traded per month over the last six months and a three-month average daily trading volume of at least $1m. This will understandably exclude the vast majority of the 1 057 local African-listed companies on WFSE-membered bourses (see table 1). The index has an 8% cap on constituent weightings.

The index’s largest non-SA constituents include the Kenyan telecommunications provider Safaricom (6.4%), the Moroccan lender Attijariwafa Bank (5.5%), the Moroccan telecoms company Maroc Telecom (4.8%), the Nigerian lender Guaranty Trust Bank (4.5%) and MTN Nigeria Communications (4%).

One of the exchange traded funds (ETFs) which tracks this index, is the VanEck Vectors Africa Index ETF. The fund has returned 25.4% over the past year in dollars and -2.72% annualised over the last three years. Over a five-year term, the New York-listed ETF, returned 7.51% annualised.

Publications

Publications

Partners

Partners