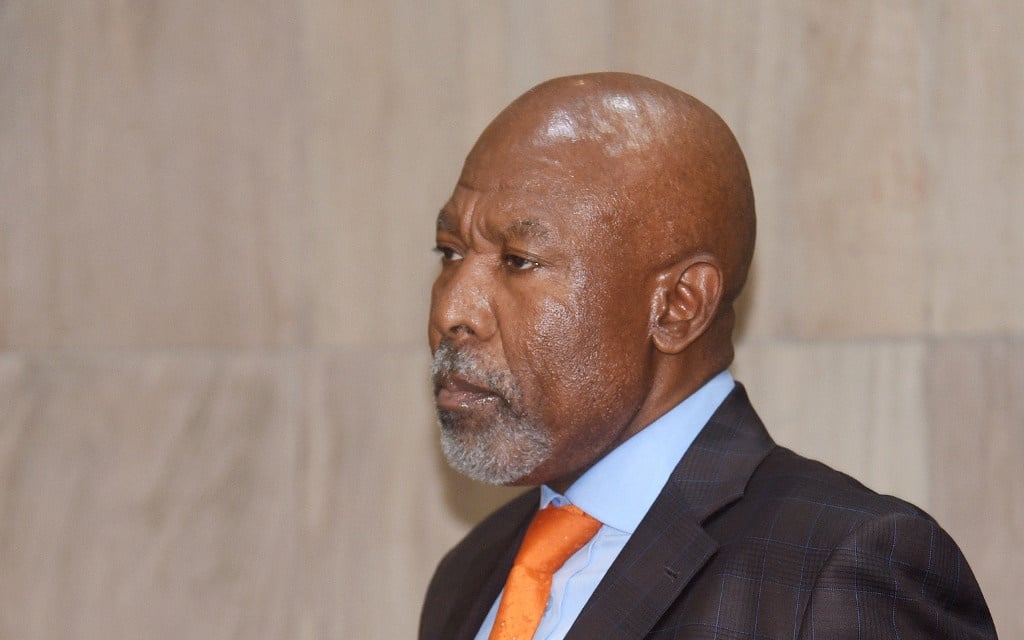

South Africa’s failure to rebuild the fiscal buffers it had in place when the global financial crisis struck has weighed on the country’s ability to respond to the coronavirus pandemic, Reserve Bank Governor Lesetja Kganyago said.

In April, the government announced a R500 billion support package aimed at reigniting economic growth and supporting those worst affected by a lockdown. That compares with a fiscal package of more than R800 billion in response to the global financial crisis, facilitated by a budget surplus and relatively low debt-to-gross domestic product ratio, Kganyago said Monday in an interview with radio station 702.

“If ever there was a case as to why you should build your buffers during the good times, that was it,” he said. “Instead of rebuilding our buffers, we continued to live life as if we were richer than what we were and that was the problem getting into this crisis. You could argue that compared to 2008 that is small, but that is what we have, that is the totality of the resources we have as a country.”

South Africa recorded its first budget surplus since democracy in 2007, and in the 2008 fiscal year, debt-to-GDP was 26.6%. The National Treasury predicted in February, before the country’s first virus case, that the deficit would swell to 6.8% of GDP and that debt will increase to 65.6% of GDP in the fiscal year through March 2021.

The central bank was able to respond to the virus with “significant boldness” because it had monetary policy buffers in place, Kganyago said. The Reserve Bank and its inflation-targeting mandate have often come under fire, especially as it became clearer over the past two years that the MPC aimed to get price growth anchored close to the 4.5% midpoint of the target band.

Lower borrowing costs

However, that approach to inflation meant that price growth has not broken the top of the target band in three years. The panel cut its benchmark interest rate by 275 basis points this year, the fifth-biggest downward move by global central banks, according to data compiled by Bloomberg.

The repurchase rate is now at 3.75%, the lowest level since it was introduced in 1998. The central bank also relaxed accounting and capital rules to release additional money for lending and tripled its holdings of South African government debt, helping to bring down borrowing costs in the domestic bond market.

The full impact of these policy measures are likely to filter through during the gradual and phased reopening of the economy, Kganyago said.

“The kind of steps that we have taken, and the totality of them being taken with so much speed are unprecedented in the history of the bank,” he said. “We have taken these steps within a space of three months and they were bold as far as we are concerned.”

While critics of the central bank and government accuse it of not doing enough to support an economy that fell into a recession even before the virus struck, “we have got to accept that any response has got to be based on the resources we have or resources we can generate,” Kganyago said.

Publications

Publications

Partners

Partners