The mini budget is not the platform for Finance Minister Tito Mboweni to announce tax increases; however, the new finance minister is a proponent of wealth tax, according to analysts.

The minister is set to deliver the mini budget on Wednesday October 24. The mini budget is intended to reflect government's policy position rather than to introduce any short term "tax stimulus", says Delia Ndlovu, managing director of Deloitte Africa tax and legal.

Ndlovu is one of several analysts who have shared views on the mini budget. Fin24 compiled the views of Old Mutual Investment Group head of economic research Johann Els, Investec Chief Economist Annabel Bishop, FNB Chief Economist Mamello Matikinca, Momentum Investments economist Sanisha Packirisamy and chairman of national tax and SARS committee at the South African Institute of Professional Accountants Ettiene Retief.

First impressions of Mboweni

Retief: Mboweni is no stranger to the financial world – he was previously the labour minister (between 1994 and 1999) and Reserve Bank Governor (between 1999 and 2009).

He has been in the private sector for many years, serving on the boards of private companies such as Discovery. According to Retief, he will have a clear understanding of the state of the economy.

Packirisamy: Mboweni is well known to the investor and political communities. His appointment was viewed as a "low risk" event by the market and was welcomed by investors, as was seen in the strengthening of the rand.

Ratings agencies are likely to be comforted by Mboweni's experience and trusted record in in previous positions in the policy making environment.

Growth projections

Matikinca: Since the February Budget, economic growth has disappointed, having entered a technical recession in the second quarter of the year.

Growth estimates have been revised downward. FNB estimates suggest growth of 0.7% in 2018, in line with market consensus, which ranges between 0.5% and 1%, possibly rising to 1.5% in 2020.

Packirisamy: Growth projections have deteriorated since the second quarter of the year. The Reserve Bank has cut is growth projection from 1.7% in May 2018 to 0.7% in September 2018. Momentum Investments expects the economy to grow at 0.8% in 2018.

Tax collections

Retief: We have already noticed that the tax collections are not mirroring the tax increases introduced in the last few years. Apart from tax avoidance and tax evasion, the economic slowdown is also responsible for this. Fewer people are employed, meaning less income tax, high worth net individuals are emigrating, taking their wealth with them. There has also been a tangible slowdown in consumer spending.

Matikinca: Revenue collection for 2018/19 appears to be slightly ahead of target. Total national government revenue is up 11.2% year-to-date against a budget review target of 10.5%. Treasury has collected 36.6% of the fiscal year projection, in line with historical collection levels over the past several years. However, this is the first year where VAT has been increased, and which should have put collection rates slightly ahead of previous years.

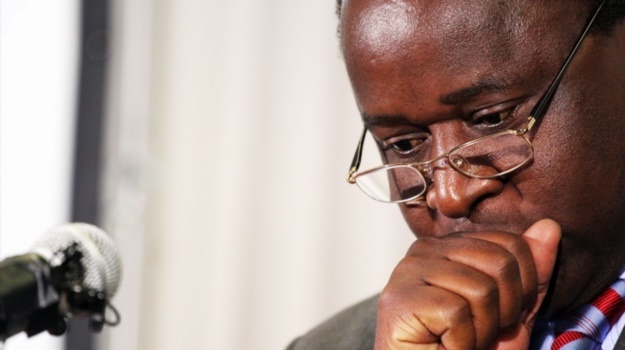

Tito Mboweni is set to deliver the mini budget on Wednesday, two weeks after being named finance minister (GETTY IMAGES)

Tax increases

Bishop: Although revenue collections will spur debate on possible tax increases, any actual material tax increases are not expected. These are only likely in the 2019 budget.

Higher taxes and utility costs have contributed to slowing economic growth, and this cycle of tax increases is likely to continue into the medium term. Personal income taxes and taxes on the super wealthy are likely to be discussed - with the new minister a wealth tax proponent.

Els: They won’t announce tax changes in the mini budget, as this is not the forum to do this, and we don’t expect further hikes in tax rates in next February’s Budget, which would further hurt the economy.

Normal so-called "sin tax" changes are likely. Mboweni has also been in favour of a wealth tax in the past, which might be on the cards, although we don’t expect this next year; perhaps in the next few years, says Els.

February targets

Els: Compared to the February budget target of a deficit to GDP being -3.6%, the mini budget might reflect a revised target of -3.7% or -3.8%. This is a "pretty good" outcome given the weak economy.

"I certainly don’t foresee a big shortfall in terms of revenue. Yes, Minister Mboweni has to reprioritise the R50bn expenditure set aside for the stimulus package, which will have to move to other areas of the Budget and might be somewhat challenging; but in terms of overall budget, they should get fairly close to the target," Els tells Fin24.

Matikinca: Fiscal ratios will likely be adjusted to mainly reflect weaker than expected growth. FNB expects the main budget deficit for the current financial year to widen around 0.3% to -4.1% of GDP, before moderating to -3.9% of GDP by 2020/21. Risks to this expectation stem from weaker-than-anticipated tax collections, says Matikinca.

Reprioritisation of funds

Bishop: The reprioritisation of government expenditure to accommodate the R50bn identified in the Economic Stimulus Recovery Plan will be announced in the mini budget. This R50bn is likely to come from unspent funds, and the diversion of future funding from underperforming areas.

Reprioritised spending would go towards creating jobs, growth enhancing reforms, the establishment of an infrastructure fund, addressing health and education and investing in municipal social infrastructure improvement. Township industrial parks are also planned.

Els: For SA to remain on the path of fiscal consolidation, it means government must cut spending instead of raising revenue through tax collections.

"The public sector Wage Bill, interest payments on government debt and social grants currently make up 58% of government expenditure, making up a significant portion of spending that we need to work on," Els tells Fin24. "With SA facing an election year next year, there is pressure on government to avoid cutting the Wage Bill."

However, at the Jobs Summit it was announced that public sector employees would not be laid off.

Government will probably take the necessary steps after the elections - they can offer voluntary retrenchments and refrain from filling vacancies after voluntary resignations.

Ratings agencies

Bishop: The rating agencies will look for fiscal slippage - widening deficit or higher debt projections as a percentage of GDP. Ratings agencies would view negatively "materially higher" public sector debt and indicate higher contingent liabilities for state-owned enterprises.

Matikinca: We see little chance of any negative ratings action from Moody’s after the mini budget as some fiscal slippage is already "baked" into their assumptions. This gives us "a little more time to right the ship".

* Visit Fin24's 2018 mini budget hub for all the news, views and analysis.

* Sign up to Fin24's top news in your inbox: SUBSCRIBE TO FIN24 NEWSLETTER

Publications

Publications

Partners

Partners