Part of the skill of investing is about separating the signals from the noise, and 2019 will be no different. What will be instructive, though, is the extent to which global politics, trade war rhetoric, and ineffectual Brexit negotiations dominate our collective efforts to fix the economy, societies and our planet.

The risk is that the noise from these increasingly loud debates may drown out an important set of signals being generated by scientists, policymakers, asset allocators, investors, consumers and the markets. Collectively, these signals point towards the emergence of green growth not only as a scientifically bounded economic idea, but also as a set of globally consistent consumer preferences. Doing more with less has always been a good idea, as has caring for the environment, along with being a good neighbour. Simply put, the notion of green growth tries to work with these ideas in the capitalist context, while at the same time acknowledging planetary system boundaries.

Climate risk to go unheeded?

Discounting the second law of thermodynamics has never been a good idea and 2019 shouldn’t present any surprises in this regard. As a consequence, it is probably not a bad idea to pay close attention to findings of the Special Intergovernmental Panel on Climate Change Assessment Report on a 1.5 degree Celsius future global warming scenario. The report looks at the reduction in risk and costs that can be achieved by stepping up global ambitions to 1.5 degrees. This represents a 25% increase on the level of ambition above the 2 degrees “target” agreed by way of the Paris Accord.

Not surprisingly, the report indicates that risks are lower for a 1.5 degree warming scenario versus that of a 2 degree scenario. From an entropy perspective, less hot is better for the stability of our global climate system, biodiversity resilience and, collectively, for humanity. This is an important contribution from the scientific community. The implications for our food, energy and transport systems are material. Take energy, for example. To stay within a 1.5 degree limit would require carbon dioxide emissions to begin decreasing immediately, a doubling of investments in renewables, a 25% decline in investments in the fossil fuels in the next 20 years, and a 66% decline in coal-fired electricity by 2030.

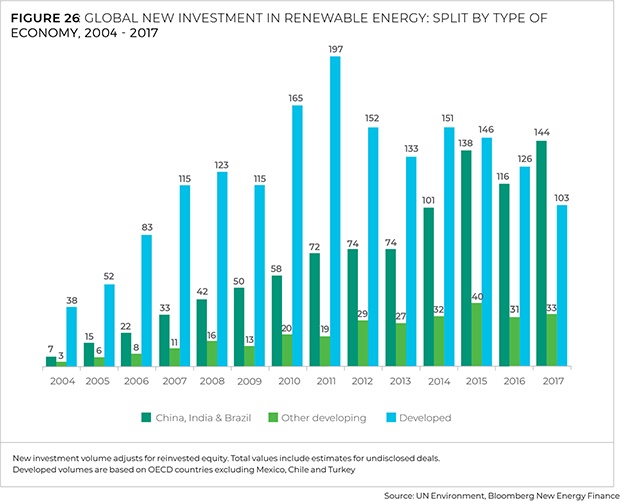

Given the economic implications of the scientific consensus around climate change, it is not surprising to see the financial ecosystem seeking out ways to minimise market risks, while at the same time capitalising on the emerging opportunity set. Important market signals here include the development of a disclosure framework through the international Financial Stability Board (FSB)’s Task Force on Climate-related Financial Disclosures (TCFD). Backed by investors with roughly US$25 trillion in assets under management, the TCFD is voluntary self-regulation by the market, for the market. What is significant is that there is firm recognition by the market of system limits imposed by climate science on the global economy. At the same time, we see continued capital flowing to renewable energy infrastructure, supported in part by innovation in the green bond market, which continues to grow. The implications here are hard to ignore – Bloomberg New Energy Finance instructively points out that what makes renewable energy so disruptive is that it is technology driven and not hampered by mining of fuel sources. And since it is a technology issue, learning rates apply. For renewables and battery storage, this rate is in the high teens, and that will force a profound change in the world’s energy mix in the coming decades. These are important scientific and technological signals not to lose sight of in 2019.

China's green economy signals versus noise

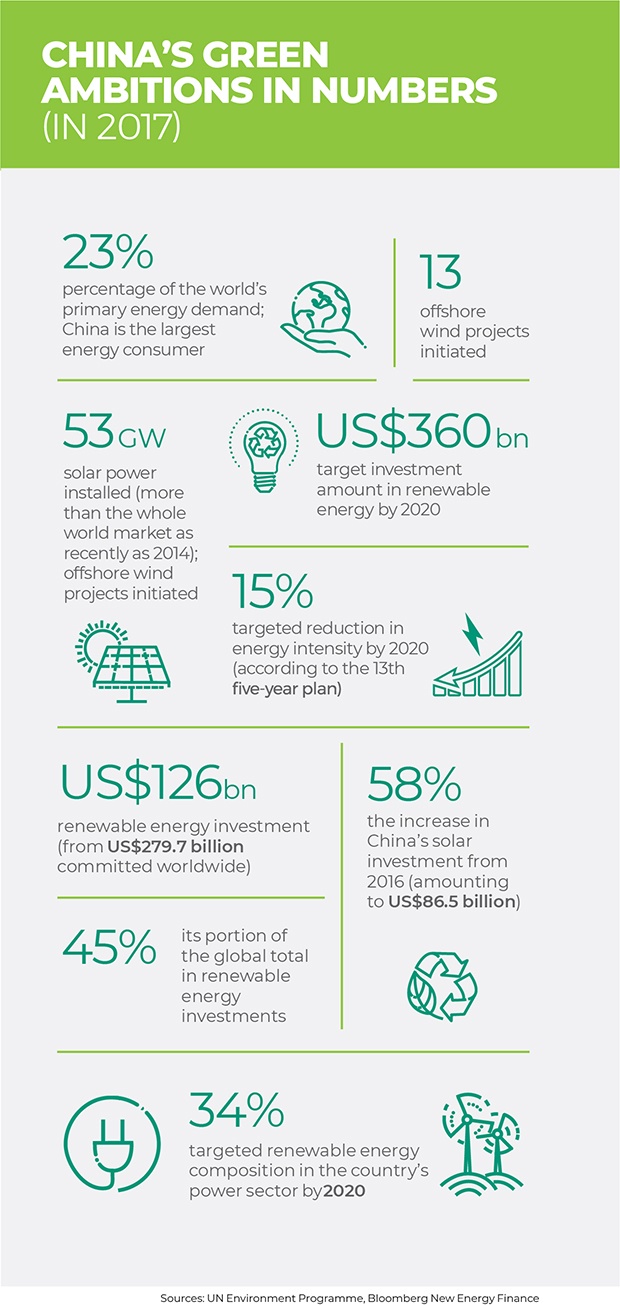

Not all scientific and technological advancements are discounted by politicians and it appears that Chinese policymakers have learnt something from the past three decades of resource-intensive growth. China is now the world's second largest economy and although its growth targets have been moderated to 6.5%, this is still well above global, and many developing world, averages. Consequently, how China chooses to manage its growth path will have profound implications for the planet. It is instructive to note the evolution and integration of green economic thinking into the

11th, 12th and now 13th five-year economy planning frameworks published by the Chinese government. President Xi Jinping has put China on a path of becoming an “ecological civilisation” that is “moderately prosperous” and guided by five key principles of “innovative, coordinated, green, open, and shared development”. This is in stark contrast to the noise we hear coming from the leadership of the largest global economy.

An important signal regarding Chinese green economy intent is, however, the evolution of the country’s energy mix. In particular, the growth of its coal fleet. Research published by CoalSwarm indicates that 259 Gigawatts (GW) of new capacity is under development in China, comparable to the entire US coal fleet (266 GW). If built, the new plants would increase China’s current coal fleet of 993 GW by 25% and overwhelm the 1100 GW coal cap set in the country’s current five-year plan. Any central government decisions to cancel or reduce this coal capacity would have the potential to free up US$210 billion in capital expenditure, enough to build nearly 300 GW of solar PV or 175 GW of wind power. The implications would be far reaching and send a powerful signal to global coal markets.

So, will sensible ideas about green growth find a political voice in both the Eastern and Western economies in 2019, or will this important set of long-term signals remain shrouded by the short-term, very noisy noise?

Publications

Publications

Partners

Partners