Written by Hywel George, Director of Investments, Old Mutual Investment Group

“It is much easier after the event to sort the relevant from the irrelevant signals. After the event, of course, a signal is always crystal clear.” – Nate Silver, The Signal and the Noise.

Identifying the relevant signals from the noise has been key to successful investing in 2018, and will be again in 2019. That is a fundamental part of our job as professional investment managers. Actively helping our clients do the same in their role is also fundamental to our industry; striking a true partnership between asset owners, their consultants and asset managers is the sensible way forward.

As such, we humbly offer four thoughts that we believe asset owners should be applying themselves in 2019:

01/ HAVE SOME PASSIVE IN THE MIX

Passive investing continues to gain support and will remain an important part of the investment landscape going forward. However, with markets having been strong, assets under management in active funds have also grown and we believe there is still a place for active investing to make up a decent component of the mix in a portfolio. Passive investing (i.e. tracking an index) comes with its own risks and to outperform under certain market conditions, history has shown the benefits of fundamental active investing. For instance, with just seven stocks making up 50% of the JSE, that level of concentration, should things turn, would be a big risk. Active managers can help navigate this.

Thus a win-win situation would be a combination of the two, leading to better outcomes for investors, because the passive investments would enable investors to manage their fee load while the stockpicking of active managers should continue to add value relative to the market.

02/ LOOK FOR RETURNS ELSEWHERE

During 2019, investors will also need to keep adding real, alternative sources of return outside of plain vanilla equity and bond portfolios. These would be real assets, including infrastructure investments, real estate and agriculture, which are popular globally, as well as private equity and hedge funds.

Overseas more than a third of the assets of the 100 largest pension funds are now invested

in alternative assets in some form or another, whereas in SA alternative investments comprise a mere 2% of institutional assets. So we have a lot of work to do to increase that exposure locally to give investors exposure to the long- term, premium real returns they can offer.

03/ INTEGRATE ESG INTO EVERYTHING YOU DO

People’s perceptions are shifting, with many becoming more mindful of sustainable investing. In fact, a 2017 Schroders Investment Study showed that 78% of respondents said that sustainable investing has become more important to them in the past five years.

With some US$80 trillion global assets under management, the investment industry has the greatest potential to influence decisions and practices relating to sustainability.

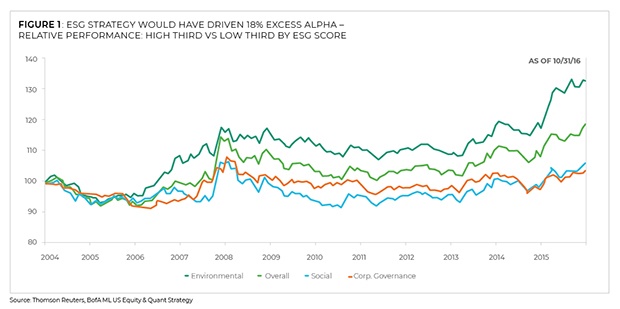

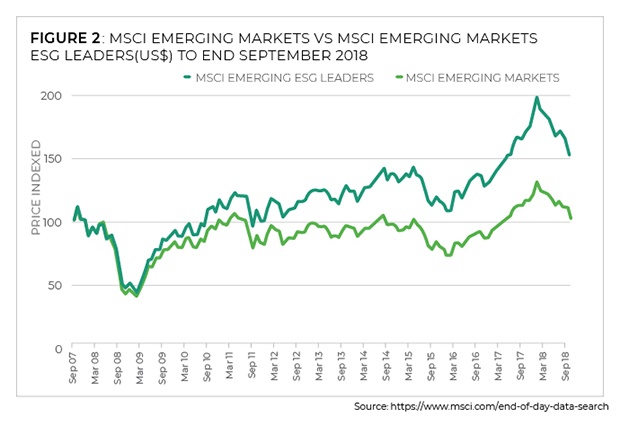

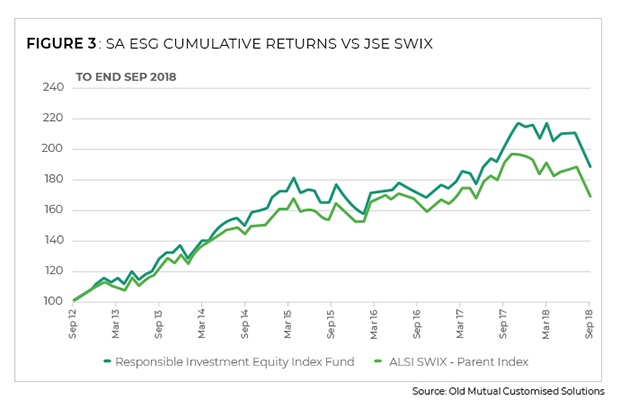

The decision to invest in funds that have a clear preference for those companies that focus on positive environmental, social and governance principles is made easier by the fact that there appears to be no trade-off between making sustainability an investment priority and achieving competitive returns. Figure 1 shows that investing in a global ESG strategy would have added significant alpha over time. This makes intuitive sense because integrating ESG into investment decisions means you generally invest in quality companies that make better long-term decisions and thus deliver more sustainable returns over time. This is particularly true in emerging markets and South Africa where the quality of a company is often informed by standards of corporate governance and other ESG considerations that affect a company’s ability to deliver in the long term. This is evident in the outperformance of an MSCI EM ESG Index versus an MSCI EM Index (see Figure 2) and in South Africa where an ESG version of the JSE SWIX Index added alpha over the past five years (see Figure 3).

This is not just about investing in those companies that meet the ESG criteria as set out by the index, but requires the asset managers’ ongoing commitment to challenge companies to make the best long-term decisions to better comply with ESG principles. This confirms that by investing in the right way, asset managers can have a positive impact on communities and the environment, while also delivering alpha (returns in excess of their benchmark).

04/ UNDERSTAND AND INTEGRATE ARTIFICIAL INTELLIGENCE INTO INVESTMENT DECISIONS

While there may be some skepticism as to the extent that artificial intelligence (AI) will change our day-to-day lives, it could well turn out to have the most profound and fundamental impact on the way we work and conduct ourselves in all aspects of our lives over the coming decade.

From an investment perspective, the way asset managers integrate AI into the way they manage money is likely to be fundamental to their future success. As such, one of our biggest work streams in 2018 (and into 2019) has been focused on embedding AI into everything we do as an asset manager. There’s no doubt AI is a new toolbox and it will facilitate greater productivity and insight from humans. We don’t believe it will be a case of machine-only, but expect the winners to be those who optimise the relationship between human and machine.

It is an exciting time and we are focused on five key areas where AI will directly impact the way we manage our clients’ assets:

1. The data asset managers need to source will evolve from the current news scrapes, management emotion measures and satellite imagery, and our ability to clean and curate that data will be key.

2. AI will help asset managers interpret that data and look for themes, or indicators that uncover new ideas.

3. AI will help asset managers design better stock and sector filter screens to identify those companies that have attractive investment characteristics.

4. AI will help with portfolio construction and risk management, helping identify risk clusters that were previously hidden.

5. AI will help in stock-specific fundamental research, finding anomalies that beg questions, and helping dig into issues that highlight the need to gather more information.

In essence, it will come down to how an asset manager uses the data to search for those hidden themes that add value to a portfolio and lead to more consistent outcomes for clients.

THE BOTTOM LINE

We believe that investment success in 2019 will partly depend on the above four factors. One can manage the fee load on investors by including passive investments in a portfolio mix, tap alternative assets for market-beating long-term returns, benefit from integrating ESG into everything we do, and ensure that we harness the power of artificial intelligence.

Publications

Publications

Partners

Partners