The thought of investing offshore can be both comforting and confusing. Diversifying internationally is an obvious comfort, as is optimising your portfolio and making it more resilient.

You can find out more about the benefits of diversification and optimisation in our useful guide, here.

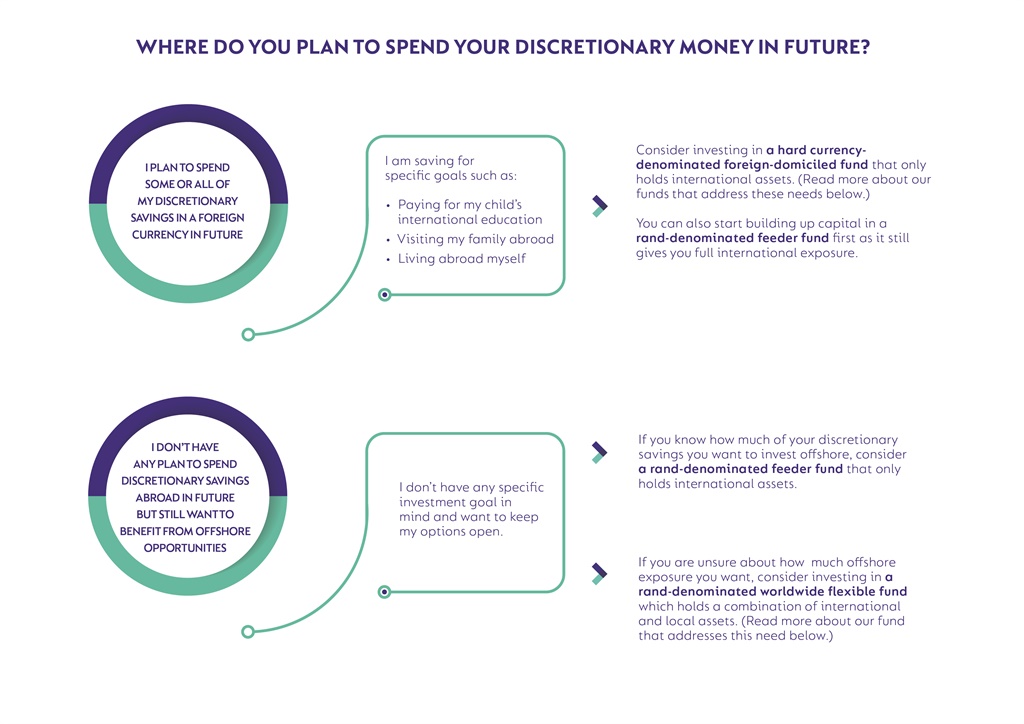

Confusion may come from simply not knowing how to invest any discretionary savings (money not in a retirement fund) offshore.

Just start with the end in mind and ask yourself where you plan to spend your savings in the future. The answer will put you on track to making the right offshore investment decisions.

Investors who plan to spend discretionary savings in a foreign currency in future, can consider Coronation’s foreign-domiciled international funds, Coronation Global Managed or Coronation Global Capital Plus.

These funds only hold international assets and are managed to maximise returns in foreign currency terms. They require a minimum investment of $15 000. Alternatively, you can build up capital in rand terms first by investing from R500 a month in a rand-denominated feeder fund, which gives you immediate international exposure.

If you prefer to keep your investments in rands in future, you can still benefit from offshore opportunities while protecting your money against any rand weakness and local price increases of foreign goods. Coronation Optimum Growth is a rand-denominated worldwide flexible multi-asset fund which manages international exposure for you without constraints, aiming to provide long-term growth in local currency terms. If you plan to remain in South Africa but don’t know what portion of your savings should be offshore, it may be well suited to you.

If you do know what portion you want to invest offshore, then consider a rand-denominated feeder fund that only holds international assets.

Investing offshore with Coronation

Find out more about our range of international funds, managed by a global team with expertise across all asset classes and geographies here, in our Corolab guide on investing offshore here or speak to your independent financial adviser.

The information contained in this article is not based on the individual financial needs of any specific investor. To find out more, speak to your financial adviser.Coronation is an authorised financial services provider.

This post and image is sponsored and provided by Coronation.

Publications

Publications

Partners

Partners