Let’s say you are already saving for retirement and have some additional money to invest.

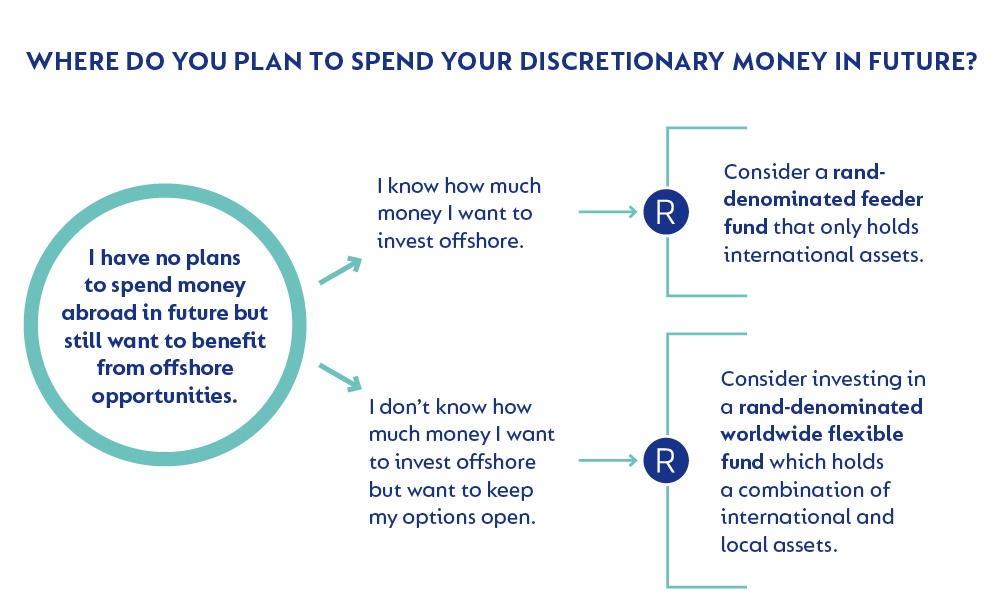

You plan to stay in South Africa and don’t envisage spending money abroad in future, but you also don’t want to miss out on global investment opportunities.

If this sounds like you, consider investing offshore in a rand-denominated worldwide flexible fund or international feeder fund.

Which type of fund is best for you?

Simply think about how much of your money you want to invest offshore.

If you know how much money you want to invest offshore, consider a rand-denominated feeder fund that only holds international assets. Types of funds include single-asset class funds (e.g. global equity funds) or multi-asset class international funds (e.g. balanced funds).

At Coronation, we believe that a balanced fund is a suitable choice for most investors in uncertain economic times.

We offer two such funds:

- Coronation Global Managed (ZAR) Feeder is suited to investors with savings goals of 5 years and longer who are willing to withstand some shorter-term volatility in pursuing longer-term growth.

- Coronation Global Capital Plus (ZAR) Feeder is a lower risk fund, offering some exposure to global growth assets (such as equities and property), but appropriate for investors who can’t withstand potential negative returns over shorter time periods such as 12-18 months.

Both these funds are also ideal for those who want to build up capital in rand terms before investing it in a hard currency-denominated foreign domiciled fund.

If you don’t know how much money you want to invest offshore, consider a rand-denominated worldwide flexible multi-asset fund such as Coronation Optimum Growth. This fund manages international exposure for you without constraints, while still aiming to provide long-term growth in local currency terms.

(Infographic: Supplied)

What opportunities can I access?

South Africa only represents 0.6%[1] of the global economy! Through investing offshore, you can gain access to companies and industries not available domestically. Read about one example, the luxury goods industry, here.

Not your type of investment goals?

Coronation offers a range of global funds. Read our guide here.

The information contained in this article is not based on the individual financial needs of any specific investor. To find out more, speak to your financial adviser.

Coronation is an authorised financial services provider.

[1] Trading Economics, World Bank

This post and content is written, provided and sponsored by Coronation.

Publications

Publications

Partners

Partners