By Suzean Haumann, Certified Financial Planner®, Brenthurst WealthMost investors in pre-retirement products are aware of what Regulation 28 is. In short, a restriction on the allocation of the investment into various asset classes, mostly the better performing one namely offshore assets.

Despite the existence of Regulation 28 of the Pension Funds Act, many funds have delivered acceptable returns for investors, but adding just a little bit of risk can make a big difference in the overall return achieved. And considering the investment, it is especially younger investors, with decades of saving ahead, who are losing out the most.

Regulation 28 was officially implemented on 1 July 2011. To understand its impact this is an analysis of how the restriction has cut into the performance of an investor’s retirement fund versus a discretionary portfolio, which is subject to exchange controls.

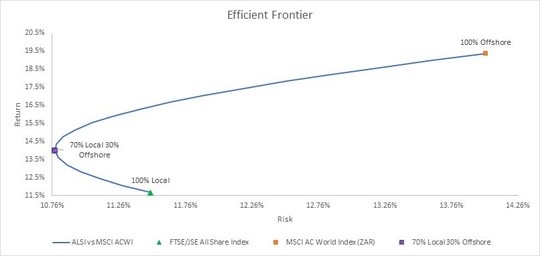

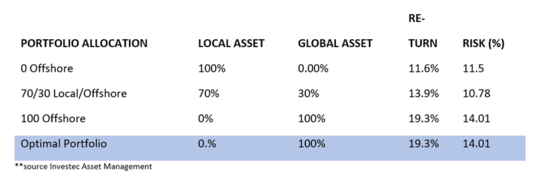

To do this I devised an optimal portfolio over the last eight years. With the use of the mean-variance optimisation-method; which is a quantitative tool that allows for optimal allocation by considering the trade-off between risk and return. This optimal portfolio for the period of eight years, has 100% offshore allocation (see below):

Even though the Regulation 28 portfolio shows the lowest risk rating, the investor in this portfolio would have had a substantially bigger return, with a slightly higher risk, you invested all your money abroad over the last 8 years.

The reasons for investing offshore is compelling and include diversification benefits, reduced emerging market and currency risk, and maintenance of ‘hard’ currency spending power. But how should investors go about investing offshore?

The answer depends on investors’ personal circumstances, risk profile and longer-term financial planning objectives. It is therefore imperative to consult a financial advisor who can help identify investment solutions that address an investor’s specific requirements.

There are many options available. A unit trust, that includes offshore assets, like a regulation 28-compliant multi-asset or balanced fund is allowed to invest up to 30% in international assets.

By making use of this type of fund, investors are effectively appointing a professional money manager who has the time, experience and access to information to decide when and how much to invest offshore on their behalf, and into which assets.

But that might not be the most efficient solution for everyone. Perhaps an unconstrained investment mandate improves the return characteristics of a multi-asset (balanced) portfolio at only marginally higher risk. That is where a rand-denominated international unit trust is a better option.

It is a direct investment into underlying funds and investors don’t have to make use of their individual offshore allowance. Rather, they invest in rand and when they disinvest, the proceeds are paid in local currency as well. However, the investors benefit from offshore exposure, but South African political risk remains.

That is where an investment in a foreign-domiciled international unit trust could be a better option, where savings goes directly into international funds in its dealing currency e.g. dollars, pounds or euros.

Many South Africans have favoured rand-denominated international funds because of the perceived complexity of applying for tax and Reserve Bank clearance to invest offshore directly.

However, now that investors can invest up to R1 million annually in an international fund without the need for any prior approvals, they can access foreign-domiciled international funds with relative ease and thereby diversify away from South African political risk.

In addition to the annual discretionary allowance of up to R1 million, investors also have a foreign investment allowance of up to R10 million per calendar year (a total sum of R11 million). Investors need to obtain foreign tax clearance from the South African Revenue Service if they wish to use this allowance.

Brenthurst Wealth has a number of global funds available in its suite of investment options, for instance the Mi-Plan Global IP Opportunity fund, which have delivered returns of CPI plus 9% for the past 12 months.

However, it is important to always remember that each investor’s situation is different and circumstances relevant to a particular individual must be considered for any retirement plan. It is advisable to consult a qualified, accredited, experienced advisor to navigate the options.

This post was sponsored and supplied by Brenthurst Wealth Management.

Publications

Publications

Partners

Partners