Johannesburg – South Africans are paying off debt faster and borrowing less, the Old Mutual Savings and Investment Monitor for 2017 revealed.

The recently-released survey looks at the saving and investment behaviour and attitudes of working people in metros, and conducted face-to-face interviews with 1 000 South Africans.

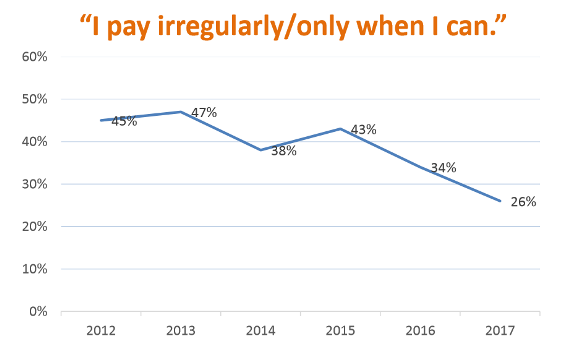

It showed a declining trend in personal loans, and that fewer (26%) people were paying off debt irregularly.

The fact that people are paying off their excessive debt is a good thing, said Rian le Roux, Old Mutual Investment strategist.

“Excessive debt can be a big burden on people,” said e Roux. When it comes to debt, people should try to tailor their spend to their income to avoid even more debt. They should also rather incur debt when buying an asset such as a house, as this will grow in value, he explained.

“It’s not a good idea to borrow money for groceries.”

Debt Rescue CEO Neil Roets said consumers need to understand their own finances. “This would start with setting up a budget, to know what they have and where their money is going. This is the easiest way to see where changes can be made to ensure that they can make ends meet, or know when to seek help when they cannot do so.”

Secondly, it is important that consumers are aware of their rights, in terms of the help available to them through the National Credit Act by means of debt counselling. “Many consumers are not aware that the process of debt counselling was created specifically for the purpose of assisting them through difficult financial times.”

The Old Mutual survey showed a slight improvement in people’s confidence in their ability to make responsible financial decisions, which was reflected in the decrease in the income to debt ratio reported by the South African Reserve Bank, said Lynette Nicholson, research manager at Old Mutual.

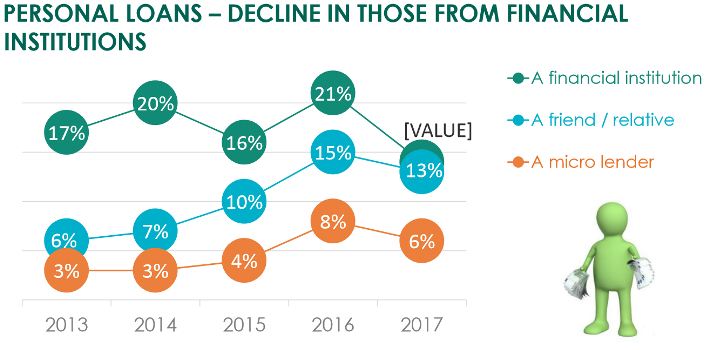

There is a recurring theme throughout the survey that people are trying to reduce debt, said Nicholson. Personal loans from financial institutions declined from 21% to 13%, while loans from friends and family declined from 15% to 13%. Fewer respondents are also borrowing from microlenders, with these loans declining 2 percentage points from 8% reported in 2016.

Cutting back on expenses

Cutting back on expenses is also a trend, said Nicholson. This includes luxury items, such as going out for entertainment and holidays. People are cutting back on clothing expenses and starting to buy groceries in bulk to stretch their budget, she explained.

More than half (52%) of respondents are cutting down on cellphone costs and airtime. About 36% of respondents are cutting back on entertainment such as subscription television.

About 52% of respondents said that their household income did not cover expenses at least once in the past year.

Some people are lucky enough to be able to dip into their savings, but some borrow from friends and family. There is a high incidence of borrowing from friends and family to cover the gap for lower income earners, said Nicholson.

Increasingly, some respondents said that they are missing payments. Others said they borrow from stokvels, with about 50% of respondents saying they have done so at least once in the past year.

* Do you have a successful savings plan or story to tell? Share it with us nowand help others to also become Savings Heroes.

SUBSCRIBE FOR FREE UPDATE: Get Fin24's top morning business news and opinions in your inbox.

Read Fin24's top stories trending on Twitter: Fin24’s top stories

Publications

Publications

Partners

Partners