Cape Town - Many South Africans feel they are too cash-strapped to save for retirement.

However, sacrifice one trip to the cinema per month and you would be surprised at the results for your retirement fund.

Sanlam’s Benchmark Survey for 2013 shows that 51% of South African pensioners cannot make ends meet.

This means that you or your neighbour or friends could face what the Brandes Institute terms “money death” – running out of money before running out of time.

According to Esther Venter, executive dean at Milpark Business School, Sanlam’s Benchmark Survey states that a main factor causing this problem is that 56% of employees only start saving for retirement at age 28 versus the recommended age of 23.

“This lag in getting started with retirement saving is understandable, considering the financial demands on the typical employed twenty-something member of Generation Y,” Venter said.

A picture of fiercely competing demands and expenses emerges.

“Think of a pack of hungry hyenas - each one vies for part of the limited resource. However, in this scenario retirement savings should not end up as the vulture patiently awaiting its turn,” she said.

“Few of the 12.1% of South Africans who complete higher education do so without accumulating hefty study debts to repay."

After securing a job, a young person needs transport before the first pay cheque can be earned. Financing a car over 60 months will cost roughly R2 000 per month for every R100 000 borrowed.

Don’t forget about running costs and short-term insurance.

“With the fuel price having almost doubled since 2009, transportation expenses appear as one of the more aggressive hyenas in the pack, with a new predator called e-tolling about to pounce,” she said.

“Unfortunately for one’s boss, one cannot live at work."

Stringent requirements of the National Credit Act mean that a sizeable income and a sizeable deposit are primary hurdles for first-time property owners.

The average price of a small home (80–140 m²) for first-time buyers is roughly R730 000 (Absa House Price Index May 2013).

With a R50 000 deposit (a R650 per month saving for five years at 10% before buying the house), one would need to earn a gross monthly income of about R22 000 to qualify for a bond.

The bond payment will devour about R6 500 of your R22 000 per month gross income, or almost 40% of your monthly after-tax income.

This has led to the "boomerang generation", young adults in their twenties moving back in with their parents.

Few in their twenties realise that at least basic medical and disability cover are essential in South Africa.

Venter says that subjectively viewed, Generation Y’s addiction to instant gratification, “living their lives” here and now, is considerable.

High value is placed on trendy clothes, the latest technology and costly social and sports activities.

“It is extremely difficult to make ends meet, and many young working people feel that there is simply not enough meat left on the bone to save anything towards retirement," she says.

However, it is surprising what can be achieved by employing a bit of what Venter calls "movie magic":

A Generation Y’er regularly spends at least R100 at the movies - overpriced popcorn included.

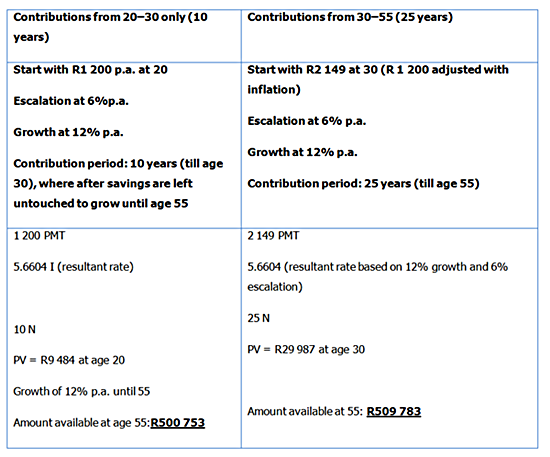

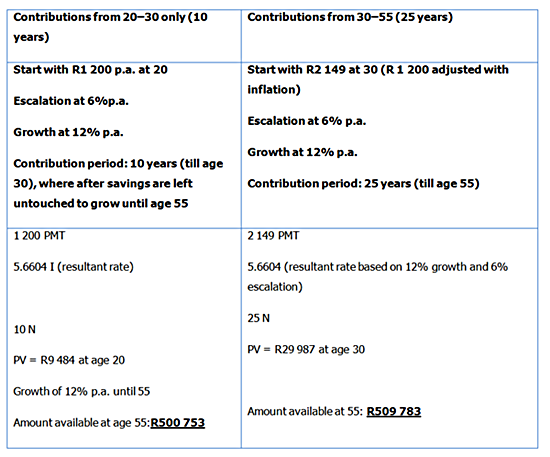

Let’s consider the head start that a sacrifice of one movie per month from age 20 can achieve over savings later in life:

This shows clearly that it pays to start feeding your retirement plan early. It’s expensive and often impossible to compensate for a late start.

“With a little bit of education and discipline as well as minimal sacrifices, young South Africans will be pleasantly surprised with the results they can achieve towards a relaxed, financially secure retirement," she said.

- Fin24

However, sacrifice one trip to the cinema per month and you would be surprised at the results for your retirement fund.

Sanlam’s Benchmark Survey for 2013 shows that 51% of South African pensioners cannot make ends meet.

This means that you or your neighbour or friends could face what the Brandes Institute terms “money death” – running out of money before running out of time.

According to Esther Venter, executive dean at Milpark Business School, Sanlam’s Benchmark Survey states that a main factor causing this problem is that 56% of employees only start saving for retirement at age 28 versus the recommended age of 23.

“This lag in getting started with retirement saving is understandable, considering the financial demands on the typical employed twenty-something member of Generation Y,” Venter said.

A picture of fiercely competing demands and expenses emerges.

“Think of a pack of hungry hyenas - each one vies for part of the limited resource. However, in this scenario retirement savings should not end up as the vulture patiently awaiting its turn,” she said.

“Few of the 12.1% of South Africans who complete higher education do so without accumulating hefty study debts to repay."

After securing a job, a young person needs transport before the first pay cheque can be earned. Financing a car over 60 months will cost roughly R2 000 per month for every R100 000 borrowed.

Don’t forget about running costs and short-term insurance.

“With the fuel price having almost doubled since 2009, transportation expenses appear as one of the more aggressive hyenas in the pack, with a new predator called e-tolling about to pounce,” she said.

“Unfortunately for one’s boss, one cannot live at work."

Stringent requirements of the National Credit Act mean that a sizeable income and a sizeable deposit are primary hurdles for first-time property owners.

The average price of a small home (80–140 m²) for first-time buyers is roughly R730 000 (Absa House Price Index May 2013).

With a R50 000 deposit (a R650 per month saving for five years at 10% before buying the house), one would need to earn a gross monthly income of about R22 000 to qualify for a bond.

The bond payment will devour about R6 500 of your R22 000 per month gross income, or almost 40% of your monthly after-tax income.

This has led to the "boomerang generation", young adults in their twenties moving back in with their parents.

Few in their twenties realise that at least basic medical and disability cover are essential in South Africa.

Venter says that subjectively viewed, Generation Y’s addiction to instant gratification, “living their lives” here and now, is considerable.

High value is placed on trendy clothes, the latest technology and costly social and sports activities.

“It is extremely difficult to make ends meet, and many young working people feel that there is simply not enough meat left on the bone to save anything towards retirement," she says.

However, it is surprising what can be achieved by employing a bit of what Venter calls "movie magic":

A Generation Y’er regularly spends at least R100 at the movies - overpriced popcorn included.

Let’s consider the head start that a sacrifice of one movie per month from age 20 can achieve over savings later in life:

This shows clearly that it pays to start feeding your retirement plan early. It’s expensive and often impossible to compensate for a late start.

“With a little bit of education and discipline as well as minimal sacrifices, young South Africans will be pleasantly surprised with the results they can achieve towards a relaxed, financially secure retirement," she said.

- Fin24

Publications

Publications

Partners

Partners