Investment analyst Melvyn Lloyd. (Supplied)

Cape Town - Some asset managers have recently come under scrutiny, as investors question whether their fund size is hindering their ability to take advantage of certain investment opportunities.

In this article we will specifically look at the challenges that some of the larger asset managers face when trying to invest in the SA listed property sector.

But before highlighting some of these challenges, let’s first consider some interesting facts about the SA listed property sector:

* The FTSE/JSE Real Estate Investment Trust Index has a combined market cap of R237bn (as at October 1 2013);

* The FTSE/JSE Real Estate Investment Trust Index (J867) is 22.4 times smaller than the FTSE/JSE All-share Index;

* SAB is 3.3 times bigger than the FTSE/JSE Real Estate Investment Trust Index (J867);

* The top five constituents on the FTSE/JSE Real Estate Investment Trust Index account for 67% of the index;

* The combined market cap of these five constituents is R10bn less than the market cap of Vodacom; and

* The combined market cap of the remaining 12 constituents is roughly equal to the market cap of Impala Platinum.

So now that we’ve looked at some of the characteristics of the listed property sector, let’s consider some of the challenges asset managers face when investing in this asset class.

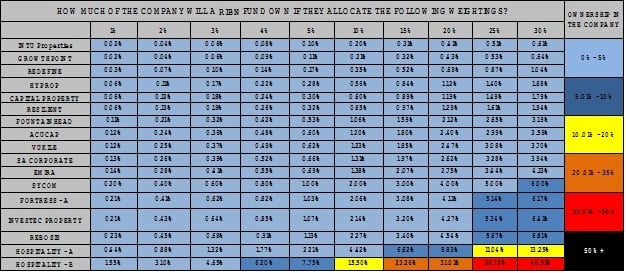

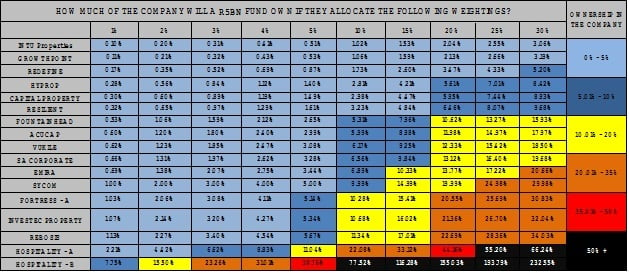

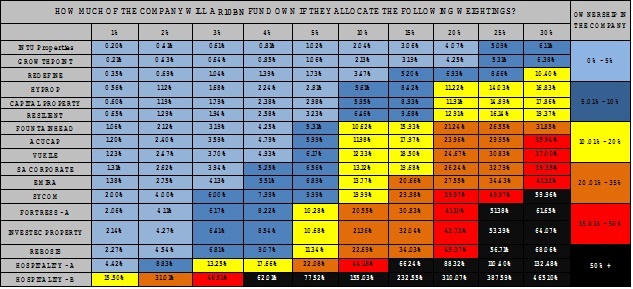

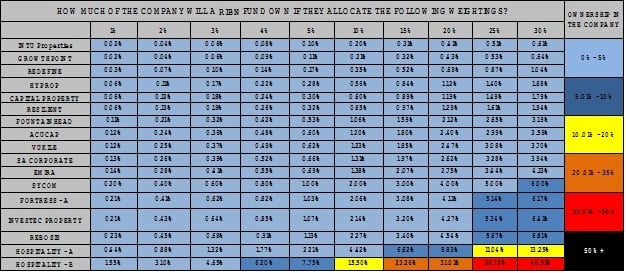

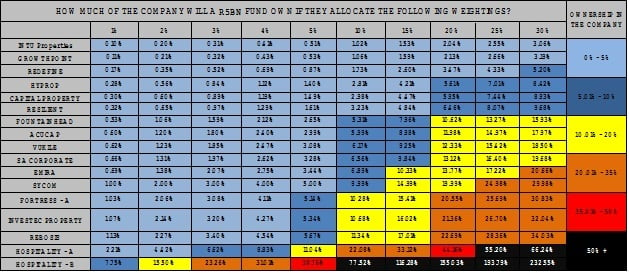

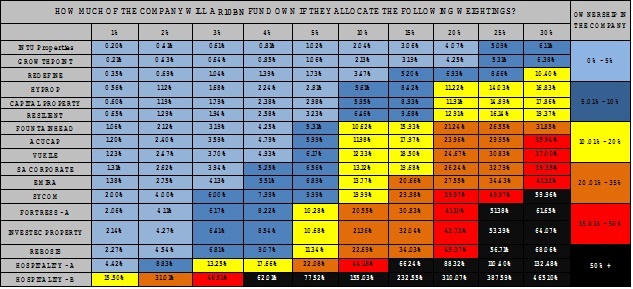

The first challenge that we are going to look at is the manager’s ability to actively invest in this sector using a hypothetical fund size of R1bn, R5bn and R10bn.

To demonstrate this, an analysis was done where we took all the property companies in the index and determined – if we had a fund size of R1bn, R5bn and R10bn – how much of the company we would own if we allocated a weighting between 1% and 30% to each respective company.

From the tables below, you will notice that it becomes more colourful the bigger the hypothetical fund gets. The reason for this is the bigger the fund, the bigger the rand allocation to the respective companies and the bigger the ownership percentage.

Let’s look at an example. Should the R1bn fund invest 5% in Sycom, it will own 1% of the company based on its market cap. If the R10bn fund allocates 5% to Sycom, it will end up owning 10% of the company.

Should the asset manager of the larger fund decide to limit ownership to a certain percentage, it would not only hinder its ability to comfortably allocate capital between these respective companies but also restrict the fund from taking significant active positions relative to the benchmark.

To illustrate this point, let’s look at another example where we use Hospitality - B, the smallest listed property company on the FTSE/JSE Real Estate Investment Trust Index. It has a market cap of roughly R645m, and the company’s tradability is relatively low when compared to its peers.

If the R1bn fund allocates the maximum permissible weighting (5% of the portfolio according to Board Notice 80 of 2012) to Hospitality - B, it would end up owning 7.75% of the company. This would result in a massive overweight position (18.5 times) relative to its benchmark.

Even more alarming, should the R10bn fund allocate the same weight to Hospitality - B it would end up owning just over 77% of the company.

Should it limit its ownership to 20%, it would only be able to allocate 1.3% of the portfolio to this counter, resulting in an overweight position of 4.8 times its benchmark weight. This illustrates the smaller fund’s ability to take significantly larger active positions (especially in some of the smaller companies) when compared to the large fund.

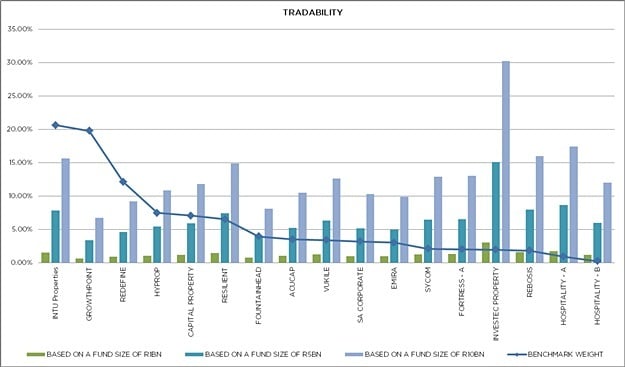

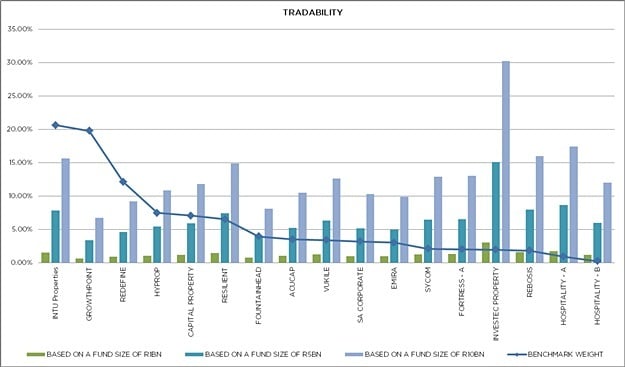

The second challenge is tradability, and more specifically the amount of time it would take these hypothetical funds to sell out of or buy into a position.

To illustrate this, we firstly determined how much of the listed property company a fund would own if it allocated the benchmark weight to it in the portfolio. After doing this, we calculated how long it would take to sell out of (or buy into) this position.

This was done by dividing the tradability (average 12-month volume/total shares in issue) by the percentage ownership in the company (based on market cap).

The results can be seen in the graph below, where the line graph represents the benchmark weight of each of the listed property companies. The bars show what percentage of the tradability (based on the last 12-month volume) needs to be traded in order to allocate the benchmark weight of each of the constituents in the portfolio.

In this article we will specifically look at the challenges that some of the larger asset managers face when trying to invest in the SA listed property sector.

But before highlighting some of these challenges, let’s first consider some interesting facts about the SA listed property sector:

* The FTSE/JSE Real Estate Investment Trust Index has a combined market cap of R237bn (as at October 1 2013);

* The FTSE/JSE Real Estate Investment Trust Index (J867) is 22.4 times smaller than the FTSE/JSE All-share Index;

* SAB is 3.3 times bigger than the FTSE/JSE Real Estate Investment Trust Index (J867);

* The top five constituents on the FTSE/JSE Real Estate Investment Trust Index account for 67% of the index;

* The combined market cap of these five constituents is R10bn less than the market cap of Vodacom; and

* The combined market cap of the remaining 12 constituents is roughly equal to the market cap of Impala Platinum.

So now that we’ve looked at some of the characteristics of the listed property sector, let’s consider some of the challenges asset managers face when investing in this asset class.

The first challenge that we are going to look at is the manager’s ability to actively invest in this sector using a hypothetical fund size of R1bn, R5bn and R10bn.

To demonstrate this, an analysis was done where we took all the property companies in the index and determined – if we had a fund size of R1bn, R5bn and R10bn – how much of the company we would own if we allocated a weighting between 1% and 30% to each respective company.

From the tables below, you will notice that it becomes more colourful the bigger the hypothetical fund gets. The reason for this is the bigger the fund, the bigger the rand allocation to the respective companies and the bigger the ownership percentage.

Let’s look at an example. Should the R1bn fund invest 5% in Sycom, it will own 1% of the company based on its market cap. If the R10bn fund allocates 5% to Sycom, it will end up owning 10% of the company.

Should the asset manager of the larger fund decide to limit ownership to a certain percentage, it would not only hinder its ability to comfortably allocate capital between these respective companies but also restrict the fund from taking significant active positions relative to the benchmark.

To illustrate this point, let’s look at another example where we use Hospitality - B, the smallest listed property company on the FTSE/JSE Real Estate Investment Trust Index. It has a market cap of roughly R645m, and the company’s tradability is relatively low when compared to its peers.

If the R1bn fund allocates the maximum permissible weighting (5% of the portfolio according to Board Notice 80 of 2012) to Hospitality - B, it would end up owning 7.75% of the company. This would result in a massive overweight position (18.5 times) relative to its benchmark.

Even more alarming, should the R10bn fund allocate the same weight to Hospitality - B it would end up owning just over 77% of the company.

Should it limit its ownership to 20%, it would only be able to allocate 1.3% of the portfolio to this counter, resulting in an overweight position of 4.8 times its benchmark weight. This illustrates the smaller fund’s ability to take significantly larger active positions (especially in some of the smaller companies) when compared to the large fund.

The second challenge is tradability, and more specifically the amount of time it would take these hypothetical funds to sell out of or buy into a position.

To illustrate this, we firstly determined how much of the listed property company a fund would own if it allocated the benchmark weight to it in the portfolio. After doing this, we calculated how long it would take to sell out of (or buy into) this position.

This was done by dividing the tradability (average 12-month volume/total shares in issue) by the percentage ownership in the company (based on market cap).

The results can be seen in the graph below, where the line graph represents the benchmark weight of each of the listed property companies. The bars show what percentage of the tradability (based on the last 12-month volume) needs to be traded in order to allocate the benchmark weight of each of the constituents in the portfolio.

The way in which this graph can be interpreted - should the R1bn fund want to either sell out of or buy a 2% position in – for example Investec Property Fund, it would have to trade 3% of the total average volume that was traded over the past 12 months.

This translates into 7.92 days of trading based on a 22-work day calendar month. Conversely, it would take a R10bn fund 79.2 days to execute the same trade.

Hence we can see that large funds will experience liquidity constraints (and the risks associated with this) if they, at best, want to hold a smaller constituent at benchmark weight.

In this article we have seen how fund size can impact an asset manager’s ability to actively invest in this sector, especially when it comes to some of the smaller constituents.

We have also illustrated the liquidity constraints that go hand in hand with managing a sizeable fund in this category. As a result, it would not come amiss to question how actively some of these property funds are actually managed.

To conclude, we have established that fund size definitely plays a key role when investing in the listed property sector. And even though our analysis was based on specialist property funds the same - if not potentially greater investment constraints - could apply to a number of sizeable multi-asset funds, especially in the low and high equity categories.

In the end property, as an asset class, remains a fantastic diversifier when it comes to constructing a well-diversified portfolio for the long term.

And whether you choose to gain exposure to this asset class via an actively or passively managed fund, one thing is for sure, size definitely matters when investing in the SA listed property sector.

* Melvyn Lloyd is an investment analyst with Glacier Financial Solutions, which is a member of the Sanlam Group.

- Fin24

Add your voice to our Property Issue:

* Write a guest post

* Share a personal story

* Ask the experts

This translates into 7.92 days of trading based on a 22-work day calendar month. Conversely, it would take a R10bn fund 79.2 days to execute the same trade.

Hence we can see that large funds will experience liquidity constraints (and the risks associated with this) if they, at best, want to hold a smaller constituent at benchmark weight.

In this article we have seen how fund size can impact an asset manager’s ability to actively invest in this sector, especially when it comes to some of the smaller constituents.

We have also illustrated the liquidity constraints that go hand in hand with managing a sizeable fund in this category. As a result, it would not come amiss to question how actively some of these property funds are actually managed.

To conclude, we have established that fund size definitely plays a key role when investing in the listed property sector. And even though our analysis was based on specialist property funds the same - if not potentially greater investment constraints - could apply to a number of sizeable multi-asset funds, especially in the low and high equity categories.

In the end property, as an asset class, remains a fantastic diversifier when it comes to constructing a well-diversified portfolio for the long term.

And whether you choose to gain exposure to this asset class via an actively or passively managed fund, one thing is for sure, size definitely matters when investing in the SA listed property sector.

* Melvyn Lloyd is an investment analyst with Glacier Financial Solutions, which is a member of the Sanlam Group.

- Fin24

Add your voice to our Property Issue:

* Write a guest post

* Share a personal story

* Ask the experts

Publications

Publications

Partners

Partners