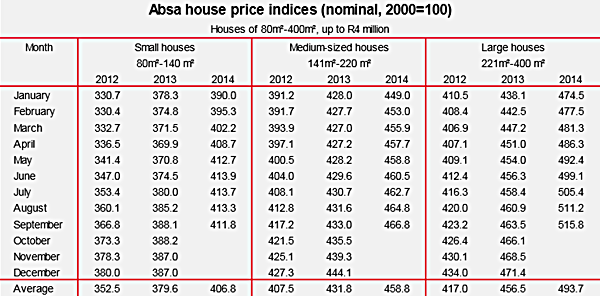

Johannesburg - The average nominal value of a small home in the middle segment of the South African property market was R820 000 in September 2014.

These are homes of between 80m² and 140m² in size.

READ: When small is a better fit

The average nominal value of medium-sized homes in the middle-segment (between 141m² and 220m²) was R1.17m and that of large homes in the middle-segment (between 221m² and 400m²) was R1.88m.

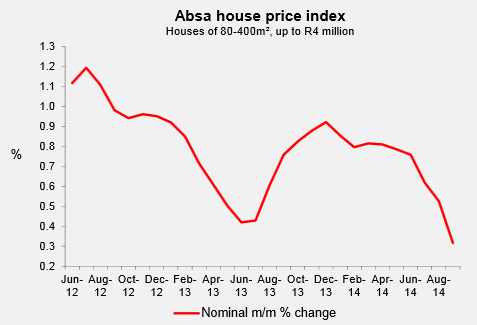

Year-on-year (y/y) growth in the average nominal value of middle-segment homes in the South African residential property market was marginally lower in September this year compared with the preceding month, according to Jacques du Toit, property analyst at Absa Home Loans.

"This came on the back of a declining trend in month-on-month price growth since January 2014, which was, as expected, eventually reflected in lower y/y price growth," he said on Monday.

Real house price growth - that is after adjustments for the effect of consumer price inflation, remained relatively subdued in the first eight months of the year compared with the corresponding period in 2013.

It was impacted by the fact that consumer price inflation averaged 6.2% y/y in January to August.

These price trends are according to the Absa house price indices, which are based on applications for mortgage finance received and approved by the bank in respect of middle-segment small, medium-sized and large homes.

Macro-economic factors

Du Toit said various macro-economic factors are currently impacting the residential property market and eventually house price trends.

These include low economic growth, low private sector formal employment growth, upward pressure on consumer price inflation, an upward trend in interest rates and declining growth in real household disposable income and consumption growth.

Other factors include a household debt ratio of 73.5% of disposable income on the back of higher interest rates, an increased number of credit-active consumers with impaired credit records and continued relatively low consumer confidence.

READ: Township property prices grow

Furthermore, consumers remain mildly to very exposed in terms of their financial vulnerability in the second quarter of the year, according to Du Toit.

"In view of these economic and household trends, as well as house price growth in the first nine months of the year, single digit nominal price growth is forecast for the remainder of the year and in 2015, with real price growth that will be influenced by trends in consumer price inflation," he said.

- Fin24

Publications

Publications

Partners

Partners