Life insurer FMI (a division of Bidvest Life) is on a mission to change industry behaviour by shifting current industry norms from the traditional ‘lump sum’ approach, to one that champions income benefits first. With multiple advantages for both advisers and customers, it should be an easy choice for advisers to make.

“As an adviser, you make an impact by protecting your clients’ income, so that they can continue to take care of themselves and their loved ones, no matter what life has in store for them,” says FMI Chief Executive Brad Toerien. “FMI’s life insurance philosophy is founded on a core belief that our income is more than just our monthly salary; it’s what supports our future lives, ambitions and dreams. Clients need to understand the total value of their entire future income – not just the monthly salary today.”

Toerien says there has been a significant growth in income benefits sold in the past 18 months. Despite the many conventional product providers that hero lump sum benefits, there’s a large increase in advisers shifting towards advising an ‘Income First’ approach when putting client cover in place for injury, illness and death.

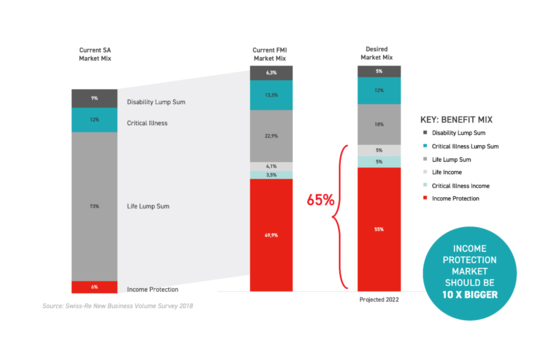

The graphic below shows how FMI-supporting IFAs are fundamentally doing life insurance differently:

The graph on the far right shows FMI’s desired benefit mix for the industry, where 65% of total risk cover is monthly income benefits. The Income Protection market could be 10 x bigger than what it is currently.

Toerien reinforces that “we’re still seeing advisers and life insurers default to insuring their clients against death and permanent disability with lump sum benefits – instead of insuring against their most likely risks such as injury, illness, and critical illnesses. The ‘Income First’ approach is effective because it replaces 100% of client’s hard-earned monthly income when they’re faced with such unfortunate circumstances.”

Income protection currently makes up only 6% of all business written by the industry – as opposed to nearly 50% of all business written by advisers who support FMI*.

As South Africa’s fastest-growing life insurer*, FMI is proving that the ‘Income First’ approach promises better value for your clients;

1. Better cover, and more chances of claiming for your clients.

Adding income protection for injury and illness protects your clients against their most likely risks. The numbers speak for themselves. According to FMI’s 2019 Risk Stats, a 32-year-old male has a 91% chance of having a temporary injury or illness during their working career, and a 37% chance of experiencing a critical illness. At the same time, FMI’s 2018 #RealityCheck consumer survey shows that a staggering two-thirds of respondents would completely run out of money within three months of losing their income.

2. Save your clients premium, or get more cover for the same spend.

The Income First approach means you can re-think the balance between income and lump sum cover solutions. On average, income benefits have proven a 20% premium savings; and not just today, but over the client’s policy life. You as the adviser can either take the premium savings in retirement investments, or, keep the premium at what it was – but give your client more cover or better claims terms, such as adjusting cover to a shorter waiting period.

Taking the Income First approach doesn’t just provide a superior product that meets customer’s needs, it also offers advisers advantages at every stage of the process, says FMI:

At application stage

- Easy sell. Income benefits mimic the income stream you are trying to replace when planning for an unexpected risk event. This should be easier to explain, and therefore easier to sell.

- Simplifies advice process and reduces advice risk. There are fewer calculations and assumptions with income benefits, compared to using a lump sum benefit to provide a future income stream.

- More investment opportunities. Premium savings can be invested towards retirement or investment funds. Plus, a client with a guaranteed future income stream is more valuable than a client that may (or may not) come to you with a lump sum pay-out.

Over duration of policy

- Reduced lapse rates. According to FMI’s 2017 Lapse Report, lump sum benefits are 66% more likely to lapse in their first year, compared to income only benefits.

- Simplifies policy servicing. Income benefits make policy servicing and annual review simpler. All you need to do is understand what may have changed in their lives, and update the policy with your clients’ latest monthly income to ensure they have the correct cover.

At claim stage

- Builds trust. Trust ultimately leads to long-lasting, indispensable relationships, and is developed by offering solutions that will deliver when your clients need it most.

- Creates a client for life. With the guaranteed monthly income, your client is likely to continue other policies and investments, which ensures longevity of your business.

- Mitigates investment and inflation risks. Your clients do not need to worry about investing a lump sum of money, and the future impact of inflation, which in turn reduces advice risk.

Life insurance is intended to insure South African’s against all major risks, but the majority of product solutions sold are not designed to meet this need sufficiently. The best way to start is with a benefit that will pay an income if your client is unable to work due to injury or illness,” says Toerien.

“The tide is changing, the industry is evolving. We’re inviting all advisers and customers to join us as we demonstrate how we’re setting a new standard for life insurance,” said Toerien. “The future of the long-term insurance industry belongs to ‘early adopters’ who understand the promise of an irreplaceable policy.”

*Source: Swiss-Re New Business Volume Survey 2018

**NMG 2018 Q4 Results: subject to all participating providers.

About FMI

FMI, a division of Bidvest Life Limited, offers a suite of life insurance products to protect individuals against life’s risks. This provides our policyholders with a monthly income when they are unable to work, due to an illness, injury or death.

Follow FMI on Facebook, LinkedIn or Twitter.

This post and content is sponsored and provided by FMI.

Publications

Publications

Partners

Partners