Public health outbreaks and epidemics like the recent coronavirus can quickly scare investors and, eventually, affect economies and businesses.

The recent coronavirus outbreak has shut down airports, halted trade, and led to the rapid construction of new hospitals in China. The effects of the outbreak may push China's economy into a period of slower growth, with stocks trading lower as investors seek protection.

So, what does that mean for investors?

Key takeaways

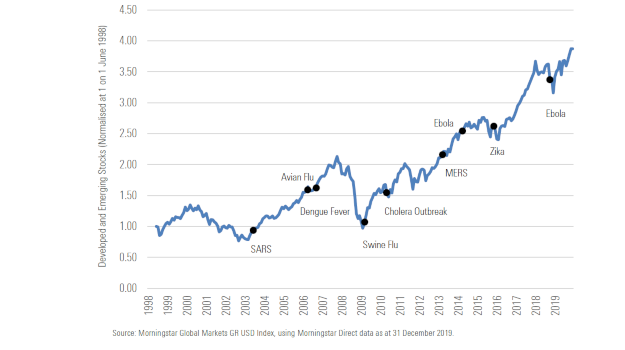

We continually monitor over 250+ markets, looking at everything from fundamental risks to contrarian opportunities. Looking at nine major outbreaks since 1998, however, there is little evidence linking global epidemics with long-term investment fundamentals.

The Chinese economy may slow, perhaps even meaningfully, but that is not a reason to invest or divest. Long-term investing is often best disconnected from short-term economic reactions, so we encourage investors to maintain their focus on what matters.

Epidemics and investing

To understand the potential impacts of an outbreak, we must make a forecast — formally or casually.

This is a complex task if done correctly, and outside the scope of this piece. But it's important to acknowledge that we're trying to peer into the future, which is wrought with intellectual danger. No one can predict the future, but plenty of research suggest ways that forecasts can be improved.

One way to improve the accuracy of a forecast is to start with base rates.

How often do outbreaks become epidemics?

What effect do epidemics have on economies or markets?

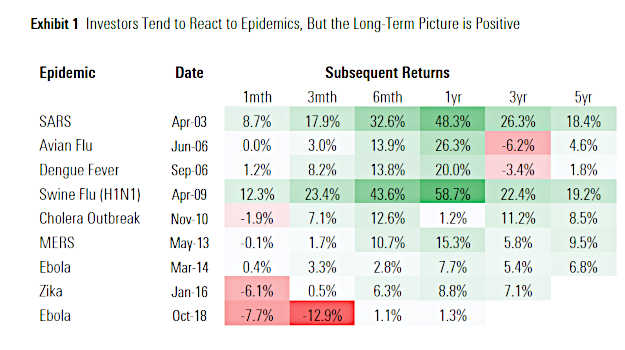

For this latter question, we look to Exhibit 1 to provide a sense of base rates—market returns following major epidemics in recent history.

As depicted, market participants tend to react to such unforeseen outbreaks, but markets tend to recover by the six-month mark. This suggests that sentiment drives early losses, but sustained economic impacts are less than perhaps investors feared at the onset.

Another way to improve forecasts is through humility—especially knowing what you don't and can't know. Expert epidemiologists might be able to produce base rates on spread rates, mortality rates, and so on, but no one can predict how unknowable factors might affect the spread of this or any outbreak. That's not to mention knowing how fear might affect markets.

So how can we make a reasonable assessment of the potential impact of the coronavirus?

As long-term, valuation-driven, fundamentally based investors, our concern is any potential impact to businesses' cash flows. For example, will the collective impact of the outbreak (fewer flights, less trade, loss of productivity, etc.) affect a few businesses, a few industries, or entire markets?

Our answer is that, at this stage, we have to assume the outbreak will take a similar path to other recent epidemics. Note that there's no "safe" approach for investors—for example, exiting stocks in favour of cash has its own risk, namely crystallising any losses suffered to sentiment while almost surely missing out on a rebound if the virus were to be contained quickly.

So we want to proceed by assuming what we consider to be the most likely scenario, while taking other possible outcomes into account.

For our part, we are ultimately very watchful but aren't taking any action. Our core ambition is to help investors reach their goals, which requires a measured and repeatable process to investing.

Across our portfolio range, we may hold exposure to Chinese stocks, emerging-markets stocks, emerging-markets debt, and companies that sell into China to varying degrees depending on the portfolio mandate. Even so, we are still expecting that these holdings will deliver positive outcomes over the long term, and it would require a clear impact to fundamentals for our view to change.

Once the facts change, we would expect to change our minds. If we were to see a clear and significant potential impact to investment fundamentals, we would carefully study the situation, conduct rigorous scenario analysis, and try to incorporate the new information into our portfolios. Until then, we remain vigilant.

Final thought

With lives at stake, it would be uncaring to call the coronavirus "noise". Yet, if we focus on the investor's perspective, we believe it is not time to act. We won’t be hitting the panic button.

Compiled by the team at Morningstar Investment SA. Views expressed are their own.

Disclaimer: Fin24 cannot be held liable for any investment decisions made based on the advice given by independent financial service providers. Under the ECT Act and to the fullest extent possible under the applicable law, Fin24 disclaims all responsibility or liability for any damages whatsoever resulting from the use of this site in any manner.

Publications

Publications

Partners

Partners