Cape Town – Increasingly, employees are asking their companies to take more off their salaries to strengthen their pension contribution, according to Sanlam.

The Sanlam Benchmark Survey revealed that 82% of funds allow members to make additional voluntary contributions, up from 69.5% in 2011. The average additional voluntary contribution for these funds (as a percentage of salary) is 1.41%.

Speaking after the release of survey, Mayuri Reddy told Fin24 that this was one of the interesting behavioural changes occurring in a country plagued by over indebtedness.

Reddy, Sanlam’s Employee Benefits marketing strategist, said education and communication was still a massive issue in the workplace.

“Induction is frequently used by employers to convey key retirement benefit messages. 74% of funds highlighted the importance of member’s taking responsibility for their retirement outcomes,… while 65% provided information on where and how to access more retirement information. 53% of funds covered the importance of preservation to members during their first few days of employment,” Reddy explained in the Benchmark Survey.

Induction failure

“When considering how members experienced their induction programmes, 36% could not recall covering retirement benefits. Of those who did recall retirement topics covered during their induction programmes, the most common messages remembered were the importance of saving early (57%), and the tax benefits of saving through a retirement vehicle (53%). Only 19% of members recalled investment topics being covered in induction, and 12% recalled preservation being discussed.

Reddy said employers were not educating their staff appropriately and this started at induction.

“We see that 72% of members will not revisit decisions that they made when they were first employed, with half of these members saying this was because they were satisfied with the decisions they made, and 24% feeling they were happy to have retirement benefits provided and were not particularly interested in the details.

“This is despite funds’ efforts to provide members with information to ensure that they have adequate retirement provision,” she explained. “In spite of this, we see a lack of understanding from members; 31% know their funds have a stated target pension, however only 66% know what this target is.”

Communicating the importance of fund preservation

The issue of preservation was important as longevity trends showed people living longer, while planning for that longevity was not evident.

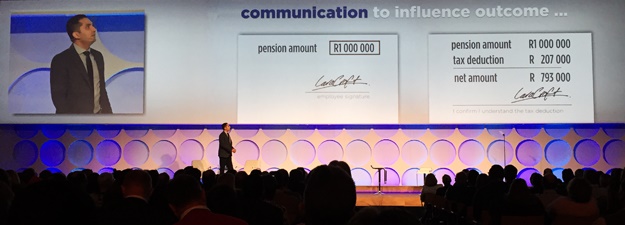

During the Sanlam Benchmark Symposium on Thursday, Sanlam Employee Benefits chief marketing actuary Viresh Maharaj demonstrated the power of communication:

Above, Maharaj gives an example (left) of how HR normally communicates an exiting employee's pension amount and (right) showsa better of way of communicating this to explain what they would lose through tax if they withdrew the amount instead of preserving it. (Photos: Matthew le Cordeur)

Here, Maharaj reveals how much an average employee could save if they preserved their pension fund instead of withdrawing it as cash.

“This lack of engagement and understanding extends to preservation,” Mayuri said. “Of the 20% of members who had withdrawn from their retirement funds, 59% withdrew the full benefit in cash and a further 17% took part of the benefit in cash.

“Almost half of these members did not realise the level of tax that would need to be paid on withdrawal, and 45% did not realise the effect the withdrawal would have on their retirement outcomes.

“Pensioners seem to have felt the impact of their lack of understanding of their withdrawal even more severely, with 63% indicating that they do not fully realise the tax implication of non-preservation, while 61% did not fully understand the impact on their retirement outcomes.

“This lack of understanding is not surprising given that only one in 10 employers provide specific communication on preservation, or lack thereof, prior to a member withdrawing from the fund.

“Given that the employee is leaving the employer, one may expect that very little is done to encourage preservation. However we also considered the new employer encouraging preservation when members are joining their fund. Only one in 4 employers have forms and procedures specifically designed to encourage members to bring previous savings into their new fund.

“This is surprising given that 70% of trustees believe that lack of preservation is the biggest mistake a member could make during their retirement savings journey.”

Publications

Publications

Partners

Partners