A Fin24 user who is paying off her car loan wants to know about settlement options and the interest penalty she is likely to incur. She writes:

I have an existing loan to the full value of R135 000 over 64 months which costs me R2 600pm.

I have since bought a second-hand car which cost R55 000 and with costs etc. R62 000. The full finance period will see me pay R110 000 in full for the car.

I have had the car for 8 months and pay R1 700pm.

Today I phoned to ask for the settlement amount (as I am thinking about trying to get one personal loan which would include the existing loan as well as the settlement amount on the car). It turns out that the settlement amount as at today's date is R65 700. So, I still owe more than the car's original price, after 8 months' payments.

Clearly I have only been paying interest (no?).

My questions now are:

(1) How do I go about this? Is it better to keep on paying on the car finance - for how long will I still be paying only interest - or what are my alternatives?

(2) I am already sick of the car - if I find another car for say a R35 000 purchase price - other than a trade-in (for which I will not even get the R65 000 settlement finance of today), what can I do to alleviate some of the financial burdens?

Douw Leadley of MFC finance, a division of Nedbank answers:

Since the promulgation and inception of the National Credit Act (NCA) in 2007, all credit providers had to adjust their lending criteria and products to comply with NCA. The purpose of NCA is to:

• Promote the economic and social welfare of all South Africans

• Promote a fair and transparent credit market

• Protect consumers and their rights in the credit market

• Regulate all credit providers, debt counsellors and credit bureaux

• Limit the cost of credit

• Level the playing fields between credit providers by standardising the way in which credit is granted by them, so that consumers can compare what is being offered.

The NCA ensures that all credit products are handled in a similar manner by the different credit providers. A credit product refers to the manner in which a credit provider offers credit to a consumer. Examples of credit products include overdrafts, credit cards, loans, clothing and/or furniture accounts.

The aim is to ensure that the different credit products are treated similarly by the different credit providers. Banks, including Nedbank and other financial institutions are credit providers and are therefore regulated by the said Act.

The instalment sale credit product also falls under the Act and requires the Bank to provide the consumer with a credit agreement containing all information regarding the instalment sale. The information should include repayment period, insurance, interest and other fees charged and the consequences should the consumer fail to pay the instalments as per the agreement. The expectation is that the consumer scrutinises the credit agreement, clarifies all concerns upfront and agrees to these terms by signing the agreement indicating consent to all terms and conditions encompassed in the contract.

A vehicle is a depreciating asset. Taking this into account, the banks reviewed the lending terms for vehicle loans and capped it at 72 months to ensure that the consumer is not burdened with a loan on a depreciating asset for more than six years. However, the consumer has the freedom of choice to finance their vehicle of choice over any term shorter than 72 months as per their personal financial position.

When it comes to lending products, the bank has two distinct but interlinked roles; the first role is to meet our client’s need for vehicle finance and the second role is to remain a responsible credit provider and ensure our client can afford the vehicle. As the responsible credit provider, we encourage our client to ensure that he/she is able to afford the monthly instalment, and if he/she is unable to afford the vehicle to rather purchase a less expensive vehicle.

Furthermore, there are no exclusions preventing a client from paying a higher monthly instalment, or should a lump sum cash amount become available to the client to deposit this into the vehicle loan account to reduce the repayment term and/or instalment. In the case where a lump sum payment is deposited into the account, the Act clearly states that the credit provider must credit the client’s account with the lump sum payment and recalculate the remaining value and term and provide the client with the immediate benefit of a reduced instalment and/or term.

In the event that a client has excess funds available these excess funds can be transferred into the vehicle loan account to settle the full outstanding balance on the vehicle loan account.

Personal loans may also be used for the financing of vehicles, however, due to shorter terms and different interest rate structures the maximum amount on personal loans have been capped at R150 000. In this instance, considering the indicated vehicle purchase price of R62 000, a deduction was made that a personal loan was probably applied for to cover the full purchase price of the vehicle in question.

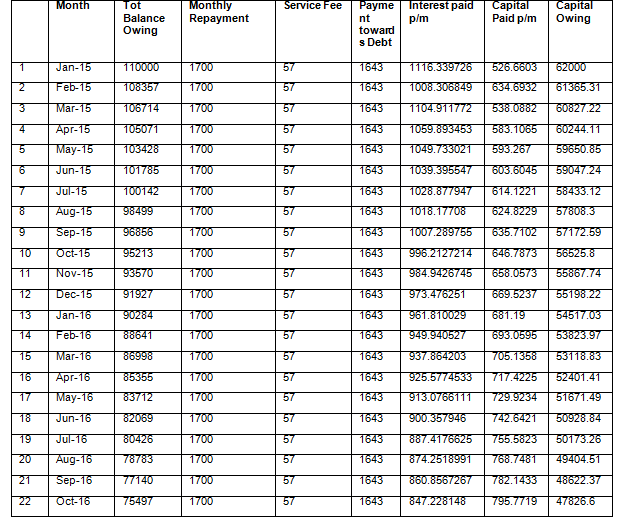

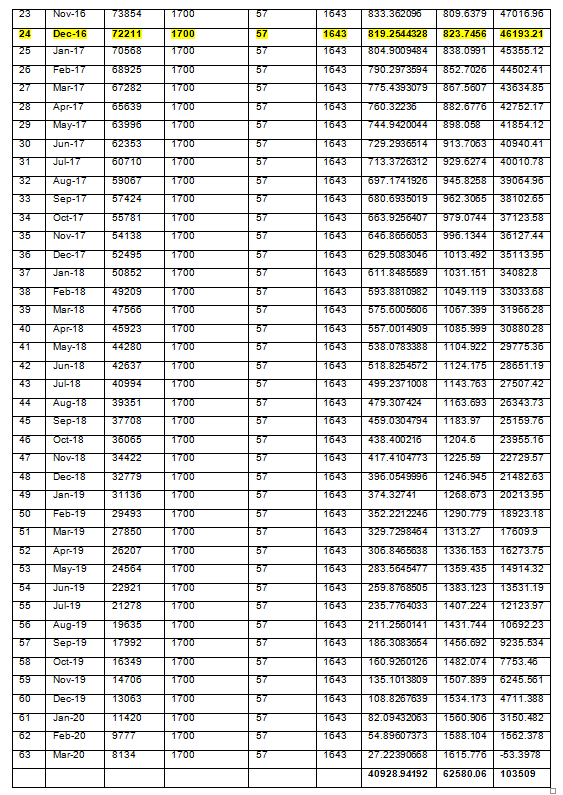

This table is for illustration purposes only:

*Do you have a pressing financial question? Post it on our Money Clinic section and we will get an expert to answer your query.

Disclaimer: Fin24 cannot be held liable for any investment decisions made based on the advice given by independent financial service providers. Under the ECT Act and to the fullest extent possible under the applicable law, Fin24 disclaims all responsibility or liability for any damages whatsoever resulting from the use of this site in any manner.

Publications

Publications

Partners

Partners