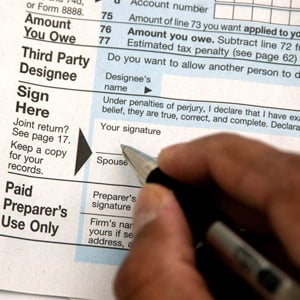

Cape Town - To help make the filing process as seamless as possible Fin24 has joined forces with the SA Institute of Tax Professionals (SAIT), to answer users' tax questions as far as possible.

User question:

"I work in Bloemfontein and live in Cape Town. Subsequently all travel expenses (flight, car hire, accommodation) to Bloemfontein on a fortnight basis are considered to be fringe benefits and as such taxable, which I do not dispute.

During the weeks that I actually am in Cape Town I am also required to travel extensively to clients in close vicinity of me (but far from my employer). Three matters now arise:

Publications

Publications

Partners

Partners