(Shutterstock)

A Fin24 user is surprised to find out that he must pay tax on an outstanding loan amount. He writes:

I resigned recently and my pension/provident fund is being transferred to another pension/provident fund.

Years ago it was allowed to make a loan from your pension/provident fund to pay your bond account.

I made use of this option due to the more favourable interest rates at that time.

With this transfer I have been informed that tax is now payable on the outstanding loan amount, which is regarded as a first withdrawal.

Why is this the case?

Soré Cloete, senior legal advisor at Old Mutual, responds:

In terms of the Pension Funds Act and the rules of a particular fund, a retirement fund may grant housing loans to fund members or provide surety for a member’s existing housing loan.

In terms of the information provided it seems that your original retirement fund allowed you the option of a housing loan.

When you resign from your retirement fund, you would, however, be required to repay the loan as the fund is no longer providing such loan.

The repayment of such an outstanding loan is then done by using your fund credit, which leads to a withdrawal from your fund.

As a withdrawal is made from your current fund credit, to benefit you in the repaying of the loan, you will be

responsible for the tax payable upon such withdrawal.

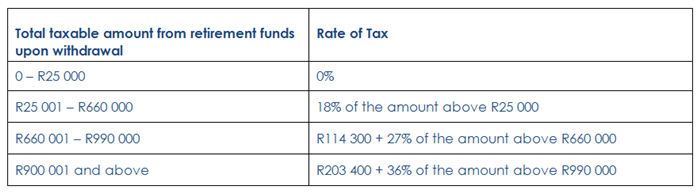

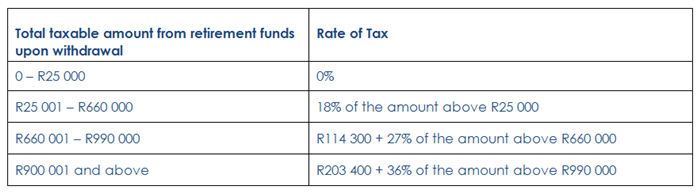

Provided you have not received any retirement benefits before, the tax will currently be calculated using the following table:

The withdrawal benefits received from your retirement fund will be aggregated with your retirement benefits upon retirement; to determine the tax implications at retirement of any retirement lump sums received.

Alternatively - should your retirement fund allow it - you could also use alternative resources to repay the outstanding loan, without having to withdraw from your retirement fund.

You could do this by possibly approaching a bank to assist with the provision of a loan.

Another option may be to approach your new retirement fund to determine whether they provide housing loans.

You would, however, still be required to repay the loan with your original fund and would still be required to have an alternative resource to repay such loan with your original retirement fund.

If an alternative resource is used to fund the repayment of the loan, tax implications will be avoided, as no withdrawal will be required to fund the repayment of the loan.

The above answer is based on the information provided and it would be advisable to seek the advice of a professional financial planner registered with the Financial Services Board (FSB) to look at your specific circumstances and options.

- Fin24

Do you have a pressing financial question? Post it on our Money Clinic section and we will get an expert to answer your query.

Disclaimer: Fin24 cannot be held liable for any investment decisions made based on the advice given by independent financial service providers.

Under the ECT Act and to the fullest extent possible under the applicable law, Fin24 disclaims all responsibility or liability for any damages whatsoever resulting from the use of this site in any manner.

I resigned recently and my pension/provident fund is being transferred to another pension/provident fund.

Years ago it was allowed to make a loan from your pension/provident fund to pay your bond account.

I made use of this option due to the more favourable interest rates at that time.

With this transfer I have been informed that tax is now payable on the outstanding loan amount, which is regarded as a first withdrawal.

Why is this the case?

Soré Cloete, senior legal advisor at Old Mutual, responds:

In terms of the Pension Funds Act and the rules of a particular fund, a retirement fund may grant housing loans to fund members or provide surety for a member’s existing housing loan.

In terms of the information provided it seems that your original retirement fund allowed you the option of a housing loan.

When you resign from your retirement fund, you would, however, be required to repay the loan as the fund is no longer providing such loan.

The repayment of such an outstanding loan is then done by using your fund credit, which leads to a withdrawal from your fund.

As a withdrawal is made from your current fund credit, to benefit you in the repaying of the loan, you will be

responsible for the tax payable upon such withdrawal.

Provided you have not received any retirement benefits before, the tax will currently be calculated using the following table:

The withdrawal benefits received from your retirement fund will be aggregated with your retirement benefits upon retirement; to determine the tax implications at retirement of any retirement lump sums received.

Alternatively - should your retirement fund allow it - you could also use alternative resources to repay the outstanding loan, without having to withdraw from your retirement fund.

You could do this by possibly approaching a bank to assist with the provision of a loan.

Another option may be to approach your new retirement fund to determine whether they provide housing loans.

You would, however, still be required to repay the loan with your original fund and would still be required to have an alternative resource to repay such loan with your original retirement fund.

If an alternative resource is used to fund the repayment of the loan, tax implications will be avoided, as no withdrawal will be required to fund the repayment of the loan.

The above answer is based on the information provided and it would be advisable to seek the advice of a professional financial planner registered with the Financial Services Board (FSB) to look at your specific circumstances and options.

- Fin24

Do you have a pressing financial question? Post it on our Money Clinic section and we will get an expert to answer your query.

Disclaimer: Fin24 cannot be held liable for any investment decisions made based on the advice given by independent financial service providers.

Under the ECT Act and to the fullest extent possible under the applicable law, Fin24 disclaims all responsibility or liability for any damages whatsoever resulting from the use of this site in any manner.

Publications

Publications

Partners

Partners