A Fin24 user wants to know about tax on a lump sum he will receive when he resigns. He writes:

I have R340 000 on my provident fund and am resigning from my job.

My provident fund works like this: My contribution is taxed and employer's contribution is not taxed.

I want to know how much I am going to get as a lump sum?

Raul Jorge CFP®, of PSG Tyger Waterfront, responds:

You will have access to the full amount. However, you will also be liable for the tax payable on this lump sum amount if you choose to withdraw from the fund value.

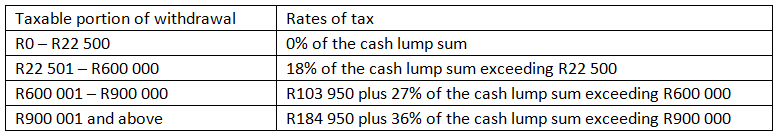

Withdrawals from retirement funds prior to retirement are taxed according to the Lump Sum Withdrawal Tax Table:

Due to the fact that you made contributions to the fund that were not tax deductible, you will be able to deduct this amount from the lump sum available at resignation.

For example, in the event of you personally having made R100 000 worth of non tax deductible contributions, this amount would first be deducted from the lump sum of R340 000, leaving you with a taxable amount of R240 000.

If you have not made any previous withdrawals from retirement funds and opt to withdraw the full fund value, the first R22 500 will be tax free and the remainder will be taxed at 18%, resulting in a total tax liability of R39 150.

The estimated after tax cash value would therefore be R300 850 (R340 000 – R39 150).

The required calculation will depend on your total non tax deductible contributions made.

It is, however, worth noting that no tax would be payable if you were to transfer this fund value to a provident preservation fund or retirement annuity.

This response is based on the limited information provided. It would be advisable to consult a tax practitioner so as to ensure that your particular circumstances are taken into account.

- Fin24

Do you have a pressing financial question? Post it on our Money Clinic section and we will get an expert to answer your query.

Disclaimer: Fin24 cannot be held liable for any investment decisions made based on the advice given by independent financial service providers.

Under the ECT Act and to the fullest extent possible under the applicable law, Fin24 disclaims all responsibility or liability for any damages whatsoever resulting from the use of this site in any manner.

I have R340 000 on my provident fund and am resigning from my job.

My provident fund works like this: My contribution is taxed and employer's contribution is not taxed.

I want to know how much I am going to get as a lump sum?

Raul Jorge CFP®, of PSG Tyger Waterfront, responds:

You will have access to the full amount. However, you will also be liable for the tax payable on this lump sum amount if you choose to withdraw from the fund value.

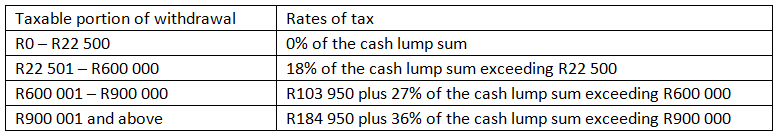

Withdrawals from retirement funds prior to retirement are taxed according to the Lump Sum Withdrawal Tax Table:

Due to the fact that you made contributions to the fund that were not tax deductible, you will be able to deduct this amount from the lump sum available at resignation.

For example, in the event of you personally having made R100 000 worth of non tax deductible contributions, this amount would first be deducted from the lump sum of R340 000, leaving you with a taxable amount of R240 000.

If you have not made any previous withdrawals from retirement funds and opt to withdraw the full fund value, the first R22 500 will be tax free and the remainder will be taxed at 18%, resulting in a total tax liability of R39 150.

The estimated after tax cash value would therefore be R300 850 (R340 000 – R39 150).

The required calculation will depend on your total non tax deductible contributions made.

It is, however, worth noting that no tax would be payable if you were to transfer this fund value to a provident preservation fund or retirement annuity.

This response is based on the limited information provided. It would be advisable to consult a tax practitioner so as to ensure that your particular circumstances are taken into account.

- Fin24

Do you have a pressing financial question? Post it on our Money Clinic section and we will get an expert to answer your query.

Disclaimer: Fin24 cannot be held liable for any investment decisions made based on the advice given by independent financial service providers.

Under the ECT Act and to the fullest extent possible under the applicable law, Fin24 disclaims all responsibility or liability for any damages whatsoever resulting from the use of this site in any manner.

Publications

Publications

Partners

Partners