I have a provident fund that should be worth around R1m in seven years' time.

I have already paid tax on my salary during my working life. Will this amount also be taxed?

Cobus Strydom (CA)SA, head of consulting at Absa Consultants and Actuaries, responds.

Tax is payable on all lump sums paid by a retirement fund.

The taxable portion on a specific retirement fund lump sum benefit (X) is equal to:

• the tax determined by applying the prescribed tax tables to the aggregate of that lump sum X

PLUS

• all other lump sum withdrawal benefits accruing to the person from March 2009, all lump sum retirement benefits accruing to the person from October 2007 and all severance benefits accruing to that person from March 2011.

LESS

• the tax determined by applying the prescribed tax table to the aggregate of all lump sum withdrawal benefits accruing before lump sum X from March 2009, all lump sum retirement benefits accruing from October 2007 and all severance benefits accruing from March 2011.

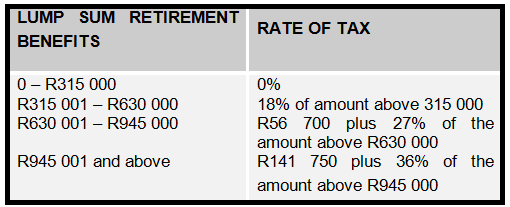

Tax payable on retirement/death/retrenchment lump sum benefits:

• The prescribed tax table for retirement/death/retrenchment lumps sum benefits is as follows:

Note: Own contributions that were not permitted as a deduction, plus (if any) a tax-free public sector portion previously transferred to the fund by the public sector fund, can be deducted from the value of the benefit before the prescribed table is applied and will rank as a tax free portion.

• Your example: If you exit your provident fund due to retirement/death/retrenchment and you decide to take your full R1m in cash,

- the tax free portion on your R1m lump sum will be R315 000

PLUS

the amount of your own contributions to your provident fund that were not permitted as a tax deduction

MINUS

any tax free portions allowed in previous years of assessment due to you retiring from another fund.

- the tax payable will be calculated as follows (for this calculation it is assumed that you did not have any tax free deductibles and no previous withdrawal or retirement lump sum accruals):

Tax on R1m will then be R141 750 plus R19 800 (36% on R55 000) = R161 550.

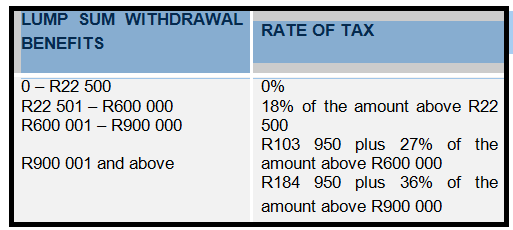

Tax payable on dismissal/resignation lump sum benefits:

• Tax free portion: As per the prescribed tax table, the tax free portion amounts to R22 500

• The prescribed tax table for resignation benefits is as follows:

• Your example: If you exit your provident fund due to dismissal/resignation and you decide to take your full R1m in cash, your R1m lump sum will be taxed as follows (for this calculation it is assumed that you did not have any tax free deductibles and no previous withdrawal or retirement lump sum accruals):

Tax on R1m will be R184 950 plus R36 000 (36% on R100 000) = R220 950.

- Fin24

Do you have a pressing financial question? Post it on our Money Clinic section and we

will get an expert to answer your query.

Disclaimer: Fin24 cannot be held liable for any investment decisions

made based on the advice given by independent financial service providers.

Under the ECT Act and to the fullest extent possible under the applicable law,

Fin24 disclaims all responsibility or liability for any damages whatsoever

resulting from the use of this site in any manner.

Publications

Publications

Partners

Partners