A Fin24 user and his employer were supposed to contribute to his provident fund, but now the latter's contributions seem to be missing. He writes:

I have a question regarding my provident fund. My contract with my employer has been terminated, but, throughout the course of my employment, we each contributed 10.5% every month towards my fund (employer and employee contributions).

However, on my provident fund statement it only reflects my 10.5%.

Now that my contract has been terminated, I would like to know what happens to my share? Will I be able to access this?

Does this mean that I am entitled to claim against the full 21% that was contributed?

READ: Tax on provident fund payout

Raul Jorge CFP®, of PSG Tyger Waterfront, responds:

For the purpose of this response I am assuming that you and your employer were contractually bound to each contribute 10.5% of your salary towards a provident fund on your behalf.

The contributions paid by you and your employer would, therefore, be for your benefit. These combined contributions form part of your fund value, along with any growth your investment has achieved.

Typically, these funds would be accessible upon death, disability, retirement, resignation or retrenchment (as specified by the fund’s rules).

You should, therefore, be entitled to claim against the full 21% contributed to the fund on your behalf throughout the period during which you were in the service of your employer.

READ: What about tax on a provident fund payout?

If a portion of your provident fund contributions was used to pay for risk benefits that formed part of your employee benefits - for instance life cover and disability cover - this would obviously have reduced the actual monthly contributions your fund received (and therefore your overall fund value).

Based on the Pension Funds Act, any amount you may owe your employer can also be deducted from your provident fund. This includes legal costs for proceedings where you have admitted liability in writing or where there has been a judgment against you in any court for damage caused to your employer by theft, dishonesty, fraud or misconduct.

You can choose to withdraw your accumulated retirement savings, or to transfer it tax free to a provident preservation fund for reinvestment. If you transfer your savings to a provident preservation fund, the full value of your provident fund can be reinvested until retirement.

This is the most prudent course of action in working towards a financially secure retirement. If you withdraw the savings in your provident fund, you will be taxed on your withdrawal.

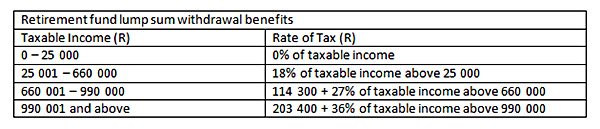

Your withdrawal will be taxed differently depending on whether you were dismissed or retrenched. If you were dismissed, your fund value at withdrawal would be taxed according to the retirement lump sum withdrawal benefits tax table:

(Source: PSG)

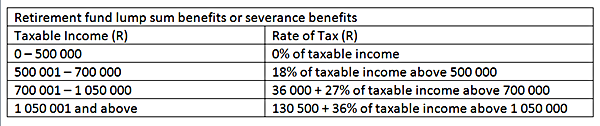

However, if you were retrenched you would be taxed according to the retirement fund lump sum benefits or severance benefits tax table:

(Source: PSG)

If you have made any retirement fund withdrawals before, these will be taken into account when determining how this withdrawal will be taxed. Similarly, any contributions you previously made to a retirement fund that did not qualify for a tax deduction will also be taken into account (contributions to retirement funds may qualify for tax deductions).

All contributions made by both you and your employer to this provident fund should have been transferred and paid into the fund each month. If your employer did not transfer its agreed contributions, the employer can be held liable for these contributions and for growth that would have accumulated if the contributions were made.

The correct course of action would be to try and resolve this matter via your employer. If this is unsuccessful, you can contact your provident fund directly.

If all else fails, the Pension Funds Adjudicator should be able to help you resolve the matter.

ALSO READ: Contract workers and provident funds

Disclaimer: Fin24 cannot be held liable for any investment decisions made based on the advice given by independent financial service providers. Under the ECT Act and to the fullest extent possible under the applicable law, Fin24 disclaims all responsibility or liability for any damages whatsoever resulting from the use of this site in any manner.

Publications

Publications

Partners

Partners