I want to know whether I should transfer my retirement capital into a life annuity or a living annuity.

What are the pros and cons?

Danelle van Heerde, head: advice processes and tools at Sanlam, responds:

There are a number of potential threats to your income and financial security after retirement:

- You or your spouse may outlive your investments and income;

- Your income may not keep up with inflation, so that your standard of living declines; and

- Negative market conditions may impact your investments and/or income.

Life annuities and living annuities mitigate these threats in different ways.

Guaranteed life annuities provide a guaranteed income stream for the life of the annuity holder.

A second annuity holder, for example a spouse, can be added at purchase. In this case the income will be paid until the last annuity holder dies.

It is possible to select an income drop (e g by 50%) at the death of the annuity holder.

Generally income ceases at death, but it is possible to select a certain term at outset, in which case income will be paid to the annuity holder’s beneficiaries until the end of the certain term if death occurs within that period.

For example, if a 10-year certain term is selected, the income will be paid for at least 10 years.

Although an increasing income stream provides a lower initial income, it is crucial to maintain your standard of living after retirement, as your expenses will rise by inflation every year.

If you require a product to provide you with your only or main source of income post retirement, you should consider an increasing guaranteed life annuity.

An inflation-linked life annuity is a special type of guaranteed life annuity that provides an income stream that is guaranteed to increase with inflation for the life of the annuity holder.

It is possible to add a second annuity holder or select a certain term at purchase, as for other guaranteed life annuities.

An inflation-linked life annuity provides the best possible protection for your financial security post retirement, as you do not carry any longevity, inflation or investment risk.

This is important if you do not have sufficient retirement and other funding to carry these risks yourself.

Investment-linked life annuities (ILLAs) are only recommended for investors with retirement proceeds in excess of R1m, with significant additional sources of post-retirement income or with low life expectancy due to ill-health.

It offers no protection against you living longer than expected, and you have to carry both the investment and inflation risk yourself.

With an ILLA, a range of investment funds is available to the annuity holder. The retirement proceeds are invested in the selected investment funds and used to provide an income.

Between 2.5% and 17.5% of the total investment value must be withdrawn each year as income.

It is possible to adjust the income annually, as long as it remains between 2.5% and 17.5% of the investment value.

If the initial level of income selected is too high and increased annually by inflation, the withdrawal percentage will at some point be capped at the maximum, after which it will not be possible to increase the income by inflation any more.

The income is very likely to start reducing thereafter.

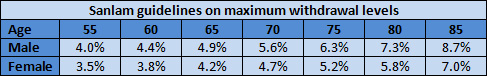

Sanlam has compiled a table of maximum recommended income withdrawal percentages for ILLAs to help clients in selecting an appropriate level of income to withdraw, given their age.

The percentages in the table give an indication of the maximum percentage that should be withdrawn. The limits are set to target an income level that should not reduce in real terms (after allowing for inflation) during their life expectancy without running into the regulatory maximum draw-down rate of 17.5%.

They are based on a portfolio that generates a return of 2% above inflation per year after fees have been taken into account (for example, a portfolio generating a return of 9.5% per year, if inflation is 5.5% and fees are 2% per year).

It is important to select an appropriate investment fund portfolio for an ILLA. The annuity holder must balance earning an investment return that can support annual increases in income, and limiting the volatility in the investment value.

A significant fall in investment values may have serious consequences for the level of future income that can be sustained.

If you are considering an investment in an ILLA, you should involve a registered financial adviser that specialises in investments. Any investment funds remaining at death will be paid to the annuity holder's estate or beneficiaries.

Another possible option is a combined life annuity, which consists of a guaranteed (could be inflation-linked) life annuity combined with an ILLA.

The guaranteed life annuity should be used to provide enough income to cover essential expenses, with the ILLA supplementing this with a more flexible income stream.

When the market is low or unstable, the income drawn from the ILLA should be reduced to protect the capital and future income.

The decisions to be taken at retirement are complex. There are many retirement income options available, and the most appropriate income strategy for you may involve a combination of them.

It is possible to convert an ILLA to a guaranteed life annuity, but a guaranteed life annuity cannot be changed. It is therefore critical that you think carefully about your options.

It is recommended that you consult with an experienced registered financial adviser to ensure that you make the decisions that are most appropriate to your specific financial situation.

- Fin24

Do you have a pressing financial question? Post it on our Money Clinic section and we will get an expert to answer your query.

Disclaimer: Fin24 cannot be held liable for any

investment decisions made based on the advice given by independent

financial service providers.

Under the ECT Act and to the fullest

extent possible under the applicable law, Fin24 disclaims all

responsibility or liability for any damages whatsoever resulting from the use of this site in any manner.

Publications

Publications

Partners

Partners