A Fin24 user writes:

I would like to know how much you would receive after tax if

you have a pension fund of R5m and you only draw 5% a month, and how long it

will last.

Danelle Esterhuizen, legal specialist for senior market

advice at Sanlam, answers:

The easy answer to your question is that your capital will last forever if the growth on your investment is more than the income you withdraw. Unfortunately, investment is not that simple.

Factors such as your age, your marginal tax rate, the underlying investment assets and your appetite for risk etc. will influence the investment dramatically.

Moreover, personal circumstances and needs (which I have no information about) add even more detail to the picture.

I assume that this scenario applies to once you have reached retirement age (thus from the age of 55) and that it speaks to a living annuity (ILLA).

An ILLA is only one of the investment options available for pension monies at retirement.

The value of your capital in an ILLA is dependent on the value of the underlying investments.

Income levels are therefore not guaranteed and, unlike a guaranteed annuity, you are exposed to investment and longevity risk.

Current legislation permits you to draw an income of between 2.5% and 17.5% per annum of the capital value of your ILLA investment.

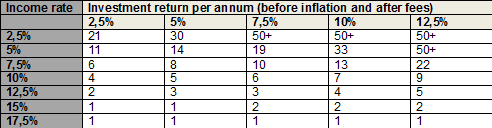

The Association for Savings and Investment in South Africa (Asisa) has provided a table that serves as a guide to the sustainability of a specific level of income for a given level of investment return in the portfolio.

However, markets and circumstances change and it is therefore vital that you, together with an accredited financial adviser, review your income percentage on an annual basis.

The table below shows the number of years it will take before your income starts to drop, given a specific investment return in your portfolio and a selected annual income rate.

The table assumes that your income will be adjusted annually to allow for inflation to maintain your standard of living.

Years before your income will start to reduce (in today’s money, ie after taking into account inflation of 6% per annum)

Now let me provide a more concrete answer to your question:

I assume that this is your only income for tax purposes, and that you are 55 years old today.

It is unrealistic to make long-term tax assumptions as tax tables change annually and your income in real terms decreases over time, which then attracts less tax.

As you get older, further rebates will also influence the tax calculation.

Therefore I will provide you with pre-tax calculations (currently R20 833 per month before tax for a person of 55 with no other taxable income and no deductions, will be equal to R17 969 per month after tax).

If an income of 5% per annum (payable monthly) is withdrawn, an inflation rate over the term of 6% is assumed, and a net investment return of 10% is achieved, you will after 33 years still have R3.3m left (in real terms).

In year one your monthly income will be R20 833 before tax, but in year 33 you will be able to buy the same goods that you can buy today with R13 965, pre-tax.

It will therefore make much more sense to allow an increase (for example of inflation) on the income rate to maintain the same purchasing power, keeping in mind that current legislation permits you a maximum withdrawal rate of 17.5%.

The income rate is thus capped at 17.5%. Based on the same assumptions as above, you will then be able to maintain the purchasing power of R20 833 before tax up until year 32.

From year 33 your income will fall (it will be only 17.5% of the investment amount). In year 33 you will be able to buy the goods you can currently buy with R18 391 per month pre-tax.

In the final analysis, the best answer to your question is to contact a qualified and accredited financial adviser (preferably a Certified Financial Planner) and obtain specialist advice relative to your personal circumstances.

- Fin24

Disclaimer: Fin24 cannot be held liable for any investment decisions made based on the advice given by independent financial service providers.

Under the ECT Act and to the fullest extent

possible under the applicable law, Fin24 disclaims all responsibility or

liability for any damages whatsoever resulting from the use of this

site in any manner.

* Do you have a pressing financial question? Post it on

our Money Clinic section and we will get an expert to answer your query.

* Follow Fin24 on Facebook, Twitter and Google+.

Publications

Publications

Partners

Partners