(Shutterstock)

A Fin24 user wants to use ETFs to grow his existing R9m and fund his retirement. He writes:

I am a 58 year old retiree. I have about R9m available in total to fund my retirement.

I am considering investing all of it in ETFs through a broker. Could you advise which ETFs to invest in?

Which ETFs are considered moderate risk and at the same time provide excellent growth?

Mike Brown, managing director of etfSA, responds:

So you want to set up a portfolio of ETFs to provide moderate risk, but with excellent capital growth?

One has to assume that you are less concerned about income generation from the portfolio? This can of course, only be ascertained by doing a financial needs analysis for you.

The following is suggested:

A passive investment technique, using index tracking ETFs, is predicated on developing a strategic asset allocation and choosing ETFs that will deliver this asset allocation in a low cost, low risk manner.

Most studies, locally and abroad, indicate that for investment periods of ten years or more (you are 58 years old), the correct asset allocation accounts for 90% or more of the long-term performance of a portfolio, with stock-picking of individual shares being relatively unimportant.

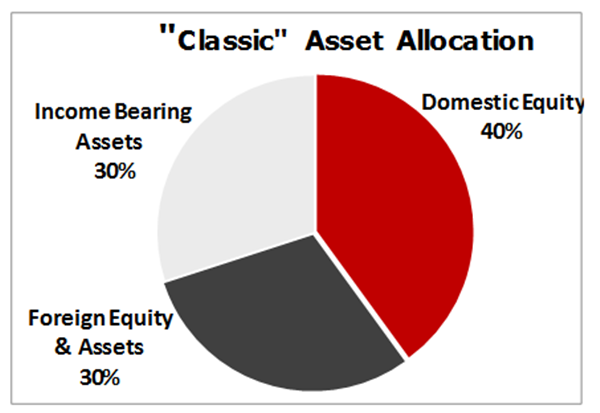

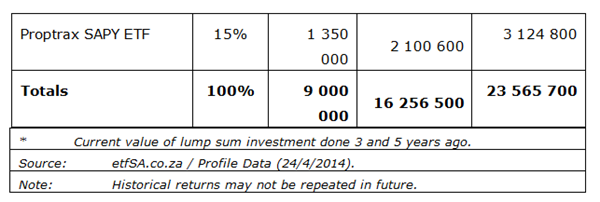

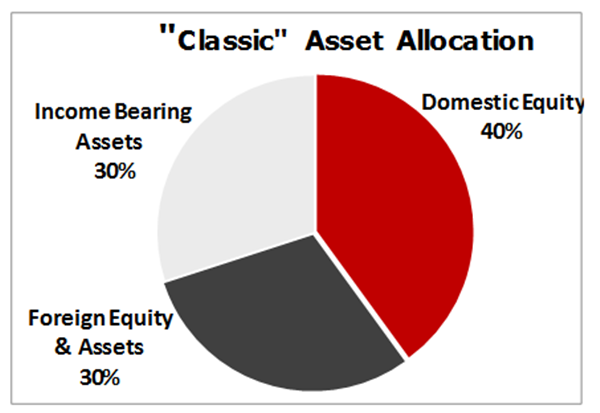

A “classic” asset allocation is as follows, for a 10 year plus investment:

The asset allocation “mix” can, of course, be amended to suit your requirements, but this requires a process of financial advice including undertaking a financial needs analysis.

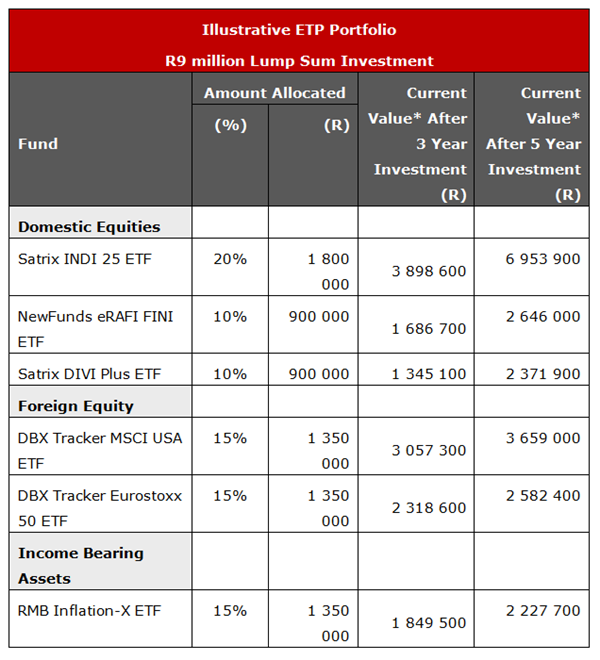

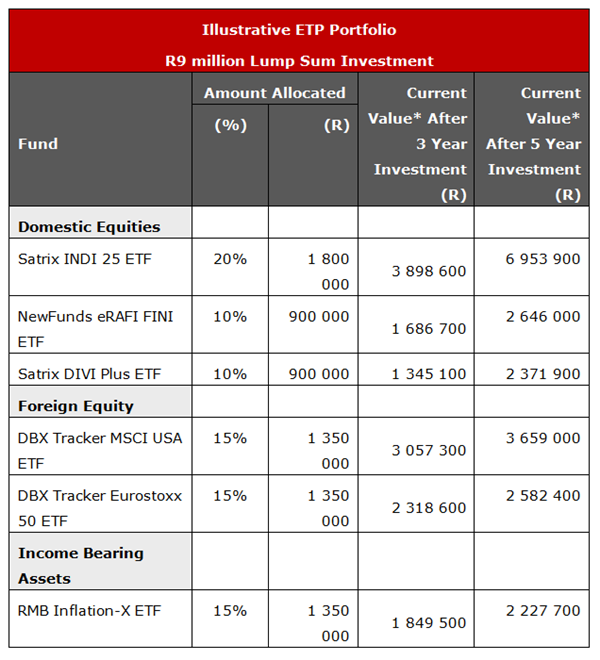

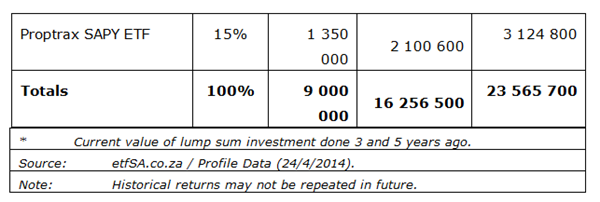

The table below shows an illustrative portfolio of ETFs selected to deliver the “classic” asset allocation above.

The “historic” performance of this portfolio has been around 30% per year over the past three to five years.

Bear in mind that historic investment performance might not be repeated in future, and that the past five years have been relatively good for most investment assets.

This was because of the worldwide recovery from the 2008/2009 financial crises.

The significantly better performance of an asset allocation portfolio, using ETFs to provide the multi-asset portfolio blends, compared with actively managed unit trust “balanced” portfolios is due to the following:

- Far greater flexibility in the asset allocation in passive portfolios, which are not inhibited by the scalability problems facing the larger asset managers;

- Far lower costs for ETFs, which makes a big difference over time;

- Significantly lower volatility in ETF portfolios.

- Fin24

Do you have a pressing financial question? Post it on our Money Clinic section and we will get an expert to answer your query.

Disclaimer: Fin24 cannot be held liable for any investment decisions made based on the advice given by independent financial service providers.

Under the ECT Act and to the fullest extent possible under the applicable law, Fin24 disclaims all responsibility or liability for any damages whatsoever resulting from the use of this site in any manner.

I am a 58 year old retiree. I have about R9m available in total to fund my retirement.

I am considering investing all of it in ETFs through a broker. Could you advise which ETFs to invest in?

Which ETFs are considered moderate risk and at the same time provide excellent growth?

Mike Brown, managing director of etfSA, responds:

So you want to set up a portfolio of ETFs to provide moderate risk, but with excellent capital growth?

One has to assume that you are less concerned about income generation from the portfolio? This can of course, only be ascertained by doing a financial needs analysis for you.

The following is suggested:

A passive investment technique, using index tracking ETFs, is predicated on developing a strategic asset allocation and choosing ETFs that will deliver this asset allocation in a low cost, low risk manner.

Most studies, locally and abroad, indicate that for investment periods of ten years or more (you are 58 years old), the correct asset allocation accounts for 90% or more of the long-term performance of a portfolio, with stock-picking of individual shares being relatively unimportant.

A “classic” asset allocation is as follows, for a 10 year plus investment:

The asset allocation “mix” can, of course, be amended to suit your requirements, but this requires a process of financial advice including undertaking a financial needs analysis.

The table below shows an illustrative portfolio of ETFs selected to deliver the “classic” asset allocation above.

The “historic” performance of this portfolio has been around 30% per year over the past three to five years.

Bear in mind that historic investment performance might not be repeated in future, and that the past five years have been relatively good for most investment assets.

This was because of the worldwide recovery from the 2008/2009 financial crises.

The significantly better performance of an asset allocation portfolio, using ETFs to provide the multi-asset portfolio blends, compared with actively managed unit trust “balanced” portfolios is due to the following:

- Far greater flexibility in the asset allocation in passive portfolios, which are not inhibited by the scalability problems facing the larger asset managers;

- Far lower costs for ETFs, which makes a big difference over time;

- Significantly lower volatility in ETF portfolios.

- Fin24

Do you have a pressing financial question? Post it on our Money Clinic section and we will get an expert to answer your query.

Disclaimer: Fin24 cannot be held liable for any investment decisions made based on the advice given by independent financial service providers.

Under the ECT Act and to the fullest extent possible under the applicable law, Fin24 disclaims all responsibility or liability for any damages whatsoever resulting from the use of this site in any manner.

Publications

Publications

Partners

Partners