My wife and I purchased a residential property in May 2014 for R980 000. We did not move into this property when transfer took place, rather opting to rent out the property to enable us to save for renovations we would like to do before moving in. We saved an amount over the past year and then put it into a fixed term savings account at Capitec Bank, earning 7.8% interest over a period of 19-24 months (this being by far the most flexible and best interest earning account of all SA banks).

We intend to continue saving for another 18 months, paying this extra money into the home loan, currently with an interest rate of 8.75%. This is to split the risk of keeping all our savings at one financial institution: read Saambou, African Bank etc.

My question: When paying money into the home loan, over and above the required instalment, general information tells me that I will be "saving" interest payments at 8.75%.

Will I forfeit these "savings" when I withdraw the funds from the flexi-reserve, either all or some of it to use towards the renovations in 18 months' time? What financial option could be used to maximise the interest earned/saved over the next 18 months, but also limit the risk of saving at one institution?

Depositing money into your home loan is the best option when compared to just purely saving.

READ: Access bond best way to save

Save risk free with a home loan - expert

As you say, your savings interest rate on your fixed deposit is 7.8% while your interest rate expense from your home loan is 8.75%.

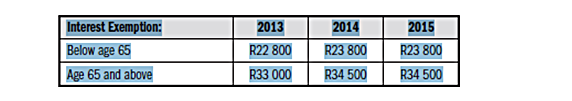

The interest on your savings is taxable once you reach a certain threshold. The following interest earnings for 2014/5 are exempt:

Not knowing the amount you have saved so far makes it difficult to be more specific to your case, as does not knowing how much of the R980 000 is outstanding.

Nevertheless, you generally will get better value from depositing money into your home loan and it may be tax efficient.

You ask whether you will forfeit your "savings" when you withdraw the funds from the flexi-reserve to use towards home renovations in 18 months' time.

The bank will only charge you interest on the outstanding balance of your home loan. Immediately after you have deposited your savings, the balance will reduce and, together with that, the interest charged.

This also implies that any withdrawals, as and when they happen, will increase the balance and increase the interest charge.

The savings will not be forfeited once a withdrawal is made as less interest is paid off every month on the home loan over the savings period.

The withdrawal, after the 18-month saving period, will only place the client back to the payment schedule that he/she was on before making the pre-payments.

As to your query of financial options to maximise the interest earned/saved over the next 18 months, Absa has several financial options to maximise your return. These include:

a. Term deposit - which include the fixed and Prime-linked deposits. This is more suitable for customers who have a lump sum investment and do not want to have access to their funds for a specific period.

b. Notice deposits – which includes Notice Select for the flexibility of having access to funds if need be. More suitable for customers wanting to lock their funds and only access them through various notice options and still add more funds regularly. You also have an option for a Target Save product that allows you regular deposits for six months and thereafter becomes a normal 32-day notice account.

c. Demand - Depositor Plus which has a high interest earning while customers enjoy the benefit of instant access to their funds. And the Trusave product allows for gradually growing your savings from as little as R50.

In addition, you may want to consider the following:

a. How your rental income is treated may dictate how your renovation expenses will also be treated – it may be tax deductible.

b. Tax efficiencies on paying extra funds in your home loan instead of saving it separately.

c. You also need to provide some detailed and definitive information in order for a better and direct assessment feedback and advice.

Absa would like to recommend that you contact a certified financial adviser for a detailed financial assessment and recommendations.

NOW READ: Accessing money in a flexi bond

Disclaimer: Fin24 cannot be held liable for any investment decisions made based on the advice given by independent financial service providers. Under the ECT Act and to the fullest extent possible under the applicable law, Fin24 disclaims all responsibility or liability for any damages whatsoever resulting from the use of this site in any manner.

Publications

Publications

Partners

Partners