(Shutterstock)

A Fin24 user wants a comparison between hospital cash back policies and medical aid schemes. He writes:

What is best between hospital cash back and medical aid?

Damian McHugh, head of marketing and sales at Momentum Health responds.

The answer to this question will really depend on what a health care consumer's needs are.

It is always recommended that a financial advisor be consulted to find the best fit for the particular family.

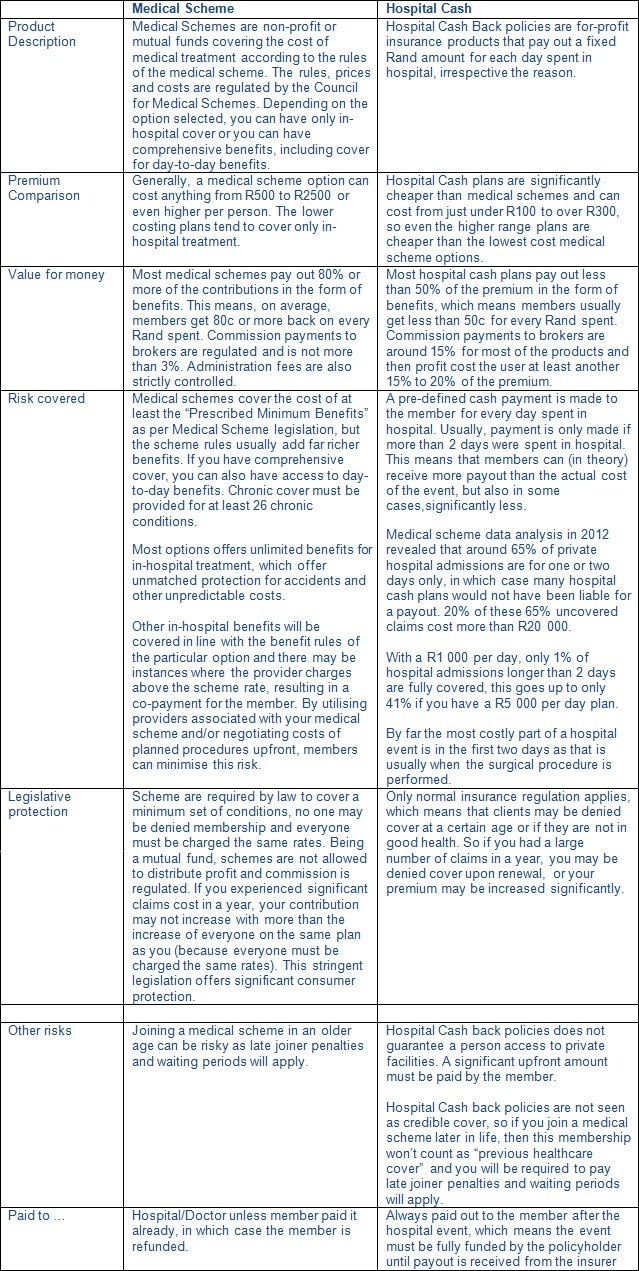

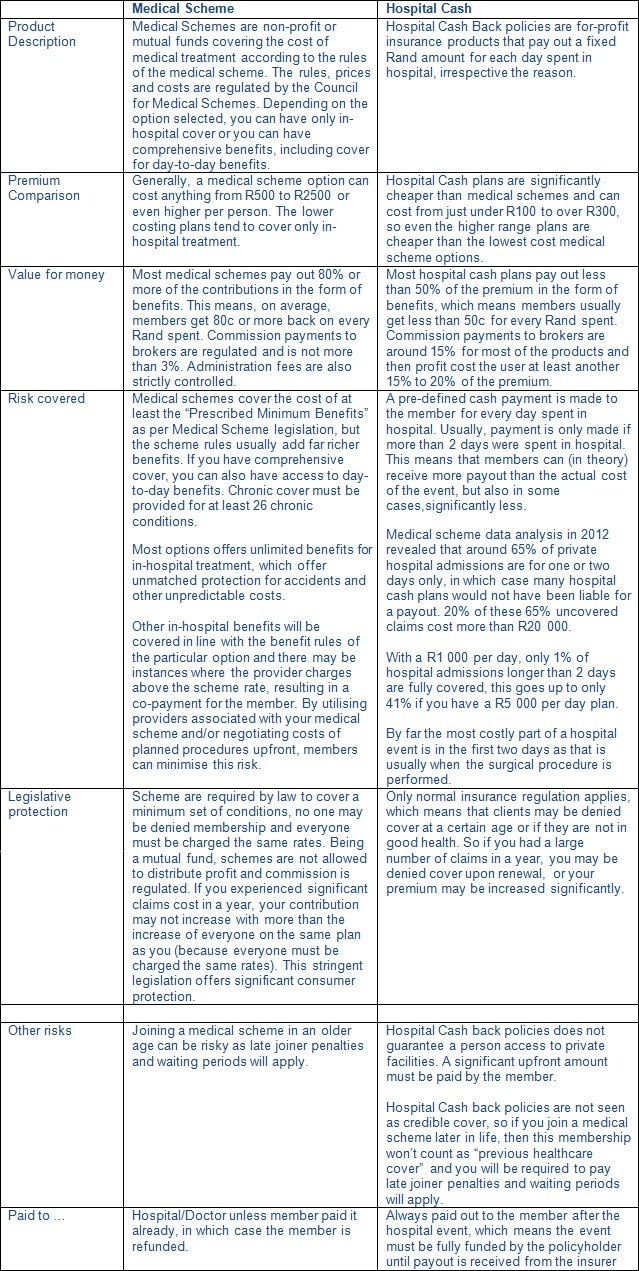

In terms of comparing medical schemes with hosptial cash back policies, comparisons can be drawn on the basis of the type of product, its price, value for money and risk covered.

It is important to note that these comparisons (provided below) are generalised and may not be applicable to each and every case scenario.

However, in our view hospital cash back policies alone will not offer you enough to make use of private hospitals when you need it, but can work for the following cases:

- You cannot afford a medical scheme and intend to use the state facilities if you are hospitalised. This policy is then used to cover incidental costs related to the hospital stay;

- You are on a medical scheme and want to make additional provision for co-payments or unknown costs not covered by the medical scheme option.

- Fin24

Do you have a pressing financial question? Post it on our Money Clinic section and we will get an expert to answer your query.

Disclaimer: Fin24 cannot be held liable for any investment decisions made based on the advice given by independent financial service providers.

Under the ECT Act and to the fullest extent possible under the applicable law, Fin24 disclaims all responsibility or liability for any damages whatsoever resulting from the use of this site in any manner.

What is best between hospital cash back and medical aid?

Damian McHugh, head of marketing and sales at Momentum Health responds.

The answer to this question will really depend on what a health care consumer's needs are.

It is always recommended that a financial advisor be consulted to find the best fit for the particular family.

In terms of comparing medical schemes with hosptial cash back policies, comparisons can be drawn on the basis of the type of product, its price, value for money and risk covered.

It is important to note that these comparisons (provided below) are generalised and may not be applicable to each and every case scenario.

However, in our view hospital cash back policies alone will not offer you enough to make use of private hospitals when you need it, but can work for the following cases:

- You cannot afford a medical scheme and intend to use the state facilities if you are hospitalised. This policy is then used to cover incidental costs related to the hospital stay;

- You are on a medical scheme and want to make additional provision for co-payments or unknown costs not covered by the medical scheme option.

- Fin24

Do you have a pressing financial question? Post it on our Money Clinic section and we will get an expert to answer your query.

Disclaimer: Fin24 cannot be held liable for any investment decisions made based on the advice given by independent financial service providers.

Under the ECT Act and to the fullest extent possible under the applicable law, Fin24 disclaims all responsibility or liability for any damages whatsoever resulting from the use of this site in any manner.

Publications

Publications

Partners

Partners