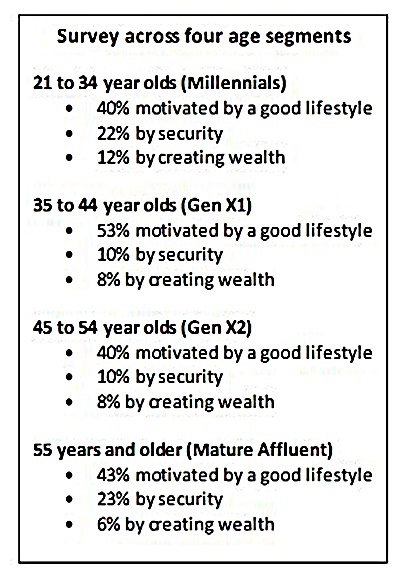

Cape Town - Lifestyle is the primary influencer in money management decisions, followed by security in second place and creating wealth as third priority.

This is according to an in depth customer survey conducted by Liberty.

The results showed that there is a general misconception in the financial services industry that creating wealth is the main motivator for money management decisions among consumers.

“Every day of our lives, we make choices about how and where we spend our money. Sometimes saying yes to one thing means saying no to something else. These decisions can influence our lives and future," says Shani Erwee, head of insights at Liberty.

"To deliver exceptional long-term insurance products that meet the exact needs of the customer, insurers must understand their customer buying decisions.”

SUBSCRIBE FOR FREE UPDATE: Get Fin24's top morning business news and opinions in your inbox.

Read Fin24's top stories trending on Twitter: Fin24’s top stories

Publications

Publications

Partners

Partners