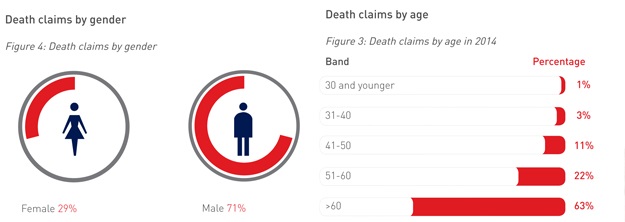

Sun City – Accidents on South Africa’s roads resulted in 49% of all unnatural deaths being claimed through life insurance in 2014, according to the Momentum Retail Insurance claim statistics for the period January to December 2014.

There was also an alarming increase in claims arising from suicide (20%), which was a concerning trend, Momentum Myriad’s chief Stephen van Niekerk told media at Sun City on Monday evening ahead of its Risk Summit.

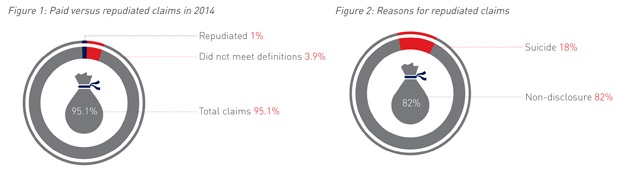

Momentum paid out 95.1% of its claims in 2014, in which R1.9bn was paid in death claims and more than R2.7bn paid across all benefit types.

Of the unpaid claims, 18% of those claims were repudiated due to suicide, said Van Niekerk.

Billions paid out

Over the last 13 years more than R130bn was paid to clients as a result of life-changing events like death, disability and critical illness. This amount was calculated by considering the claims statistics for individual life policies of the largest life insurers in South Africa.

It is important to recognise that the overwhelming majority of this cover was put in place by financial advisers as part of a comprehensive financial plan.

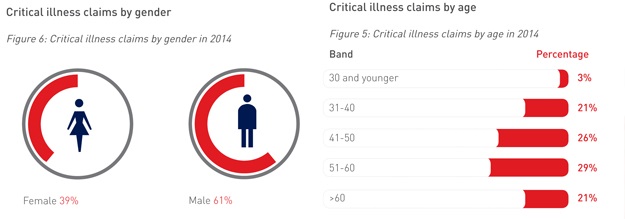

“According to the 2014 claim statistics, critical illness was again the second largest claim category, after death claims, and increased in relative terms from 2013,” said Van Niekerk.“With the expected improvements in longevity and the associated higher prevalence of critical illness events in older ages, we expect this trend to continue."

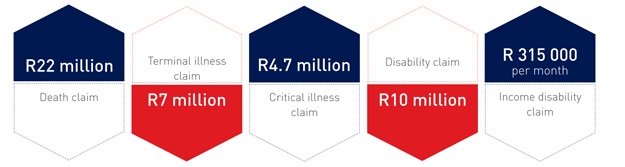

Momentum risk briefing: insurance company paid out R82 million in terminal illness claims in 2014.

— Matthew le Cordeur (@lecordeur) March 2, 2015“This persisting trend once again highlights the importance of critical illness cover and longevity protection as part of your financial planning solution."

Even though the “Big 4” (heart attack, heart bypass, cancer and stroke) conditions accounted for 71% (down from 78% in 2013) of all the critical illness claims, 29% of claim events were as a result of conditions that fall outside of these.

“Given the recent tax changes on income disability benefits it is worthwhile mentioning the importance of being protected against the financial impact of temporary disability,” said Van Niekerk.

See the full presentation:

Key findings:

Largest claims of 2014:

* Fin24 was hosted by Momentum at the Momentum Risk Summit 2015.

Publications

Publications

Partners

Partners