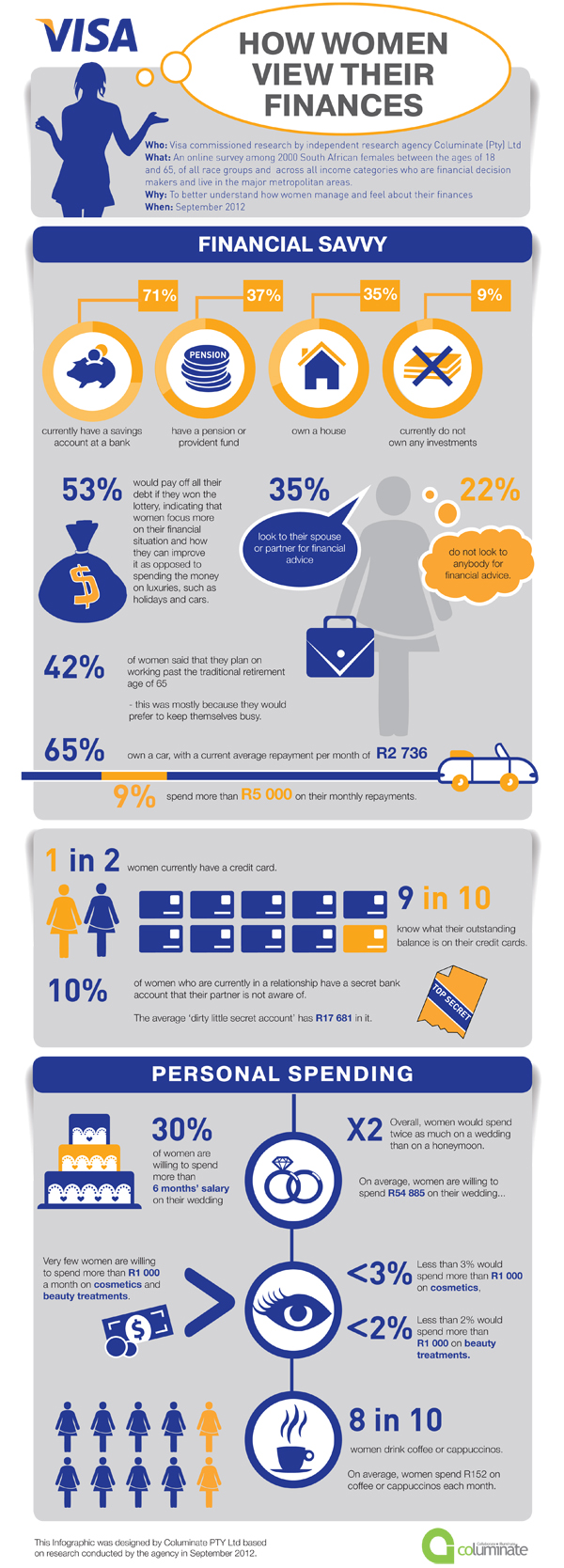

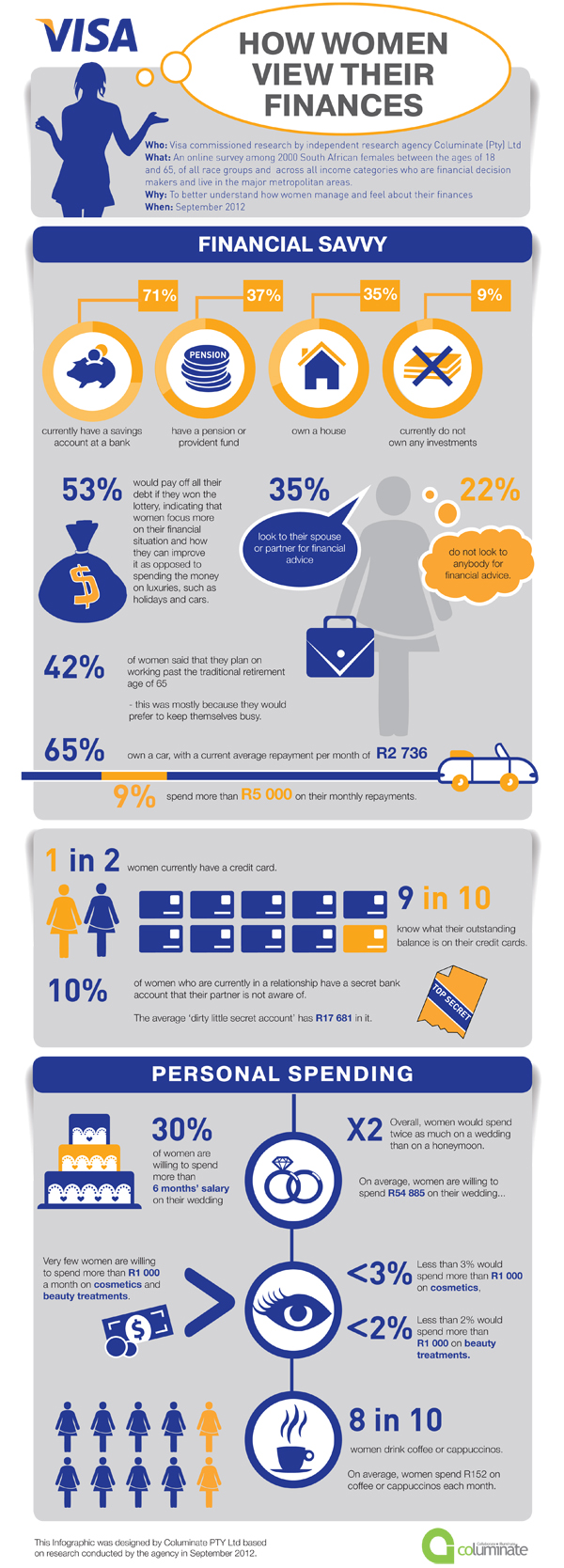

Johannesburg – Global payments technology company Visa on Tuesday disclosed the results of its first annual Women’s Money Matters Survey 2012, one of the most comprehensive reports into women and money conducted in South Africa.

The report surveyed 2 000 women from all income groups across the country who have household financial decision-making responsibilities. The report was designed to highlight women’s attitudes and behaviour towards money matters and identify areas of risk.

Findings in a nutshell

• 71% currently have a savings account at a bank, 37% have a pension or provident fund, 35% own a house;

• 9% indicated that they currently do not own any investments;

• Only 27% look to professionals for money advice;

• 54% say a house is their “preferred investment choice”;

• Only 2% invest directly in shares;

• 30% of women are willing to spend more than six months’ salary on their wedding. Overall, women would spend twice as much on a wedding than on a honeymoon;

• Only 2% spend more than R1 000 per month on beauty treatments;

• Buying shares tops the "worst investment choice" rankings;

• 51% of those who currently own a home do not know the interest rate on their home loan;

• 1 in 2 women currently have a credit card;

• 10% of women in a relationship have a secret bank account that their partner is unaware of. The average secret account has R17 681 in it;

• 70% of women have no short-term insurance;

• Women spend an average R152/month on coffee, 5% spend over R500/month;

• Women spend 24% of their budget on car repayments; and

• 53% would pay off all their debt if they won the lottery.

Visa country manager for South Africa Mandy Lamb said the report was an important one, as it gave insights into how South African women approach money and flagged areas of concern and potential improvement.

“Increasingly, it’s women who have their hands on the purse strings. Even for traditionally ‘male’ purchases such as cars, women are having a greater say.

For expert advice, Visa has teamed up with highly respected personal finance expert Maya Fisher-French to comment on the findings.

Little faith in advisers

Personal finance expert Maya Fisher-French advised women to seek out expert advice. “It is very concerning that less than a third of women use a financial adviser.

"This could point to a lack of trust in the financial industry or that women don’t value advice - yet finding the right financial adviser to help you not only make the correct investment decisions but also to keep you to your financial plan is worth paying for.”

Fisher-French says for example that women often cash in their retirement funds in order to allow them to extend their maternity leave, which leaves them vulnerable in retirement.

“An adviser can help remove the emotion from your financial decisions and help you see the consequences of financial choices.”

Savings and investment choices

Said Fisher- French: “While it is encouraging to see women saving through a variety of vehicles, women traditionally tend to be very conservative with their money and often avoid growth investments, such as equities, to the detriment of their long-term investment returns.

“While cash may be suitable for shorter savings goals like weddings and house deposits, it is not appropriate for medium term and longer-term goals like children’s education and retirement.”

Fisher-French says women need to educate themselves on the benefits of investing in growth assets such as shares.

For example, if you invested R100 000 in cash 11 years ago it would be worth around R250 000 today.

In comparison, a R100 000 investment in JSE All-share Index would have delivered R530 000 over the same period – and this includes one of the biggest market crashes in history.

Fisher-French says the wild market swings over the past few years had likely put off many women from investing in the stock market.

When asked what the worst investment choice ever made was, the highest proportion of respondents who had a negative response said "equities".

Fisher-French says this is often a result of not fully understanding the long-term nature of equities, or investing in shares based on a hot tip from a family friend.

“But it looks as if South African women need to rethink their exposure to equities. There are many great, low-cost investment options out there which are ideal for long-term investment growth.”

No pension plans

Fifty-eight percent of women said they do not plan on working past the traditional retirement age of 65.

“Ability to retire is all dependent on how much you save during your working years. There is a great deal of research that shows that women have less money in retirement than men, although women need more money in retirement as we live on average seven years longer.

"So it is concerning that over a third of women wished they had a provident fund or retirement fund, suggesting that they have made no provision so far.”

Fisher-French says most women will need to delay retirement. “If you delay retirement for three years you can increase your retirement income by around 20%, so working well into retirement is one way to make up for the shortfall.

"The assumption however is that your employer will allow you to continue to work. Many women may find that they have to find other job opportunities to provide an income in later years.”

A secret stash

Fisher-French says that it is important that a woman has her own savings; however, she needs to analyse why she feels a need to keep it a secret from her partner and what that means to their relationship.

Investment attitudes

“The relatively high figure for property investment may be a result of women wanting to own their own home, but having property as your only investment is a risky strategy.

"Not only are you exposed to one asset class, but residential property is a fairly illiquid asset - try selling a house when you need cash. It is often worth less than you expect.”

Fisher-French says it is also important to know your mortgage rate – “you need to know if the rate is fixed or variable and how the next rate cut will affect you”.

The big day

When quizzed about reasonable budgets for weddings and honeymoons, respondents said the average budget was R54 885 for a wedding and R27 474 for a honeymoon. And in terms of how many times monthly salary is reasonable to spend on a wedding, 30% said more than six months.

Fisher-French says according to wedding planners, a wedding costs on average R70 000 – so the figure of six months’ salary is probably realistic for many of the respondents. The question is, who pays?

“This is certainly an important question for the parents of the bride who are close to retirement. Can they afford to jeopardise their retirement plans if they have not made provision for a wedding?

“Nowadays young couples are mostly paying for their own weddings, yet we have 68% of women saying they can’t afford to save. That could mean they would have to borrow the money, which is not a good financial start to your marriage.”

Fisher-French says if a woman took out a loan of R50 000 and paid it off over two years, it would equate to R2 668 per month or R64 000 over the period. The wedding just cost you nearly 30% more.

In contrast, a R50 000 lump sum invested for 20 years on the JSE All-share Index could grow to R500 000, assuming a 10% return.

Car debt a drag

Fisher-French says the average 24% of their budget women spend on car payments is a high figure, and possibly explains why 68% say they do not have money to save.

“Think about the effect those car payments are having on saving for your wedding or a deposit on your own home, let alone long-term savings. Women should be very circumspect when buying a car and remember additional costs like insurance, petrol and maintenance,” says Fisher-French.

Insurance and protection

“While South African women seem to be a doing a decent job of making some savings, they are putting themselves at risk by not insuring themselves,” noted Fisher-French.

“The most alarming fact is that only a quarter of women surveyed have dread disease or critical illness cover. This means if they get sick and are unable to work, they leave themselves and their dependents in a dire position, as they will no longer be earning an income.

“Stay at home moms also need to consider critical illness or disability insurance as they would have to hire someone to fulfil their role as caregiver,” says Fisher-French.

Caffeine hangover and beauty buys

When it came to looking at those little indulgences, it was found that eight out of 10 women regularly buy coffee and cappuccinos, with women spending an average of R152 per month on the bean. Five percent of women spend over R500 a month.

“While no one is suggesting treating yourself is a bad thing, investing that money can make a huge difference over time,“ advised Fisher-French.

“If you put R500 a month into a low cost exchange-traded fund like the Satrix 40 and earn 10% over 10 years, you’ll have about R100 000 saved in 10 years.”

When it came to spending on make-up, the average is R339 per month. Only 3% of women spend more than R1 000 per month, while 25% spend less than R100 on cosmetics per month.

On beauty treatments, the average spend is R217 per month.

Interestingly, 35% of women say they spend nothing each month on beauty treatments, while only 2% spend more than R1 000 each month.

As someone who enjoys her cappuccinos and occasional beauty treatments, Fisher-French says women need to find a balance between saving and treating themselves.

“A cup of coffee could be far more valuable than the R15 or R16 you spend. It is an hour out of a busy day or an hour catching up with friends, so we need to frame our spending in terms of trade-offs.

"Would you sacrifice your daily cappuccino for a month in order to buy a pair of shoes for R450? Is spending money on beauty products to stay looking younger for longer worth cutting back on eating out?

“There is always a place for luxuries, but we need to decide what means more to us and spend for maximum enjoyment.”

The survey also indicated that one in two women currently have a credit card. Nine in 10 of these women know their outstanding balance on their credit cards.

The report surveyed 2 000 women from all income groups across the country who have household financial decision-making responsibilities. The report was designed to highlight women’s attitudes and behaviour towards money matters and identify areas of risk.

Findings in a nutshell

• 71% currently have a savings account at a bank, 37% have a pension or provident fund, 35% own a house;

• 9% indicated that they currently do not own any investments;

• Only 27% look to professionals for money advice;

• 54% say a house is their “preferred investment choice”;

• Only 2% invest directly in shares;

• 30% of women are willing to spend more than six months’ salary on their wedding. Overall, women would spend twice as much on a wedding than on a honeymoon;

• Only 2% spend more than R1 000 per month on beauty treatments;

• Buying shares tops the "worst investment choice" rankings;

• 51% of those who currently own a home do not know the interest rate on their home loan;

• 1 in 2 women currently have a credit card;

• 10% of women in a relationship have a secret bank account that their partner is unaware of. The average secret account has R17 681 in it;

• 70% of women have no short-term insurance;

• Women spend an average R152/month on coffee, 5% spend over R500/month;

• Women spend 24% of their budget on car repayments; and

• 53% would pay off all their debt if they won the lottery.

Visa country manager for South Africa Mandy Lamb said the report was an important one, as it gave insights into how South African women approach money and flagged areas of concern and potential improvement.

“Increasingly, it’s women who have their hands on the purse strings. Even for traditionally ‘male’ purchases such as cars, women are having a greater say.

For expert advice, Visa has teamed up with highly respected personal finance expert Maya Fisher-French to comment on the findings.

Little faith in advisers

Personal finance expert Maya Fisher-French advised women to seek out expert advice. “It is very concerning that less than a third of women use a financial adviser.

"This could point to a lack of trust in the financial industry or that women don’t value advice - yet finding the right financial adviser to help you not only make the correct investment decisions but also to keep you to your financial plan is worth paying for.”

Fisher-French says for example that women often cash in their retirement funds in order to allow them to extend their maternity leave, which leaves them vulnerable in retirement.

“An adviser can help remove the emotion from your financial decisions and help you see the consequences of financial choices.”

Savings and investment choices

Said Fisher- French: “While it is encouraging to see women saving through a variety of vehicles, women traditionally tend to be very conservative with their money and often avoid growth investments, such as equities, to the detriment of their long-term investment returns.

“While cash may be suitable for shorter savings goals like weddings and house deposits, it is not appropriate for medium term and longer-term goals like children’s education and retirement.”

Fisher-French says women need to educate themselves on the benefits of investing in growth assets such as shares.

For example, if you invested R100 000 in cash 11 years ago it would be worth around R250 000 today.

In comparison, a R100 000 investment in JSE All-share Index would have delivered R530 000 over the same period – and this includes one of the biggest market crashes in history.

Fisher-French says the wild market swings over the past few years had likely put off many women from investing in the stock market.

When asked what the worst investment choice ever made was, the highest proportion of respondents who had a negative response said "equities".

Fisher-French says this is often a result of not fully understanding the long-term nature of equities, or investing in shares based on a hot tip from a family friend.

“But it looks as if South African women need to rethink their exposure to equities. There are many great, low-cost investment options out there which are ideal for long-term investment growth.”

No pension plans

Fifty-eight percent of women said they do not plan on working past the traditional retirement age of 65.

“Ability to retire is all dependent on how much you save during your working years. There is a great deal of research that shows that women have less money in retirement than men, although women need more money in retirement as we live on average seven years longer.

"So it is concerning that over a third of women wished they had a provident fund or retirement fund, suggesting that they have made no provision so far.”

Fisher-French says most women will need to delay retirement. “If you delay retirement for three years you can increase your retirement income by around 20%, so working well into retirement is one way to make up for the shortfall.

"The assumption however is that your employer will allow you to continue to work. Many women may find that they have to find other job opportunities to provide an income in later years.”

A secret stash

Fisher-French says that it is important that a woman has her own savings; however, she needs to analyse why she feels a need to keep it a secret from her partner and what that means to their relationship.

Investment attitudes

“The relatively high figure for property investment may be a result of women wanting to own their own home, but having property as your only investment is a risky strategy.

"Not only are you exposed to one asset class, but residential property is a fairly illiquid asset - try selling a house when you need cash. It is often worth less than you expect.”

Fisher-French says it is also important to know your mortgage rate – “you need to know if the rate is fixed or variable and how the next rate cut will affect you”.

The big day

When quizzed about reasonable budgets for weddings and honeymoons, respondents said the average budget was R54 885 for a wedding and R27 474 for a honeymoon. And in terms of how many times monthly salary is reasonable to spend on a wedding, 30% said more than six months.

Fisher-French says according to wedding planners, a wedding costs on average R70 000 – so the figure of six months’ salary is probably realistic for many of the respondents. The question is, who pays?

“This is certainly an important question for the parents of the bride who are close to retirement. Can they afford to jeopardise their retirement plans if they have not made provision for a wedding?

“Nowadays young couples are mostly paying for their own weddings, yet we have 68% of women saying they can’t afford to save. That could mean they would have to borrow the money, which is not a good financial start to your marriage.”

Fisher-French says if a woman took out a loan of R50 000 and paid it off over two years, it would equate to R2 668 per month or R64 000 over the period. The wedding just cost you nearly 30% more.

In contrast, a R50 000 lump sum invested for 20 years on the JSE All-share Index could grow to R500 000, assuming a 10% return.

Car debt a drag

Fisher-French says the average 24% of their budget women spend on car payments is a high figure, and possibly explains why 68% say they do not have money to save.

“Think about the effect those car payments are having on saving for your wedding or a deposit on your own home, let alone long-term savings. Women should be very circumspect when buying a car and remember additional costs like insurance, petrol and maintenance,” says Fisher-French.

Insurance and protection

“While South African women seem to be a doing a decent job of making some savings, they are putting themselves at risk by not insuring themselves,” noted Fisher-French.

“The most alarming fact is that only a quarter of women surveyed have dread disease or critical illness cover. This means if they get sick and are unable to work, they leave themselves and their dependents in a dire position, as they will no longer be earning an income.

“Stay at home moms also need to consider critical illness or disability insurance as they would have to hire someone to fulfil their role as caregiver,” says Fisher-French.

Caffeine hangover and beauty buys

When it came to looking at those little indulgences, it was found that eight out of 10 women regularly buy coffee and cappuccinos, with women spending an average of R152 per month on the bean. Five percent of women spend over R500 a month.

“While no one is suggesting treating yourself is a bad thing, investing that money can make a huge difference over time,“ advised Fisher-French.

“If you put R500 a month into a low cost exchange-traded fund like the Satrix 40 and earn 10% over 10 years, you’ll have about R100 000 saved in 10 years.”

When it came to spending on make-up, the average is R339 per month. Only 3% of women spend more than R1 000 per month, while 25% spend less than R100 on cosmetics per month.

On beauty treatments, the average spend is R217 per month.

Interestingly, 35% of women say they spend nothing each month on beauty treatments, while only 2% spend more than R1 000 each month.

As someone who enjoys her cappuccinos and occasional beauty treatments, Fisher-French says women need to find a balance between saving and treating themselves.

“A cup of coffee could be far more valuable than the R15 or R16 you spend. It is an hour out of a busy day or an hour catching up with friends, so we need to frame our spending in terms of trade-offs.

"Would you sacrifice your daily cappuccino for a month in order to buy a pair of shoes for R450? Is spending money on beauty products to stay looking younger for longer worth cutting back on eating out?

“There is always a place for luxuries, but we need to decide what means more to us and spend for maximum enjoyment.”

The survey also indicated that one in two women currently have a credit card. Nine in 10 of these women know their outstanding balance on their credit cards.

Publications

Publications

Partners

Partners