Cape Town - To help South Africans better understand credit basics, TransUnion has provided the following facts to debunk various myths surrounding consumers and their credit scores …

Myth #1: Income level is reflected in a credit report.

Fact: Salary is not a direct contributor to a person’s credit score, but some lenders may evaluate income before issuing a loan to make sure the borrower will be able to make their payments. Regardless of a person’s salary level, it’s important to use credit responsibly and pay bills on time and in full each month.

Myth #2: It’s impossible to know what’s factored into a credit report or score.

Fact: Credit seems daunting, but in fact there are many resources available to help you understand your own credit standing.

Myth #3: Checking a credit report can lower a credit score.

Fact: A person checking their credit score will not affect it as this is considered a soft inquiry. A soft inquiry happens when a person or company checks a credit score in the course of routine work. However, if a creditor or potential lender looks at a potential borrower’s credit report and uses that information to decide whether to extend credit to them, then that is considered a hard inquiry and can have a negative impact on their score.

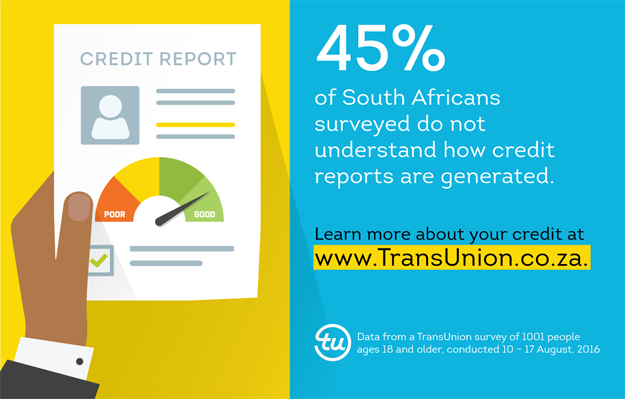

Survey: Credit is important to South Africans but few understand how reports are generated

More than 72% of a group of South Africans who participated in a TransUnion survey released this week agree that their credit score is important to them, but only 45% say they understand how credit reports are generated.

In terms of the above mentioned survey, most consumers are also confused about credit scores and reports themselves as only 36 percent of respondents recognize that credit reports are different from credit scores. A credit report is a record of how consumers manage their money. This data is then distilled and calculated to create a three-digit credit score.

“Credit is foundational to overall financial wellness, but so few South Africans are monitoring their credit, and many don’t understand credit basics,” said Garnet Jensen, senior director for TransUnion.

“This data, against a backdrop of the recent continuing negative Consumer Credit Index outlook released by TransUnion in August, as well as a National Credit Regulator report that identified a 40 percent impairment credit record rate across 24 million credit active South Africans, makes this issue especially relevant.”

Read Fin24's top stories trending on Twitter: Fin24’s top stories

Publications

Publications

Partners

Partners