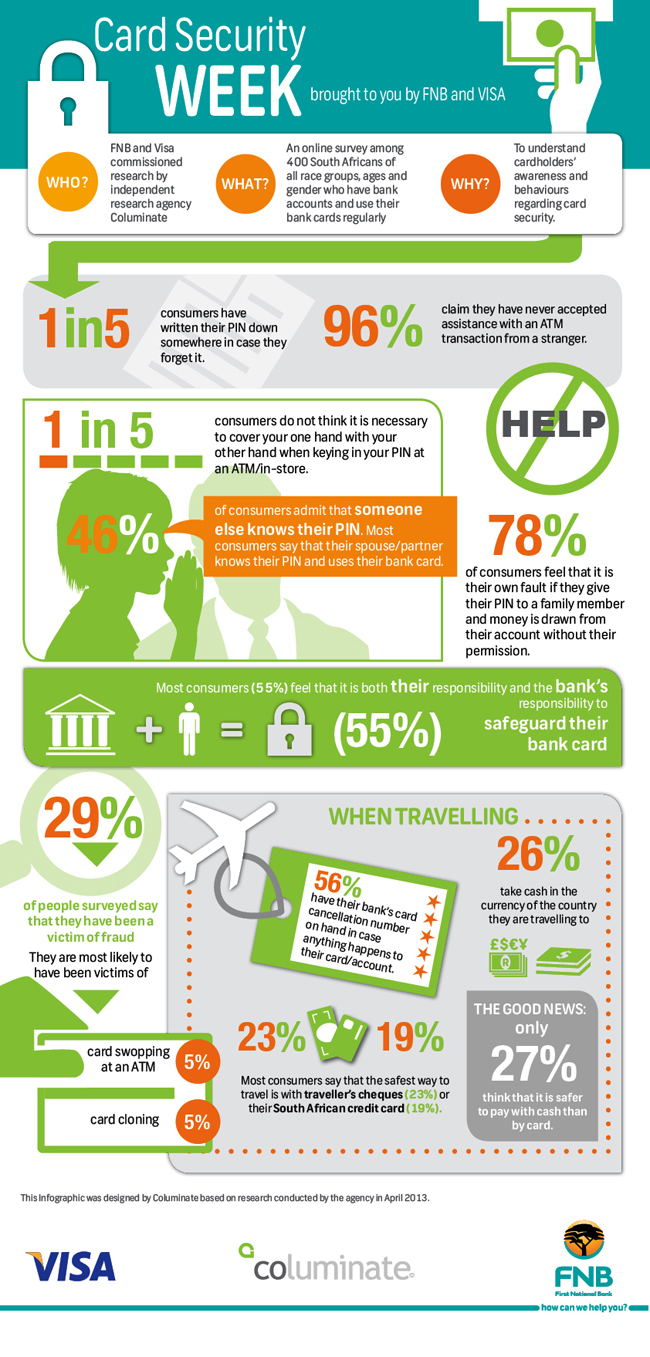

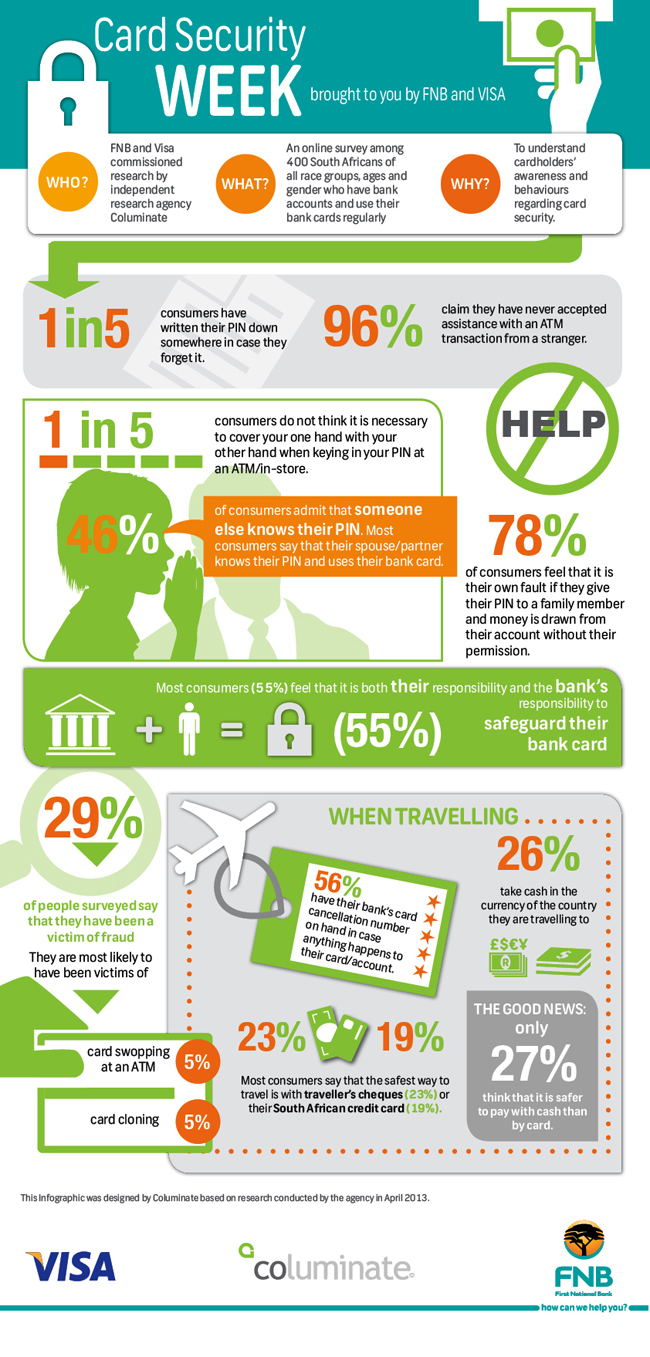

Cape Town - South Africans are still too lax when it comes to adhering to safety measures for their bank PIN codes, according to a recent study.

The study, commissioned by Visa and FNB and which focused on customers who bank with one or more of the country’s top banks, showed that one in five people have written their PIN down somewhere in case they forget it.

More alarming is that 46% of consumers admit that someone else knows their PIN. Most of the respondents said their spouse or partner knows their PIN and use their bank card.

Although 78% of consumers feel that it is their own fault if they give their PIN to a family member and money is drawn from their account without their permission, 55% feel that it is both their and the bank's responsibility to safeguard their bank card.

But the bank disagrees. "PIN security is something each customer should make a priority, as your PIN is your 'first-line' of defence against card fraud,” said Johan Maree, CEO of FNB credit card.

“PIN-enabled transactions are considered to be authorised by the card-holder – as your PIN number is unique, and should not be shared.

"Should a dispute arise on an ATM withdrawal or a purchase at a point of sale and a PIN has been used, FNB will consider this a legitimate transaction. The incident will be investigated to determine if the card has been cloned. If there was no skimming or card cloning, FNB will not refund the customer."

FNB believes skimming and cloning pose the biggest card fraud threats to customers, said Maree.

Almost 30% of the people surveyed said that they have been a victim of fraud, with 5% each most likely being victims of card swopping at an ATM and card cloning respectively.

“Consumers should be most vigilant when transacting online in a card-not-present purchase and when their cards could be skimmed and cloned in a retail or ATM transaction,” he said.

“It’s important to keep your card in sight whenever possible and regularly check amounts that have gone off your card."

Bryce Thorrold, Visa head of country risk management for sub-Saharan Africa, said card fraud is a reality facing South African consumers.

"We continuously monitor card fraudsters around the world to ensure we are up to date with their methods of obtaining customer information.”

He added that both FNB and Visa adopt a zero-tolerance approach towards all types of card fraud.

The study surveyed individuals online from all the nine provinces with the majority coming from Gauteng, Kwa-Zulu Natal and the Western Cape.

The respondents represented groups from across all races and across low, middle and high income groups

*Ever been a victim of bank fraud? Share your story and get published.

The study, commissioned by Visa and FNB and which focused on customers who bank with one or more of the country’s top banks, showed that one in five people have written their PIN down somewhere in case they forget it.

More alarming is that 46% of consumers admit that someone else knows their PIN. Most of the respondents said their spouse or partner knows their PIN and use their bank card.

Although 78% of consumers feel that it is their own fault if they give their PIN to a family member and money is drawn from their account without their permission, 55% feel that it is both their and the bank's responsibility to safeguard their bank card.

But the bank disagrees. "PIN security is something each customer should make a priority, as your PIN is your 'first-line' of defence against card fraud,” said Johan Maree, CEO of FNB credit card.

“PIN-enabled transactions are considered to be authorised by the card-holder – as your PIN number is unique, and should not be shared.

"Should a dispute arise on an ATM withdrawal or a purchase at a point of sale and a PIN has been used, FNB will consider this a legitimate transaction. The incident will be investigated to determine if the card has been cloned. If there was no skimming or card cloning, FNB will not refund the customer."

FNB believes skimming and cloning pose the biggest card fraud threats to customers, said Maree.

Almost 30% of the people surveyed said that they have been a victim of fraud, with 5% each most likely being victims of card swopping at an ATM and card cloning respectively.

“Consumers should be most vigilant when transacting online in a card-not-present purchase and when their cards could be skimmed and cloned in a retail or ATM transaction,” he said.

“It’s important to keep your card in sight whenever possible and regularly check amounts that have gone off your card."

Bryce Thorrold, Visa head of country risk management for sub-Saharan Africa, said card fraud is a reality facing South African consumers.

"We continuously monitor card fraudsters around the world to ensure we are up to date with their methods of obtaining customer information.”

He added that both FNB and Visa adopt a zero-tolerance approach towards all types of card fraud.

The study surveyed individuals online from all the nine provinces with the majority coming from Gauteng, Kwa-Zulu Natal and the Western Cape.

The respondents represented groups from across all races and across low, middle and high income groups

*Ever been a victim of bank fraud? Share your story and get published.

Publications

Publications

Partners

Partners