Global stocks including the JSE advanced on Friday despite the US economy recording its highest number of job losses ever in April.

Stocks from Asia to the USA rose unabated on Friday despite forecasts indicating that April jobs data would be the worst one on record. The surge is attributed to investors focusing on the planned reopening of most global economies, as well as the job losses reported being less than what was initially predicted.

There was also positive news that China and the USA had a constructive phone call on trade, with different verbal resolutions being agreed on. The rand strengthened against the greenback as it peaked at a session high of R18.30 before it was recorded trading 1.41% firmer at R18.32/$ at 17.00.

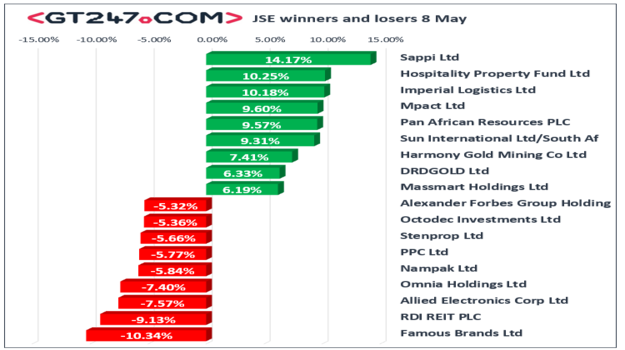

On the JSE, Sappi [JSE:SAP] recorded a another session of strong gains as the share surged 14.17% to close at R27.56. Imperial Logistics [JSE:IPL] rallied 10.18% to close at R42.43, while Mondi [JSE:MNP] gained 3.75% to close at R320.83. Resilient [JSE:RES] was buoyed by the release of a business update which saw the share gain 5.49% to close at R37.65. Retailers had some momentum mainly due to the firmer rand which saw gains being recorded for Truworths [JSE:TRU] which gained 4.71% to close at R29.56, as well as Mr Price [JSE:MRP] which advanced 3.47% to close at R133.53.

Significant gains were recorded for Harmony Gold [JSE:HAR] which surged 7.41% to close at R65.94, and Gold Fields [JSE:GFI] which added 4.62% to close at R152.23.

Famous Brands [JSE:FBR] struggled as it tumbled 10.34% to close at R35.12. Some of the bluechip stocks to record weakness on the day included Anglo American Platinum [JSE:AMS] which fell 2.84% to close at R976.70, Aspen Pharmacare [JSE:APN] which tumbled 2.75% to close at R129.70, and Sasol [JSE:SOL] which closed at R82.89 after falling 2.37%.

Nampak [JSE:NPK] slipped 5.84% to close at R1.45, while cement maker PPC Ltd [JSE:PPC] lost 5.77% to close at R0.98. Losses were also recorded for Telkom [JSE:TKG] which dropped 5.03% to close at R18.11, and for Brait [JSE:BAT] which lost 3.56% to close at R3.25.

The JSE All-Share index eventually closed 1.97% firmer while the blue-chip JSE Top-40 index gained 2.09%. All the major indices managed to record gains on the day.

Industrials rose 1.73%, Financials gained 1.78% and Resources advanced 2.57%.At 17.00 CAT, Gold was unchanged at $1716.34/Oz, Platinum was 0.88% firmer at $772.94/Oz, and Palladium had surged 1.19% to trade at $1886.55/Oz.Brent crude was up 1.6% at $29.93/barrel just after the JSE close.

Musa Makoni is a trading specialist at Purple Group

Publications

Publications

Partners

Partners