22 Oct 2018

The rand closed at R14.28 to the greenback on Monday afternoon after trading between R14.25 to R14.45 for most of the day. This as all eyes turn to Finance Minister Tito Mboweni who is set to deliver his maiden mid-term budget speech on Wednesday.

22 Oct 2018

U.S. equities swung between gains and losses as investors downplayed an overnight rally in Asian equities ahead of a spate of earnings reports this week, Bloomberg reports.

The dollar rose to the highest level in two months, while the pound slumped. After initially opening higher, the S&P 500 and Dow Jones Industrial Average fell before pushing higher again, led by gains in tech companies.

In China, the Shanghai Composite Index surged more than 4%, the biggest increase since March 2016, in the wake of verbal interventions from authorities at the end of last week and plans to cut personal income taxes.

Chinese President Xi Jinping vowed “unwavering” support for the country’s private sector.

“The biggest headwind that this market has right now -- and there’s a lot of them -- it’s getting something accomplished on trade with China,” said Art Hogan, chief market strategist at B Riley FBR.

“That can be lost in the parade of earnings that we're going to hear from and have heard from.”

22 Oct 2018

Bloomberg reports that Brent steadied near $80 a barrel as Saudi Arabia dismissed using its oil wealth as a political tool following the killing of journalist Jamal Khashoggi.

Futures in London fell 0.1%. Saudi Arabia’s Energy Minister Khalid Al-Falih said his country has used its oil responsibly and separated it from politics, according to an interview with Russia’s TASS news agency.

Still, the kingdom’s admission that Khashoggi was killed in its consulate in Istanbul may strain its ties with the U.S. at a time American sanctions on Iran are set to squeeze exports from the OPEC member.

“The Saudis admitting that Khashoggi died in the consulate may make some nervous about how the West reacts, but Al-Falih saying that they will continue to increase output, and won’t use oil as a weapon isn’t as constructive” for oil prices, said Warren Patterson, commodities strategist at ING Bank NV.

Crude has fallen from a four-year high earlier this month as a darkening demand outlook, coupled with stock market routs have spurred a flight from risk assets. While President Donald Trump praised Saudi Arabia’s official report of Khashoggi’s death, the oil market remains on edge as many leaders questioned the explanation that he was accidentally killed in an altercation.

Turkish officials have leaked details saying the journalist was murdered.

Brent for December settlement was at $79.67 a barrel on the London-based ICE Futures Europe exchange, down 11 cents, as of 13:40 local time.

22 Oct 2018

The rand has rallied ahead of the mid-term budget announcement on Wednesday, trading at R14.31 to the greenback at 14:05.

Meanwhile, Bloomberg reports in its midday markets wrap that U.S. equity futures advanced alongside European stocks after Chinese officials pledged to support the world’s second-biggest economy, helping to kick start a rally in Asia. The dollar and Treasuries were steady, while Italian bonds climbed. Insurance and mining shares led gainers on the Stoxx Europe 600 Index as both the regional benchmark and S&P 500 futures contracts headed for the first increase in four sessions.

In China, the Shanghai Composite Index surged more than 4%, the biggest increase since March 2016, in the wake of verbal interventions from authorities at the end of last week and plans to cut personal income taxes. Chinese President Xi Jinping vowed “unwavering” support for the country’s private sector.

Italy’s sovereign bonds sustained their advance after the nation’s populist government promised it won’t let the budget deficit widen further than currently planned.

The pound retreated as the U.K. blurred more red lines in its Brexit negotiations, heightening the danger to Prime Minister Theresa May.

Risks still abound across global markets, from the continuing U.S.-China trade showdown and tension surrounding the killing of a Saudi journalist to Italian budget fears and President Donald Trump’s unpredictable actions ahead of American midterm elections. Still, equities are attempting to bounce back after a miserable few weeks, and company results from the likes of Amazon, Alphabet, Microsoft and Intel as well as U.S. growth data may provide a welcome stimulus in the coming days.

Elsewhere, commodities were mixed. Brent crude edged toward $80 per barrel and gold dropped. Emerging-market stocks jumped.

22 Oct 2018

SA markets face potential ‘explosively volatile’ week

This could be an explosively volatile trading week for the South African markets as anticipation mounts ahead of the medium-term budget policy statement (MTBPS) on 24 October, Lukman Otunuga, Research Analyst at FXTM said on Monday.

A gloomy statement is likely to translate to rand weakness and losses on the JSE, said Otunuga, adding that investors will be closely scrutinising the speech and statement for clues on how South Africa plans to get its economy back on track.

“Focusing on the technical outlook, the rand has entered the trading week on a firm footing mostly due to a weakening US dollar. The USDZAR is likely to challenge 14.20 in the near term amid dollar weakness,” he said.

In Europe, Italy’s budget woes with the European Union enters a critical phase on Monday as Rome faces a noon deadline to explain why it is in breach of EU fiscal rules. “With the Italian government bracing for the EU to reject its 2019 budget on Tuesday, the euro is likely to take a hit. Uncertainty in Italy remains one the major geopolitical factors weighing on global sentiment and denting investor confidence.”

Also on the radar this week is the European Central Bank meeting which is expected to conclude with monetary policy left unchanged. “Given the growing uncertainty revolving around the political situation in Italy, there will be an extra focus on Mario Draghi’s press conference. If the central bank head strikes a cautious and dovish tone, the euro will most likely depreciate,” said Otunuga.

Moving to the US, the main event risk this week will be the first reading of third quarter GDP data scheduled for release on Friday. US economic growth is expected to have expanded 3.3% during the third quarter of 2018, slower than the 4.2% achieved in Q2. “An upside surprise on GDP growth has the potential to boost buying sentiment towards the Dollar and reinforce market expectations of higher US interest rates.”

In Asia, shares were mostly higher on Monday as Chinese indexes rallied more than 4% on verbal support from the country’s top officials. Otunuga said although the positive momentum from Asia has seeped into European markets, gains remain threatened by fragile risk sentiment. With investors bombarded by geopolitical factors such as trade tensions, Italy’s budget woes and Brexit-related uncertainty, caution is set to prevail this week.

“Global equity bulls still have an opportunity to re-enter the scene on the back of robust corporate earnings. However, expectations of higher US interest rates, global growth fears and geopolitical tensions all present downside risks to equity markets across the world.”

22 Oct 2018

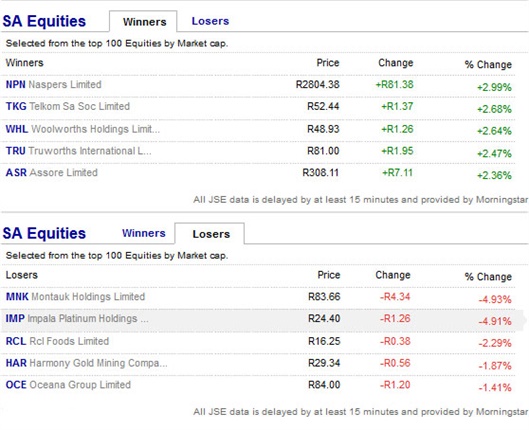

Naspers leads JSE higher

The JSE firmed in morning trade on Monday, led by a strong showing in Industrials (+1.4% to 63 638 points). The All-share index added 0.67% to 52 441 points and the Top-40 index gained 0.76% to 46 242.

Financials added 0.4% to 15 590, while Resources bucked the uptrend, giving up 0.23% to 41 040 points.

Heavyweight Naspers tracked Tencent gains, adding 2.81% to R2799.46 by 10:37 on the JSE.

22 Oct 2018

SA and global economic week ahead

The Medium-Term Budget Policy Statement to be delivered by Finance Minister Tito Mboweni on Wednesday and President Cyril Ramaphosa’s much-anticipated investment conference are likely to overshadow consumer and producer inflation data expected to be released on Wednesday and Thursday respectively.

"The importance of the SA CPI and PPI data on Wednesday and Thursday might be somewhat lost amid the MTBPS hype. If, as we expect, both price measures moderated in September, then the SARB will be forced to re-evaluate the assumptions informing its inflation profile, which is currently steeper than market consensus," according to RMB's Nema Ramkhelawan-Bhana.

She says international data becomes more significant as the week progresses, culminating in the 3Q18 US GDP release on Friday. "At 3.2%, the Bloomberg consensus expectation of third quarter growth is almost 1% weaker than the actual second quarter print but still well above the US potential growth rate.

"In terms of event risk, the ECB’s interest rate announcement on Thursday could occasion a few pre-conference jitters as council members are openly divided over the timing of the first hike. Despite a plethora of downside risks — not least rising Italian bond yields, weakening German industrial output and a slowdown in core inflation — the ECB is likely to reiterate its forward guidance and emphasise that the timing of the first hike remains dependent on data."

The calendar for the week

Monday

- EC Govt Debt/GDP Ratio (11:00)

- US Chicago Fed Nat Activity Index (14:30)

- Botswana MPC

Tuesday

- GE PPI (08:00)

- SA Leading Indicator (09:00)

- EC Consumer confidence (16:00)

Wednesday

- SA CPI (10:00)

- SA Medium Term Budget Policy Statement (14:00)

- US FHFA House Price index (15:00)

- US Markit Manufacturing PMI (15:45)

- Namibia MPC

Thursday

- SA President Ramaphosa’s investment summit commences

- SA PPI (11:30)

- EU ECB announces refinancing rate (13:45)

Friday

- US GDP Annualised (14:30)

- US Personal Consumption (14:30)

- US GDP Price Index (14:30)

- US Core PCE (14:30)

- US University of Michigan Sentiment (16:00)

22 Oct 2018

Rand firms almost 1% against US dollar

The rand firmed to R14.26 to the US dollar in early trade on Monday as China’s top finance officials called for calm in the financial markets.

"That is not to say that emerging market currencies are out of the woods just yet. Bloomberg’s EM-8 Carry Trade Index — which measures the total cumulative return of eight EM currencies — is still teetering at almost two-year lows of 242 and if the Fed remain true to its word, then a continued tightening of US financial conditions could lead to renewed EM outflows," said Nema Ramkhelawan-Bhana, head of RMB Global Markets Research.

By 09:31 the local unit was trading 0.92% firmer at R14.28 to the greenback.

Ramkhelawan-Bhana said after months of speculation, South Africa’s much-anticipated Medium Term Budget Policy Statement will be delivered on Wednesday.

"Having taken up the mantle just over two weeks ago, Minister Tito Mboweni is faced with the almighty task of having to balance populism with pragmatism as he outlines Treasury’s spending priorities for the next three years. He’s is likely to sound all the right notes for ratings agencies by proposing cost-containment measures and further expenditure cuts, thereby reaffirming Treasury’s commitment to fiscal consolidation. But, the reality is that there is little scope to continue rationalising expenditure without affecting service delivery."

22 Oct 2018

Verimark to consider delisting proposal

Verimark [JSE:VMK] announced on Monday morning that it would consider a proposal to delist from the JSE.

"Shareholders are advised that the company has received notice from its controlling shareholder, the Van Straaten Family Trust, of its conditional, non-binding intention to acquire the minority interests in the company and thereafter apply for its delisting from the JSE Limited."

The retailer did not say why the Van Staaten Trust wanted to delist. It said its board had established a committee to consider the proposal.

22 Oct 2018

Key market indicators around 03:00 GMT

Shanghai - Composite: Up 3.9% at 2 649.02 points

Tokyo - Nikkei 225: Down 0.3% at 22 462.54 (break)

Hong Kong - Hang Seng: Up 1.5% at 25 938.96

Euro/dollar: Down at $1.1501 from $1.1511 at 21:00 GMT on Friday

Pound/dollar: Down at $1.3054 from $1.3066

Dollar/yen: Down at 112.44 from 112.50 yen

Oil - West Texas Intermediate: Down five cents at $69.07 per barrel

Oil - Brent Crude: Down eight cents at $79.70 per barrel

New York - Dow Jones: Up 0.3% at 25,444.34 (close)

London - FTSE 100: Up 0.3% at 7 049.80 (close)

Source: AFP

22 Oct 2018

In the currency markets

USDZAR 14.3819

EURUSD 1.1510

EURZAR 16.5453

GBPUSD 1.3067

GBPZAR 18.7834

AUDZAR 10.2147

CADZAR 10.9781

CNYZAR 2.0733

ZARJPY 7.8294

CHFZAR 14.4237

Source: TreasuryONE

22 Oct 2018

Enthusiasm for oil is at its worst in a year as global financial woes and rising US stockpiles dim the demand outlook.

“It’s amazing how strangely and quickly things have changed. I think the original move up to the mid $70s was completely not called for,” said Phil Streible, senior market strategist at RJO Futures in Chicago. “It was a lot of speculation over sanctions on Iran, Venezuela declining, Libya declining and who will pick up the slack.”

Oil slipped to the lowest in almost a month last week as expanding American stockpiles overshadowed tensions between the US and Saudi Arabia over the disappearance of a prominent kingdom critic. Meanwhile, trade tensions between the Trump administration and China and financials woes in emerging economies are clouding the picture for oil consumption.

22 Oct 2018

Asian markets were mixed on Monday, with Shanghai surging almost 4% to build on a rally at the end of last week, but traders are still cautious over geopolitical tensions.

A close eye is being kept on China this week after Vice Premier Liu He led the country's top economic officials in a coordinated drive to shore up beleaguered equities, which have fallen more than a quarter this year.

The Shanghai Composite Index piled on more than 2% after that, with observers suggesting government-backed funds known as the National Team helped provide support.

And those gains filtered through to Monday after further support measures, with President Xi Jinping promising help for non state-backed firms, while authorities also unveiled a plan to lower taxes. The moves came as data on Friday showed the world's number two economy grew at its slowest pace for nine years during the third quarter.

Publications

Publications

Partners

Partners