* Sign up to Fin24's top news in your inbox: SUBSCRIBE TO FIN24 NEWSLETTER

31 Oct 2018

31 Oct 2018

OVERVIEW: U.S. stocks rallied on the final day of one of the worst months of the bull market, as earnings from Facebook jolted tech shares higher. The dollar added to a 16-month high and Treasury yields jumped.

The S&P 500 Index headed for the first back-to-back gains of October, paring its steepest monthly drop since 2011 to 7%. Strong earnings that had largely been ignored in prior days added to the gains. Facebook jumped, General Motors rallied and T-Mobile US advanced. Private payrolls data calmed nerves about the strength of the economy, lifting the dollar.

Treasuries fell as the Treasury Department said it will raise the amount of long-term debt it sells this quarter. In Europe, miners and energy companies led the way as almost every sector on the Stoxx Europe 600 Index climbed. Italian bonds bucked a decline as the risk-on mood sent core European debt lower. The euro drifted down as inflation accelerated in October and underlying price pressures increased, handing policy makers a headache after growth data disappointed.

The pound rebounded after Tuesday’s slump. Equity bulls will be hoping this rebound can last following a series of bounces in the past few weeks that quickly gave way to declines as some $8 trillion was wiped off stock markets globally.

The MSCI All-Country World Index has dropped more than 8% in October, poised to post the worst monthly performance since May 2012. Corporate results may be key to sustaining the share gains: attention will next turn to earnings from Apple after the close on Thursday. But there are risks in the background, from the American midterm elections to trade talks with China.

Meanwhile, the U.S. jobs report is due Friday - private data surprised to the upside on Wednesday.

In Asia, Japanese stocks were the stand-out performers as indexes rose across the board. China’s overnight repo rate surged the most in more than four years as authorities take steps to combat bets against the yuan, which held near the weakest level in a decade against the greenback.

The yen edged lower after the Bank of Japan left its monetary stimulus unchanged and kept its 10-year bond yield target at about 0%.

Elsewhere, gold fell and oil edged up from a two-month low. In emerging markets, the Indian rupee pared a drop after the finance ministry moved to diffuse growing tensions with the central bank. Developing-nation stocks jumped as currencies edged lower.

31 Oct 2018

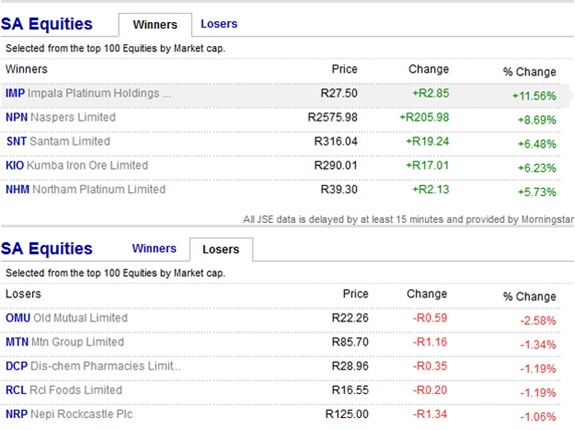

JSE rallies on Naspers, Implats surge

Africa’s largest company by value jumped as much as 9.7%, the most since December 2014, after MSCI said equities with unequal voting structures will continue to be eligible for inclusion in its indexes at their free float market capitalization weight.

The e-commerce giant further benefited from a 5.9% rally in its 31%-owned Tencent Holdings in Hong Kong, the biggest gain for the Chinese internet giant in 2 1/2 weeks.

Index compiler MSCI said overnight it has decided against penalising companies with multiple share classes - like Naspers - with reduced representation in its equity benchmarks.

In other share price moving news, Bloomberg reports Steinhoff International is considering the sale of properties within French furniture chain Conforama, the latest move by the embattled retailer to shore up its balance sheet, Sanlam details new empowerment deal and Implats says it's going ahead with job cuts in Rustenburg.

The JSE All-share index and Top-40 index rallied 2.97% and 3.22% respectively.

31 Oct 2018

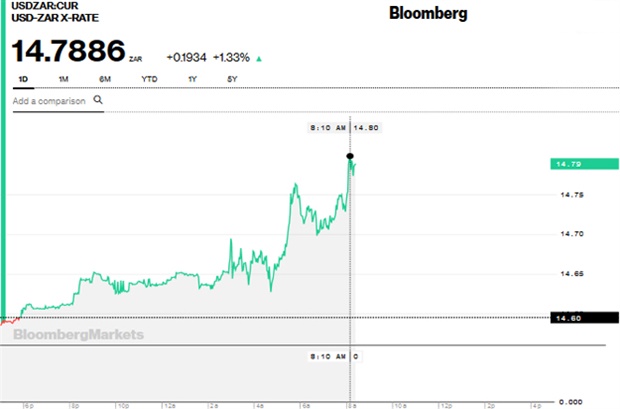

Latest Trade Balance figures for September came out negative R3bn vs the positive R4.2bn which was expected. The rand slightly on the back foot after the release jumping around 5 cents higher. Briefly spikes over R14.80 and currently trading at 14.79.

- TreasuryONE

31 Oct 2018

Sanlam share rise as it details new BEE plan

Financial-services group Sanlam [JSE:SLM] announced on Wednesday that it was moving forward with plans to issue 111 million new ordinary shares - 5% of its ordinary share capital - to an entity held by new and existing broad based black economic empowerment shareholders.

This would “substantially broaden the base of Sanlam’s empowerment beneficiaries,” it said.

At 13:03 on Wednesday its shares were trading 3.8% higher at R74.66 a share.

Sanlam said that 80% of the transaction would benefit new beneficiaries including professional black women, rural and urban poor black women groups, black youth and black youth groups, black business partners and broad based black groups, and employees of the Sanlam Group.

The group’s existing anchor empowerment shareholder Ubuntu-Botho, would receive 20% of the transaction.

In a separate transaction, it is also proposing to grant a R2bn facility to Ubuntu-Botho, which would enable “Ubuntu-Botho to invest in certain Sanlam subsidiaries”.

31 Oct 2018

Emerging markets are poised to end October in the red as the global stock sell-off, concern over the Federal Reserve’s tightening path and an escalation in the U.S.-China trade war scupper the chance of a recovery in this year’s worst-hit economies.

The MSCI Emerging Markets Index of equities has fallen 9.2% in October, set for its worst month since August 2015, after the S&P 500 Index slipped into a correction from a record close in September. An MSCI measure of developing-nation currencies is down almost 1%, even as the Argentine peso, Turkish lira and Brazil’s real head for a winning month.

“October was a month where risk-off mood dominated in emerging markets triggered by declines in U.S. equities, amid various uncertainties including U.S.-China trade frictions,” Koji Fukaya, chief executive officer at FPG Securities in Tokyo, said in a phone interview.

“But I don’t see any reasons that would justify a further sell-off in emerging markets, nor do I see them sharply rising from here. What we’re going to see is more of a consolidation.”

The Argentine peso is on track to become the top performer among its peers this month as the International Monetary Fund approved a larger amount of funding. The Turkish lira was bolstered by easing political tensions with the U.S., while the Brazilian real gained on optimism over a victory by market-friendly Jair Bolsonaro in its presidential election.

Still, plenty of headwinds remain for emerging markets. The International Monetary Fund cut its global growth forecast for the first time in more than two years, blaming escalating trade tensions and stress in developing nations. The Chinese yuan is hovering around its weakest level against the dollar in a decade, amid concerns over the escalating trade row. While “idiosyncratic developments” have allowed some currencies to claw back their recent losses, the higher U.S. rate outlook remains a major headwind for emerging markets, as do ongoing trade tensions and signs of further slowing in China, Win Thin, head of global currency strategy in New York at Brown Brothers Harriman & Co., wrote in a note.

Many of the headwinds buffeting emerging markets should eventually abate if the dollar loses steam when the economic stimulus from tax cuts wears off next year, according to Gary Greenberg, the London-based head of emerging markets at Hermes Investment Management. He also added that U.S. policies could become “less bellicose” with a potential Democratic majority in the House following the U.S. mid-term elections set for next week.

“We see reasonable growth, low interest rates and sensible economic policies in the majority of countries comprising the EM benchmark” of stocks, Greenberg wrote in a note. - Bloomberg

31 Oct 2018

Naspers bounce helps push up JSE

Shares in Naspers were trading 8.85% higher on Wednesday morning at 11:39, changing hands at R2 578.33 a share.

This, in turn, helped push up the JSE All Share index, which was up 3.5% at 52 549 points just before noon.

31 Oct 2018

How much further will China’s currency fall after it touched the weakest level in a decade on Tuesday?

The answer may depend in large part on whether Beijing can keep capital outflows under control. Official figures released over the past few weeks suggest money is increasingly leaving China’s borders, a reminder that motivated citizens and companies still have ways to get their cash out despite a tightening of capital controls after the country’s shock devaluation in 2015. While there’s little to suggest a stampede for the exits is imminent, the risk increases with every tick lower in the yuan. - Bloomberg

31 Oct 2018

Oil’s set for its biggest monthly drop since 2016 as the specter of a slowdown in the global economy haunts the market while U.S. inventories grow and producers relay mixed signals.

Futures in New York are poised for an 8.8% drop in October, following two months of gains. A global equity rout and an escalating U.S.-China trade war are weighing on the outlook for growth and energy demand, dragging down prices that only weeks earlier surged to a four-year high.

Concerns of a supply squeeze due to impending American sanctions on Iran eased after some other OPEC nations pledged to pump more. Still, while Saudi Arabia’s Energy Minister said the Organisation and Petroleum Exporting Countries is in a “produce as much as you can mode,” an OPEC committee said it could cut supplies next year, spurring uncertainty in the market.

In the U.S., inventories are forecast to climb for a sixth consecutive week. After breaching $76 a barrel earlier this month for the first time since 2014, New York’s West Texas Intermediate has lost over 10%.

“In the oil market, concerns continue to exist over the ongoing U.S.-China trade spat as well as the risk aversion sentiment that’s caused by a plunge in global shares,” Kim Kwangrae, a commodities analyst at Samsung, said by phone.

“Prices couldn’t remain above $75 a barrel this month on rising U.S. inventories and strong indication from Saudi Arabia to ramp up production.” WTI for December delivery traded at $66.78 a barrel on the New York Mercantile Exchange, up 60 cents, at 08:43 in London. The contract had declined more than 2% in the past two sessions. Total volume traded was about 12% below the 100-day average.

Brent for December settlement, which expires Wednesday, added 81 cents to $76.72 a barrel on the London-based ICE Futures Europe exchange. Prices are on course for a 7.3% drop this month, the biggest monthly loss since July 2016.

The global benchmark crude traded at a $9.91 premium to WTI. In the U.S., the industry-funded American Petroleum Institute was said to report crude inventories expanded by 5.69 million barrels last week.

If it’s confirmed by the Energy Information Administration data on Wednesday, it will be a sixth consecutive week of gains, the longest streak of increases since March 2017. Meanwhile, both Russia and Saudi Arabia have been raising production to ease shortages and to meet demands from U.S. President Donald Trump to lower prices. Russian Energy Minister Alexander Novak said he sees no grounds for reducing output and that there’s the risk of a deficit in crude markets, while the Saudis have already boosted supplies to 10.7 million barrels a day, near an all-time high. - Bloomberg

31 Oct 2018

Rand trading 0.5% weaker

The local currency was changing hands at R14.66/$ at 10:00 on Wednesday, down 0.5%, afetr opening at R14.59/$.

Andre Botha of TreasuryONE said in a morning note to clients that the rand was trading weaker because of dollar strength.

"The usual suspects are still at the forefront with regards to rand sentiment with any US dollar related move being mirrored in emerging markets. This morning we have seen the US dollar on the front foot which has resulted in a slight weakening of the rand.”

NKC African Economics has put the daily expected trading range at between R14.50/$ and R14.80/$.

31 Oct 2018

What are we waking up to?

A strong close on Wall Street last night has pushed Asian stock markets higher this morning. US indices all finished around 1.5% up as the dollar remained strong and US Treasury yields rose. The 10-year yield climbed to 3.13% while the 30-year yield was at 3.36%.

Locally, poor unemployment numbers are not helping the rand which is at 14.6500 this morning after hitting 14.5400 yesterday. The Reserve Bank hinted at an imminent rate hike yesterday after expressing concerns for the inflation outlook. The SARB said that the rand is undervalued and interest rates are too low.

Gold has slipped to below $1 220.00 while Brent has fallen to $76.30.

- TreasuryONE

31 Oct 2018

In the commodities markets, benchmark US crude shed 1.3% to $66.18 per barrel in New York on Tuesday. Brent crude, used to price international oils, lost 1.8% to $75.91 per barrel in London.

Gold lost 0.2% to $1 225.30 an ounce. Silver rose 0.1% to $14.46 an ounce. Copper slumped 2.8% to $2.66 a pound.

Latest commodity indicators

Gold 1 217.61

Plat 833.20

Plad 1 079.25

Rhod 2 415.00

Irid 1 470.00

Ruth 263.00

Copp 6 076.50

Brent 76.32

Gold ZAR 17 824.23

Plat ZAR 12 196.96

- TreasuryONE

31 Oct 2018

Latest currency indicators:

USDZAR 14.6460

EURUSD 1.1339

EURZAR 16.5988

GBPUSD 1.2705

GBPZAR 18.5985

AUDZAR 10.3701

CADZAR 11.1499

CNYZAR 2.1010

ZARJPY 7.7187

CHFZAR 14.5586

- TreasuryONE

31 Oct 2018

good morning. Welcome to Fin24's Markets LIVE blog.

Here's a quick snapshot

The rand started the day on the back foot, weakening 0.37% to R14.64 by 07:18 after opening on R14.59.

In Asia, markets staged a rare rally on Wednesday following a bounce on Wall Street, with attention turning to the release of key US jobs data later in the week.

However, while investors briefly have a spring in their step, a mountain of problems - from China-US trade tensions and Brexit, to Chinese weakness and rising US interest rates - is keeping optimism at a premium, reports AFP.

READ: Asian markets enjoy bounce but traders remain on edge

October has been a painful month for Asian equities, which have seen billions wiped from their values, and observers warn of further pain with Washington and Beijing seemingly unlikely to back off from their tariffs standoff anytime soon.

Still, Wall Street put in a healthy performance on Tuesday - the Dow added 1.8% while the S&P 500 and Nasdaq jumped 1.6% - after data showed US consumer confidence at a new 18-year high in October.The positive reading sent the dollar up against the yen and the unit continued to rise in Asia, providing a push for Japanese exporters.

READ: Stocks rally on earnings a day after ending at 5-month lows

Key figures around 02:30 GMT

Tokyo - Nikkei 225: Up 1.6% at 21 790.00 (break)

Hong Kong - Hang Seng: Up 0.9% at 24 813.77

Shanghai - Composite: Up 0.8% at 2 589.08

Euro/dollar: Down at $1.1345 from $1.1346 at 20:30 GMT

Pound/dollar: Down at $1.2706 from $1.2708

Dollar/yen: Up at 113.21 from 112.97 yen

Oil - West Texas Intermediate: Up 26 cents at $66.44 per barrel

Oil - Brent Crude: Up 40 cents at $76.31 per barrel

New York - Dow: Up 1.8% at 24 874.64 (close)

London - FTSE 100: Up 0.1% at 7 035.85 (close)

- AFP

Publications

Publications

Partners

Partners