02 Nov 2018

02 Nov 2018

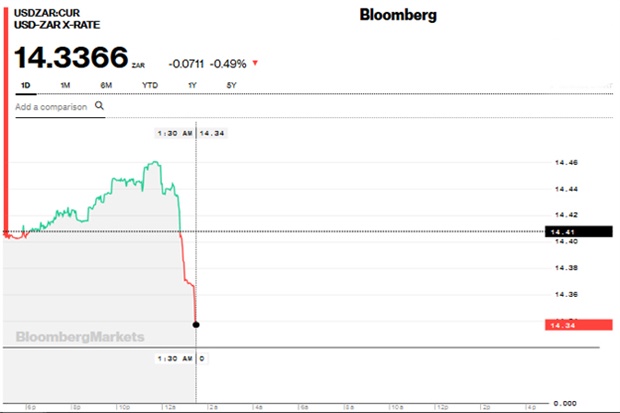

OVERVIEW: The rand firmed by 1% on Friday afternoon, trading at R14.22 to the greenback.

U.S. stocks were mixed, with trade-sensitive industrials rallying on hopes of easing tensions with China, while Apple’s poor forecast hit tech-heavy indexes. Treasuries fell after U.S. hiring rebounded more than forecast in October.

The S&P 500 looked to continue its rebound from the worst month in seven years, though an overnight rally in futures topped 1% on the trade hopes got cut by a jobs report that also indicated annual wage gains surpassed 3% for the first time since 2009.

The Nasdaq 100 fell as Apple retreated after underwhelming sales forecasts. The 10-year Treasury yield hit 3.17% and the dollar came off its lows as investors speculated the Federal Reserve won’t be deterred from its rate-hike path.

“It will be more difficult for the Fed to slow its rate hiking campaign,” said Alec Young, managing director of global markets research at FTSE Russell. “Recent volatility has been driven by the fact the Fed is steadily tightening amid ongoing US-China trade tensions and slowing global growth. As such, investors were hoping the Fed would have greater scope to pause its tightening campaign.

”Prospects for easing protectionist tensions are helping round out a week that’s seen appetite for risk assets return following the October rout in equities. Doubts remain, though, on the capacity of earnings to deliver. Apple’s disappointing forecast for the key holiday period suggested weaker-than-expected demand for the company’s pricier new iPhones. Next up is mid-term elections next week. Analysts also doubted the Trump administration’s ability to end the trade tensions any time soon. "Talks between the U.S. and China may not be straightforward, with intellectual property theft still a stumbling block. A Chinese state-owned company was charged Thursday with conspiring to steal trade secrets from American chipmaker Micron Technology as the Justice Department steps up actions against the Asian nation in cases of suspected economic espionage.

The Stoxx Europe 600 Index headed for its best week in two years and equities from Hong Kong to Tokyo surged, taking gains on the MSCI Asia Pacific Index to 5% for the week. Emerging-market shares jumped the most since March 2016, while currencies from South Korea to Australia joined the rally. The euro gained. Meanwhile, WTI extended a decline as fears over a supply disruption eased after the U.S. was said to agree on giving waivers to eight nations to continue importing Iranian crude.

Bloomberg’s gauge of industrial metals extended a rebound from a 15-month low as copper, zinc and nickel led gains in other raw materials.

02 Nov 2018

The rand has hardly reacted to the the news that the US unemployment rate remained steady at 3.7%, TreasuryONE reports. By 15:48, the rand was trading at R14.32/$.

Bloomberg reported that Treasuries extended declines and the dollar pared losses after U.S. hiring rebounded more than forecast in October, potentially clearing the path for the Federal Reserve to maintain its rate-hike schedule.

Stock futures trimmed advances.The 10-year Treasury yield jumped to 3.18%, while Bloomberg’s dollar index trimmed its second straight drop. U.S. stock futures cut overnight gains sparked by an easing of trade tensions.

Nasdaq 100 futures fell as shares of Apple dropped in pre-market trading after underwhelming sales forecasts. The strong hiring data also indicated annual wage gains topped 3% for the first time since 2009 and the jobless rate held at a 48-year low, signaling the labor market will keep driving consumption and economic growth.

U.S. traders awoke to a global rally in stocks, falling Treasuries and a weaker dollar spurred by fresh hopes for an end to trade tensions between the world’s two biggest economies as the October rout in risk assets continued to ease. The Stoxx Europe 600 Index headed for its best week in two years and equities from Hong Kong to Tokyo surged, taking gains on the MSCI Asia Pacific Index to 5% for the week.

Emerging-market shares jumped the most since March 2016, while currencies from South Korea to Australia joined the rally.

The euro gained. Prospects for easing protectionist tensions are helping round out a week that’s seen appetite for risk assets return following the October rout in equities. Doubts remain, though, on the capacity of earnings to deliver.

Apple’s disappointing forecast for the key holiday period suggested weaker-than-expected demand for the company’s pricier new iPhones. Next up is mid-term elections next week. The boost to sentiment came after Bloomberg News reported U.S. President Donald Trump is interested in reaching an agreement on trade with Chinese President Xi Jinping at the Group of 20 nations summit in Argentina this month, and has asked key officials to begin drafting potential terms.

“Either President Trump is paving the way for a trade deal being agreed at the Buenos Aires G-20 summit later this month, or he’s cynically driving up equity indices ahead of U.S. mid-terms,” said Kit Juckes, the London-based global fixed-income strategist at Societe Generale SA.

“What’s for sure, is that talk of a trade deal has added further juice to the last few day’s risk appetite.”Talks between the U.S. and China may not be straightforward, with intellectual property theft still a stumbling block. A Chinese state-owned company was charged Thursday with conspiring to steal trade secrets from American chipmaker Micron Technology as the Justice Department steps up actions against the Asian nation in cases of suspected economic espionage.

Meanwhile, WTI extended a decline as fears over a supply disruption eased after the U.S. was said to agree on giving waivers to eight nations to continue importing Iranian crude. Bloomberg’s gauge of industrial metals extended a rebound from a 15-month low as copper, zinc and nickel led gains in other raw materials.

02 Nov 2018

The onshore yuan was headed for its biggest two-day advance in more than 11 years amid prospects that China and the U.S. are working toward a possible deal in a trade war that has roiled global financial markets. China’s currency climbed 0.67% to 6.8740 per dollar as of 19:49 in Shanghai, extending its two-day gain to 1.43%, the most since April 2007.

The offshore yuan jumped 0.83% to 6.8601. The rally came after Bloomberg reported that U.S. President Donald Trump wanted to reach an agreement on trade with Chinese President Xi Jinping at the Group-of-20 nations summit in Argentina later this month and has asked key officials to start drafting potential terms. The two leaders had a telephone call on Thursday, which Trump described as “long and very good,” and said in a tweet that their discussions on trade were “moving along nicely.”

Optimism for a possible trade deal between the world’s two largest economies helped the yuan pare its loss over the past six months to 7.5%, and eased concerns that the Chinese currency would soon hit the psychological milestone of 7 per dollar for the first time since the global financial crisis.

"It is uncertain as to whether the yuan gain can be sustained," said Frances Cheung, head of Asia macro strategy at Westpac Banking Corp in Singapore.

"Some actual follow-through on a deal is needed to sustain the yuan’s gain. We tend to be more cautious given past false hope." The yuan had come under intense pressure to weaken of late, as slowing growth in China and trade tensions with the U.S. prompted investors to shift away from riskier emerging-market assets. The depreciation already led to a pickup in capital outflows, with Chinese demand for foreign-exchange surging the most since 2016 in September. - Bloomberg

02 Nov 2018

02 Nov 2018

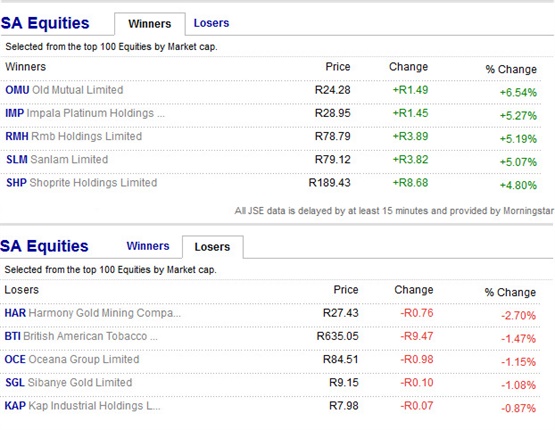

Geerit van Rooyen, an economist at NKC said in a note to clients, "The JSE All Share Index has bounced back strongly in the past few days after falling to a 16-month low last week.

"Naspers led the way thanks to a rebound in Tencent shares; Capitec was also a major gainer thanks to strong client growth and profit figures. There was an improvement in risk sentiment this week thanks to rising expectations of US-China and Brexit trade deals.

"The rand edged stronger against the US dollar this week. The rand initially traded on the back foot due to poor South African data releases and euro weakness but erased these losses and headed stronger thanks to an improvement in risk sentiment and broad US dollar weakness.

"Government bond yields dipped lower this week as the rand recovered some losses, oil prices headed lower and the appetite for EM debt improved. Crude oil prices fell this week due to rising US crude output and increased expectations that the loss of Iranian output due to US sanctions may be less than expected.

"On November 1, the Central Energy Fund measured an under-recovery of roughly 22c/litre in petrol prices. Approximately 6c/litre of the under-recovery in petrol prices was due to lower international crude oil prices and roughly 16c/litre of the under-recovery was thanks to a stronger average exchange."

02 Nov 2018

Stocks extended gains globally, Treasuries dropped and the dollar fell on Friday as a buoyant mood swept markets on the back of fresh hopes for trade between the world’s two biggest economies. Crude oil fell. The boost to sentiment came after Bloomberg News reported U.S. President Donald Trump is interested in reaching an agreement on trade with Chinese President Xi Jinping at the Group of 20 nations summit in Argentina this month and has asked key officials to begin drafting potential terms.

The Stoxx Europe 600 Index headed for its best week in two years, with basic resources leading the charge as almost all 19 sectors posted gains.

U.S. equity index futures advanced, after stocks from Hong Kong to Seoul and Tokyo surged, taking gains on the MSCI Asia Pacific Index to almost 5% for the week.

A gauge of emerging-market equities soared the most since March 2016, while currencies from South Korea to Australia also joined the rally.News of a phone call between Trump and Xi showed that the door is still open for U.S.-China trade talks, easing concern about the outlook for global growth.

The phone call is positive, China Foreign Ministry spokesman Lu Kang said at a briefing Friday in Beijing. Sentiment proved resilient to underwhelming news from Apple, though the key U.S. jobs report later Friday may provide further direction for markets. Prospects for easing protectionist tensions are helping round out a week that’s seen appetite for risk assets return following the October rout in equities.

Doubts remain, though, on the capacity of earnings to deliver. Apple’s disappointing forecast for the key holiday period suggested weaker-than-expected demand for the company’s pricier new iPhones. Its shares tumbled more than 6% in after-hours trading.

“Positive comments from President Trump over U.S.-China trade tension are cheering the market in the short term,” said Tai Hui, chief market strategist for Asia Pacific at JPMorgan Asset Management in Hong Kong. “While we are still cautious over a full resolution of recent tensions in the medium term, resumption of dialogue between Washington and Beijing would be good enough to investors for now.”- Bloomberg

02 Nov 2018

Market focus turns to US jobs data

The non-farm payrolls number will be released today around 14:30 SAST to see if any additional jobs have been added to the US workforce in October.

Analyst expectations are for an increase in the jobs number to 193 000 jobs compared to the previous number of 134 000 non-farm jobs.

The big picture: With the initial jobless claims in the US rising slightly, the NFP number today will be watched closely by market participants. An increase in the workforce number might add to the Federal Open Market Committee's inflation outlook and a raise in interest rates in the December sitting.

- Barry Dumas, GT247.com

02 Nov 2018

Rand firms to under R14.30/$

The rand was leading the emerging market currency grouping on several news events out on Thursday.

“There were all sorts of stories out yesterday. News of Chinese stimulus helped push the rand below R14.70, which triggered off some USD selling. The GBP also had a spectacular day. We then heard President Cyril Ramaphosa had heeded advice from the tax commission and fired Tom Moyane, while Finance Minister Tito Mboweni put his hand up on SAA, stating he sees little chance of a buyer for the airline.

“We also saw a rebound in car sales, but the ABSA manufacturing PMI for October continues to fall and that means the start of the fourth quarter does not bode well,” said Adam Phillips of Umkhulu Consulting.

Phillips said there has been some yoyo movement in the rand in the last couple of days, with most of the good news coming from political rather than economic news.

By 08:49 the local unit was trading 0.47% former at R14.33 after hitting an intra-day best level of R14.27 to the dollar. The last time the unit reached these levels was on 24 October after Finance Minister Tito Mboweni delivered his maiden mini budget speech.

Today the focus will be on US non-farm payrolls and average earnings. The next big issue will be US mid-term elections on Tuesday. “This event could be a defining moment for Trump’s presidency. If the Republicans do well, then the USD will rally further. A poor performance could mean a good run on emerging market currencies could occur,” said Phillips.

02 Nov 2018

Oil set for biggest weekly loss since February

Oil is poised for the biggest weekly loss since February on concerns over growing supply at a time when speculation is increasing that US sanctions on Iran won’t cut the OPEC producers' exports to zero.

While futures in New York edged higher on Friday on signs of a possible trade deal between the US and China, they’re still on course for a 5.7% weekly loss, reports Bloomberg.

The Organisation of Petroleum Exporting Countries increased production in October to the highest level since 2016, while Russia was said to raise output to a post-Soviet record.

Meanwhile, India and South Korea were said to agree with the US on the outline of waivers from sanctions to keep importing some Iranian oil.

Oil is approaching a bear market with prices falling about 16% from a four-year high in October as a rout in global equity markets and US-China trade tensions stoked concerns over economic growth. As the US prepares to impose sanctions on Iran on November 5, OPEC and its allied producers have sent mixed supply signals to the market, while American inventories and production have risen.

- Tsuyoshi Inajima, Bloomberg

02 Nov 2018

What are we waking up to?

Overnight news that US China trade talks look to be back on track has boosted risk appetite and we find the dollar trading softer against most currencies this morning. The euro at 1.1415 and pound at 1.3000 are both up while the rand is at 14.33 in line with other emerging markets.

US Treasury yields are steady while equity markets in the US and Asia are up.

Gold surged 2% to $1 232.35 while oil fell to a 7-month low at $72.60.

Non-farm payroll data this afternoon to look out for.

- TreasuryONE

02 Nov 2018

Currency indicators as at 06:30

USDZAR 14.4266 (14.33 at 07:38)

EURUSD 1.1400

EURZAR 16.4451

GBPUSD 1.2988

GBPZAR 18.7387

AUDZAR 10.3863

CADZAR 11.0139

CNYZAR 2.0805

ZARJPY 7.8017

CHFZAR 14.3921

- TreasuryONE

02 Nov 2018

The rand rallied to R14.33 to the US dollar in early morning trade after opening on the front foot at R14.40 to the greenback.

After starting the week on a fairly stable footing, mostly trading around the R14.66/$ level with intermittent weakness, the rand recovered ground during trade on Thursday as risk appetite improved, said Peregrine's Bianca Botes. She expects the unit to trade between R14.32 and R14.56 to the dollar.

02 Nov 2018

Good morning. Welcome to Fin24's Markets LIVE blog.

Here's a quick overview:

The rand is on a roll, firming to its best level in more than a week as investors jumped back into high-yielding units on improved risk appetite. In the UK, the British pound rallied on reports of a post-Brexit financial services deal.

READ: Sterling jumps on report of Brexit progress, US stocks rally again

Stock markets in the US and Asia extended gains as a tweet by US President Donald Trump lifted trade hopes.

Key figures around 03:00 GMT

Tokyo - Nikkei 225: Up 1.2% at 21 954.61 (break)

Hong Kong - Hang Seng: Up 2.4% at 26 016.45

Shanghai - Composite: Up 1.2% at 2 637.43

Pound/dollar: Down at $1.2988 from $1.3004 at 21:00 GMT

Euro/dollar: Down at $1.1395 from $1.1407

Dollar/yen: Up at 112.72 yen from 112.62 yen

Oil - West Texas Intermediate: Down 32 cents at $63.37 per barrel

Oil - Brent Crude: Down 29 cents at $72.60 per barrel

New York - Dow: Up 1.1% at 25 380.74 (close)

London - FTSE 100: Down 0.2% at 7 114.66 (close)

- AFP

Publications

Publications

Partners

Partners