Welcome to Fin24's inaugural Markets LIVE blog, a one-stop shop for our users to keep up to date with the day’s markets and business news.

* Sign up to Fin24's top news in your inbox: SUBSCRIBE TO FIN24 NEWSLETTER17 Oct 2018

The rand closed 0.20% weaker at R14.18/$ ahead of the release of the US Federal Reserve Bank's September meeting minutes expected on Wednesday evening.

Market analysts had expected the rand, which opened at R14.16/$, to trade within a range of R14.10/$ and R14.30/$. According to Bloomberg its movements ranged between R14.15/$ and R14.28/$.

Earlier Statistics South Africa released retail sales figures for August, which surprised. Analysts from NKC Economics had expected a contraction of -0.5% while Investec expected a contraction of -0.1%.

The main positive contributors to growth came from the textiles, clothing and footwear and leather goods category. Investec economist Lara Hodes shared views in a report that the retail sales sector could make a modest contribution to third quarter GDP, barring a "large slide" in September figures.

Further abroad US stocks fell due to disappointing earnings by corporates, the pound and euro both weakened on the back of inflation figures for the respective regions.

Currency indicators at markets close from TreasuryONE:

USDZAR 14.1874

EURUSD 1.1528

EURZAR 16.3530

GBPUSD 1.3135

GBPZAR 18.6294

AUDZAR 10.0983

CADZAR 10.9058

CNYZAR 2.0466

ZARJPY 7.8985

CHFZAR 14.2887

R186 9.12%

US 10 Year 3.15%

JSE -1.79%

FTSE -0.46%

S&P 500 -0.86%

17 Oct 2018

Stocks fall as confidence fades, dollar advances

US stocks fell as the week’s second big serving of corporate earnings did much less to reassure bulls than yesterday’s almost uniformly strong reports. The dollar and Treasuries rose.

The S&P 500 Index slid back below 2 800, heading for a second loss in three days. IBM’s disappointing results dragged the Dow Jones Industrial Average lower by more than 200 points.

Netflix was the best performer in the broader measure after blowout subscriber numbers. Home Depot sank with homebuilders as housing starts missed estimates. Suppliers of auto parts led losses among retailers.

17 Oct 2018

17 Oct 2018

Marijuana stocks tumble in first hours of Canada's legal market

Cannabis stocks were off to a shaky start in pre-market trading on Wednesday, hours after Canada’s legalisation of adult use went into effect.

Medical pot producer Tilray underperformed peers, while Canopy Growth’s US-listed shares briefly turned positive before giving up the gains.

17 Oct 2018

European equities mostly drop as outlook darkens

European stocks mostly sank on Wednesday on stubborn worries over global trade and high oil prices, but London rose after the EU offered to extend Britain's Brexit transition period, dealers said.

In early afternoon deals, Frankfurt and Paris stocks both sank, despite gains in Asia and on Wall Street on upbeat US company earnings.

17 Oct 2018

MARKET UPDATE: US Federal Reserve Bank minutes in focus

The USDZAR has scope to trade towards 14.32 in the near term if prices can keep above 14.20, says Lukman Otunuga, FXTM research analyst.

Global stocks rebound on strong US earning

Stocks in Asia were broadly higher today after upbeat US corporate earnings and encouraging economic data elevated Wall Street overnight. Some semblance of stability is likely to return to financial markets this week as earnings season offers investors a short-term distraction away from trade tensions and global growth fears.

Although robust earnings are poised to instill equity bulls with a renewed sense of confidence, the underlying factors weighing on stock markets remain present.

With US-China trade disputes, concerns over plateauing global growth, Brexit-related uncertainty, geopolitical tensions and prospects of higher US interest rates still in the mix, equity bears have plenty of ammunition.

European Union summit in focus

With just over five months left until the official Brexit deadline, markets and investors are still scrambling for clarity with many questions still unanswered.

Over the next few days investors will be keeping a very close eye on the EU summit which could provide some direction on Brexit. With a deadlock on the Northern Irish border issue seen as a major obstacle in Brexit talks, there is little hope for a breakthrough at the EU summit.

If the summit concludes with no real progress made on negations, this simply raises the risk of a no-deal Brexit outcome.

Given the pound is extremely sensitive to Brexit headlines, such a scenario could send the currency collapsing like a house of cards.

Dollar gains ahead of FED minutes

Buying sentiment towards the dollar took a slight hit on Tuesday after Donald Trump once again criticised the Federal Reserve, stating that it was his "biggest threat" because it is raising rates too fast.

However, the dollar’s downside was limited by positive US industrial production figures which boosted sentiment towards the US economy.

Although Trump’s repeated criticism of the Fed is unlikely to impact the central bank’s interest rate hiking path, it could continue weighing on the dollar. Today’s main event risk for the dollar will be the Federal Open Market Committee meeting minutes which investors will closely comb through for clues on rate hike timings beyond December.

The dollar could be given an opportunity to rebound if the minutes come across as more hawkish than expected. The dollar index has staged an impressive rebound from the 94.80 level with prices trading towards 95.20 as of writing.

Bears need to break below the 95.00 support level for prices to sink towards 94.60. Alternatively, an intraday breakout above 95.30 could trigger a move higher to 95.44.

Commodity spotlight – Oil

Oil prices seem to be witnessing some stability as US-Saudi tensions ease with investors redirecting their focus towards looming sanctions against Iran and a surprise decline in US Crude inventories.

US sanctions against Iran’s oil exports and falling production from Venezuela are two likely factors to push oil prices higher this quarter. Geopolitical risk factors may spark uncertainty over the global supply outlook – ultimately fanning fears of possible supply shocks.

Although the current market conditions favour higher oil prices, global trade tensions still remain a threat to oil bulls down the road. Heightened trade disputes between the world’s two largest economies represent a threat to global growth. Slowing global growth in the event of a full-blown trade war will most likely dent demand for crude.

17 Oct 2018

Graph of emerging market currencies to date.

Excluding the Argentinian Peso and Turkish Lira, the ZAR has lost the most ground as stated by Bloomberg.

17 Oct 2018

Mediclinic shares tank as H1 profits drop

Mediclinic International's share price took a beating on Wednesday afternoon after the group warned shareholders that profits would likely be lower than expected.

By noon on Wednesday, Mediclinic shares were changing hands at R72.10, down 19%.

In an interim trade update issued on Wednesday morning, ahead of the financial results for the half year ended September 30, the group had announced that H1 adjusted EBITDA was down around 4%, and adjusted EBITDA was down around 8%.

17 Oct 2018

Rand holds steady on August retail sales data

The rand held its ground following the release of August retail sales data.

Statistics South Africa released the figures at 13:00, which reflected a 2.5% year-on-year increase.

Analysts from NKC Economics had expected a decline of -0.5%.

The rand which had been trading at R14.26/$ ahead of the release, held steady and by 13:15 it was trading at R14.25/$.

The major contributors to the increased sales in August were household furniture, appliances and equipment which increased by 10.4%; textiles, clothing, footwear and leather goods (up 6%0, and pharmaceuticals and medical goods, cosmetics and toiletries (up 3.1%).

17 Oct 2018

17 Oct 2018

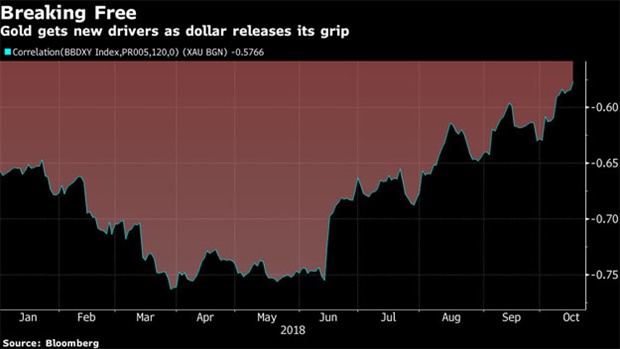

CHARTS: 4 ups, 1 downer for gold investors

The shiny metal is in the middle of a surprise advance, posting the fastest rally since the Brexit vote as a surge in haven demand combines with seasonal buying. The sudden snap of its unlucky streak - bullion has declined every month since April - blindsided fast-money investors, but that could be good for gold bugs.

17 Oct 2018

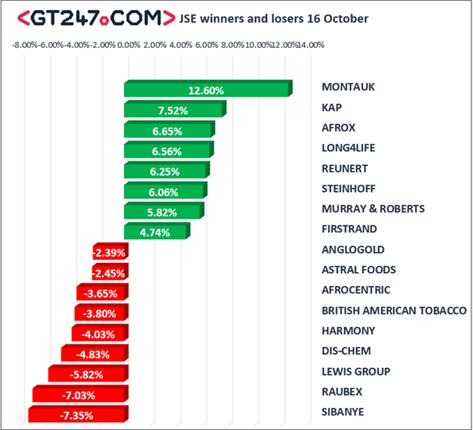

JSE muted despite surge in global markets

The JSE Top-40 index gave up 0.06% in early trade, lagging a more than 2.2% surge in US equities overnight and strong gains in Asia.

Mediclinic was the biggest loser, giving up 17.71% to R73.24 following an interim trade update.

Dis-Chem gained 4.35% to R28.80 after reporting positive results with improved market shares across all its core categories. Earnings attributable to shareholders and headline earnings both grew by 10.5% in the six months to end-August compared with the corresponding previous period. Earnings per share and headline earnings per share are both 51.7 cents per share, an increase of 10.5%.

The JSE All-share index was up 0.02% at 53 249.87 points.

The rand, trading between R14.15 and R14.25 to the US dollar, was quoted 0.39% weaker at R14.21/$ by 10:10.

AFP reports the dollar was down against most high-yield and emerging market economies as traders came out of their shells after recent selling.

Ray Attrill, head of forex strategy at National Australia Bank, suggested US President Donald Trump's latest outburst against the Fed's rate hikes, which he claims are excessive, were weighing on the dollar.

"While such name calling shouldn't mean anything in terms of what the Fed actually does, it is a factor which somewhat undermines sentiment towards the dollar," he said."We'd argue, (it) is a contributory factor, albeit minor, to recent poor performance of the US dollar in the face of first higher US yields, then last week's sharp turn for the worse in US equity market."

17 Oct 2018

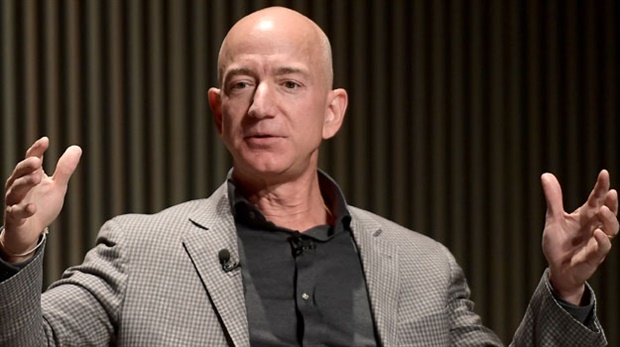

Jeff Bezos opens up lead on rich list as stocks surge

It’s a perfect 10. Every one of the world’s 10 richest people added at least $1bn to their fortunes as US stock markets ripped higher, brushing off last week’s malaise.

Amazon.com’s Jeff Bezos, the world’s wealthiest person, added $4.7bn to his net worth, taking it up to $150.3bn.

17 Oct 2018

Rand loses 0.35% to trade above R14.20 to the US dollar. At the end of January the rand was trading at a 3-year best level of under R12/$.

17 Oct 2018

What South Africans are waking up to

Equities in the US and Asia have bounced off recent lows after major US companies showed upbeat earnings reports.

The bounce in equities has stopped the recent momentum in gold as the safe-haven asset dropped back to as low as $1 221.00 after topping around $1 233.00 yesterday.

The ZAR was on its own warpath yesterday being the strongest EM as it traded back below 14.20 which were levels last seen towards the end of September.

The USD is on the front foot this morning and could likely look to regain some lost ground against the EMs.

- TreasuryONE.

17 Oct 2018

Latest currency indicators from TreasuryONE

USDZAR 14.1770

EURUSD 1.1558

EURZAR 16.3776

GBPUSD 1.3173

GBPZAR 18.6660

AUDZAR 10.1102

CADZAR 10.9361

CNYZAR 2.0464

ZARJPY 7.9165

CHFZAR 14.2914

17 Oct 2018

Bias on the rand remains stronger

The rand benefited yesterday from surging stock markets worldwide, taking its cue from the Turkish lira which hit a two-month high against the dollar.

Paul Muller, Corporate Treasury Manager at Peregrine Treasury Solutions says the dollar remains on the back foot against all major currencies, still reeling from the release of sluggish retail sales figures, while emerging markets enjoyed a good day as risk-on trading resumed in the market.

"Today will see the release of local retail sales figures, as well as US housing starts data and Federal Reserve minutes.

"The bias on the rand remains stronger, with the expected range for the day between R14.10 - R14.30/$, while a break of R14.10/$ will test the key R14.00/$ level."

17 Oct 2018

Asian markets staged a much-needed rally on Wednesday as investors tracked Wall Street's best performance in more than six months thanks to a healthy round of earnings reports.

However, "perhaps a bit surprising is that local equity markets are not exactly knocking it out of the park this morning".

"I suspected they would take their

lead from the US equity froth. But again, local dealers remain a better

seller of risk until a definitive shift in US-China trade tensions is

offered up," said Stephen Innes, head of Asia-Pacific trade at OANDA.

17 Oct 2018

Wall Street stocks surged higher as a batch of strong earnings reports pushed aside lingering doubts about the economy and trade fights that have pressured markets.

17 Oct 2018

Welcome to Fin24's inaugural Markets LIVE blog, a one-stop shop for our users to keep up to date with the day’s markets and business news.

Locally the JSE closed firmer and the rand broke below R14.20 to the US dollar.

Publications

Publications

Partners

Partners