The JSE reversed earlier gains in the afternoon session as it slumped to close weaker on Thursday.

The local bourse had managed to open firmer following a rally in Asian stocks in earlier trading.

However, the turn was brought about by a flurry of weak readings across a range of economic data starting with a lower GDP number for Europe, and a higher than expected unemployment claims number out of the USA.

This data showed how rapidly growth is deteriorating across some of the world’s largest economies as a result of the pandemic.

The rand weakened along with other emerging market currencies as investors fled to safe-haven currencies.

The local unit was trading 1.34% weaker at R18.37/$ at 17:00. This was after it had tried to breach R18/$ after peaking at a session high of R18.01/$.

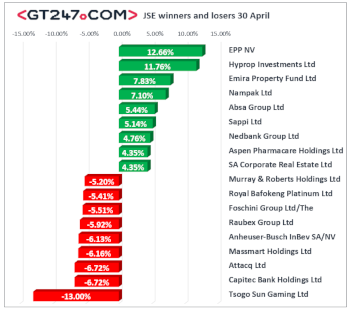

On the JSE, Tsogo Sun Gaming [JSE:TSG] was one of the day's biggest losers after the stock plummeted 13% to close at R2.61.

The weaker rand saw weakness being recorded for most retailers as declines were recorded for Massmart Holdings [JSE:MSM] which lost 6.16% to close at R24.68, The Foschini Group [JSE:TFG] which fell 5.51% to close at R73.02, and Woolworths [JSE:WHL] which closed at R30.49 after dropping 4.09%.

Diversified mining giant, Anglo American PLC [JSE:AGL] tumbled 5.11% to end the day at R329.10, while commodity trader, Glencore [JSE:GLN] lost 3.07% to close at R34.15.

Platinum miner, Northam Platinum [JSE:NHM] lost 5.04% to close at R92.45, while Anglo American Platinum [JSE:AMS] shed a modest 0.56% to end the day at R976.53.

Significant declines were also recorded for Capitec Bank Holdings [JSE:CPI] which lost 6.72% to close at R902.00, as well as Bidvest Group [JSE:BVT] which closed 2.31% lower at R150.55.

A couple of listed property stocks recorded some of the day’s biggest percentage point gains.

EPP NV [JSE:EPP] surged 12.66% to close at R5.25, Hyprop Investments [JSE:HYP] climbed 11.76% to close at R19.00, and Emira Property Fund [JSE:EMI] gained 7.83% to close at R6.47.

Financials recorded decent gains on the day with gains being recorded for Absa Group [JSE:ABG] which added 5.44% to close at R91.30, and for Standard Bank [JSE:SBK] which advanced 1.04% to close at R102.13.

Sappi [JSE:SAP] added 5.14% as it closed at R22.50, while Aspen Pharmacare [JSE:APN] closed at R115.64 after adding 4.35%.

The JSE Top-40 index eventually closed 1.03% while the JSE All-Share index fell 1.02%.

The Financials index eked gains of 0.3%, however the Resources and Industrials indices retreated 2.06% and 0.86% respectively.

Brent crude was trading 10.11% higher at $26.68/barrel just after the JSE close.

At 17:00, palladium had gained 0.79% to trade at $1968.72/oz, platinum was down 0.28% at $785.26/oz, and gold was 0.5% weaker at $1704.35/oz.

Publications

Publications

Partners

Partners