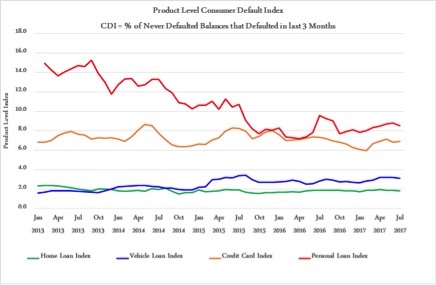

A total of 3.57% of South African consumers’ credit balances was in default for the first time for the period May to July 2017. This is according to global information services company Experian’s Consumer Default Index (CDI), which was launched in October.

The CDI is built on 14.7m consumers across 18.4m active home loan, vehicle loan, personal loan and credit card accounts with R1.54tr in total outstanding debt.

According to David Coleman, chief data officer at Experian, when converting the index into Rand value, the composite index of 3.57% recorded means that over the period May to July 2017, R13.45bn rolled into default for the first time, across the four products.

The overall index reading is an improvement on the same period last year, where a value of 3.81% was recorded, Coleman said. This means that there was a reduction in the sum of first-time defaulted accounts as a percentage of the total sum of balances outstanding.

Coleman said the improvement is attributed to a slowdown in credit extension to households.

Credit extensions have been decreasing since the fourth quarter of 2012, due to increased regulations in terms of more affordability guidelines being set out. In addition, the introduction of more strenuous and lower pricing caps and recent reductions in interest rates resulted in the implementation of stricter lending policies.

The report is to be published on a monthly basis with a two-month lag.

The index offers an understanding of the engagement practices of different South Africans and segments them into various groups, said Riona Naidu, head of marketing solution at Experian. The index affirmed that levels of financial literacy are attributable to the difference in education levels. Also, more educated groups earn better incomes and thus are more attractive to financial institutions to grant credit to.

The lower educated and lower compensated segments have struggled in recessionary conditions with proportionally more defaults due to granting of credit to this segment being curtailed in the 12 months ending July 2017.

One of the segmented groups in the index, the “Midlife cruisers”, made up of highly educated wealthy individuals, recorded the lowest CDI of 2.02% for May to July 2017. A group of “Indigent Township Families”, made up of very low income, mostly unemployed young people, were the worst performing segment with a CDI of 8.15% over the same period.

The CDI for home loans remained quite static over time at 1.84% by July 2017, according to Experian. It had not changed much year-on-year, with 1.9% recorded over the same period last year.

Coleman stated that “the index intuitively makes sense as you would expect more secured assets like home and vehicle loans to have a better index reading as opposed to more unsecured lending”.

Publications

Publications

Partners

Partners