Finance minister Tito Mboweni has abandoned any attempt to hang on to South Africa’s last investment-grade credit rating, with a budget that bluntly acknowledged debt will not stabilise over the next few years and unexpectedly eased the tax burden on individuals in a desperate attempt to resuscitate the flagging economy.

The decision not to raise taxes to help curb ballooning public sector debt and to narrow widening budget deficits — as had been expected — is likely to prompt Moody’s Investors Service to downgrade its investment-grade credit rating for SA, triggering large capital outflows which will raise borrowing costs in the country.

S&P and Fitch, the other rating agencies which have already slapped “junk” status on SA’s sovereign debt, are also likely to downgrade their ratings again. Treasury has clearly decided to risk taking the knock and riding out the volatility, which it believes will be short term.

“It will be foolhardy to increase taxes in this economic situation,” Mboweni said in a media briefing ahead of his Budget speech in Parliament. “In a difficult situation like this, it would be preferable to have far deeper tax cuts.”

But his goal of bringing debt back to sustainable levels in the next few years now hangs on a substantial reduction in the bloated public sector wage bill — an outcome which is far from certain, as labour unions have stubbornly resisted any attempt to accept salary increases below the rate of inflation for many years.

National Treasury says it intends to cut the wage bill for 1.2m public servants, which accounts for 35% of its spending, by a cumulative R160.2bn over the coming three years, making it the bulk of spending cuts pencilled in for this period.

It calculates that the changes will amount to a one percentage point contraction in public service compensation over that period, in inflation-adjusted terms. Treasury also wants to renegotiate the current three-year public sector wage agreement dating back to 2018, on the grounds that it’s unaffordable.

“The process is going very well,” Mboweni said. “Naturally there will be agreement and disagreement, but eventually I think the government and public sector will find each other. For the credibility of our fiscal stance, that R160bn has to be found – we are all in this together.”

He said he had full political support from Cabinet.But both the Congress of South African Trade Unions and the Public Servants Association rejected the request to renegotiate the previous wage agreement outright when it was presented to them on the eve of the Budget, threatening to collapse the public service and saying it amounted to “a declaration of war”.

Deputy finance minister David Masondo said at the briefing that the reaction was unfair to the country, as the size of the wage bill prevents the government from employing more workers and providing proper service. Credit rating downgrades would affect government, companies and individuals, he warned.

Treasury made clear that spending restraint and structural reforms to the economy — particularly to generate more electricity — were urgently needed to boost economic growth, which is increasingly at risk from the global fallout of the spreading coronavirus.Growth forecasts were slashed to an estimated 0.3% in 2019 and 0.9% in 2020 — both of which are in line with independent estimates, although many analysts believe growth could be lower this year because of power shortages.

The biggest Budget shock, albeit a positive one for South Africans, is Treasury’s decision to scrap planned tax hikes of R10bn this year, particularly as further increases on top of those had been expected to help narrow the budget deficit.

Instead, Treasury provided relief for individuals by raising personal income tax brackets above inflation, providing a reduction of R2bn which was offset by increases for the normal range of existing indirect taxes, including the fuel levy and taxes on alcohol and cigarettes.

It pointed out in the Budget review that growth in wages, consumption and business profitability had stagnated in recent years, lowering tax receipts from individuals, companies, and value-added tax.

Revenue for the 2019-2020 financial year, which ends on 29 February, was now R63.3bn lower than last year’s estimate.

“In this context, substantial tax increases are unlikely to be effective. SA already has a relatively high tax-to-GDP ratio compared with other countries at a similar level of development. New tax increases at this time could harm the economy’s ability to recover.”

To boost investment, production and competitiveness, government wanted to lower the existing corporate tax rate of 28%, which had remained at 28% for more than a decade, Treasury said.

Recently, three of SA’s main trade partners — India, the UK and the US — had all lowered their corporate income tax rates below that level, it added.

The sting in the tail to this news was an announcement that there will be a review of a wide range of tax incentives for both companies and individuals, which Treasury said could “compromise the principles of a good tax system” by creating “complexity and inequities between individuals, sectors and activities”.

Treasury’s unexpected decision to cut rather than raise taxes may help SA avoid slipping into a recession this year, a scenario which economists believed was possible if taxes were higher and load-shedding continues as Eskom carries out intensive maintenance to fix its neglected power plants (see cover story on p.26).

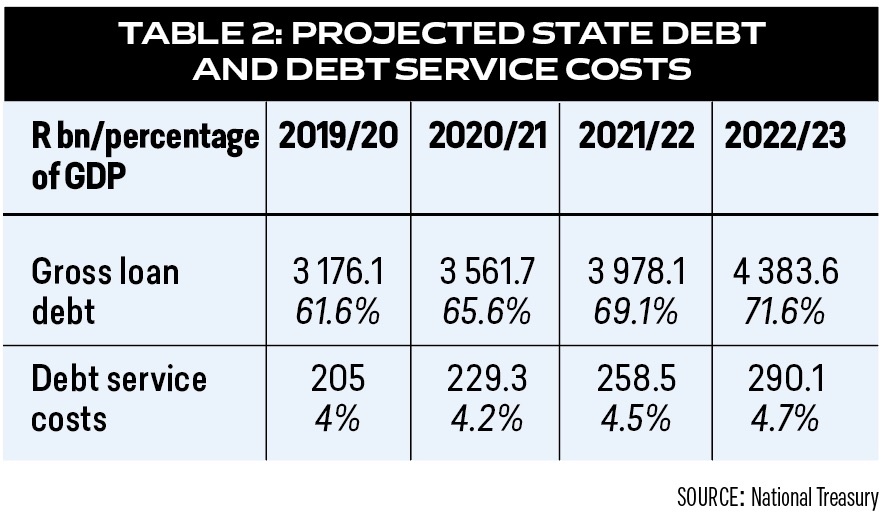

But SA’s unravelling finances must be brought into order, and quickly (see table 2). Debt service costs are the fastest-growing area of government spending and now absorb 15.2% of revenue, compared with 9.8% a decade ago.

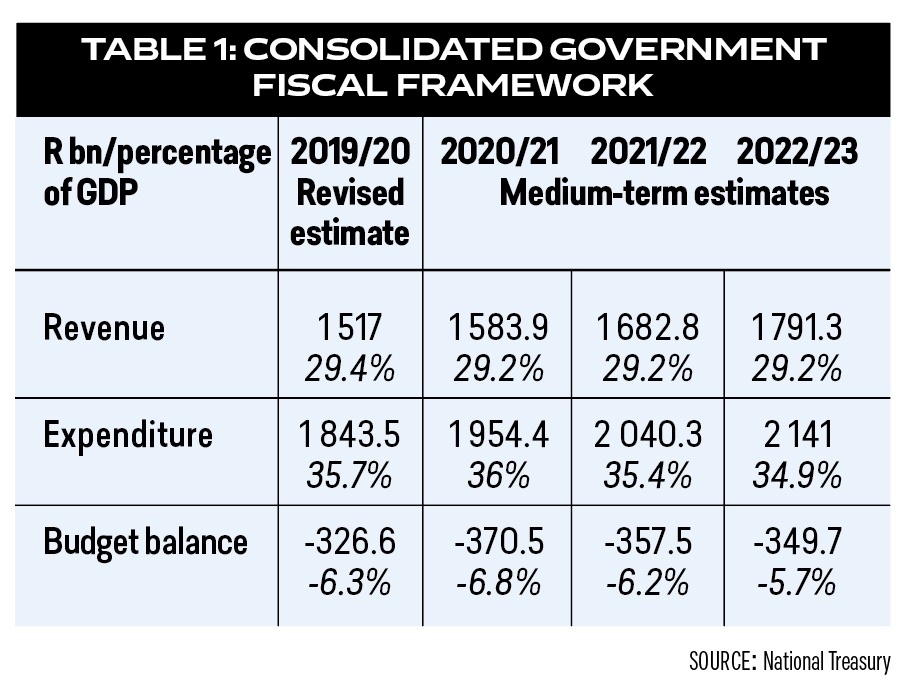

The budget deficit is expected to have widened to 6.3% of GDP in the 2019-2020 financial year and peak at 6.8% in the 2020-2021 financial year (see table 1). These forecasts are above the estimates given in the October medium-term budget policy statement, which shocked financial markets and analysts.

But again, Mboweni was upbeat, saying the rating agencies will react to how they read Treasury’s stance, and would take cognisance of its determination to reduce the budget deficit in the next few years.“I don’t think that they will rerate us on the basis of the fiscal stance.

They might give us a bit of a klap but I don’t think they will do anything untoward,” he said.Moody’s is due to update its credit rating for SA on 27 March, and if it chooses not to downgrade the country then, it will take the step at its review in November.

Opinion is divided on how severely domestic markets will react to a downgrade, as the event is seen to have been factored into government bond prices.

Nonetheless, SA will fall out of the World Government Bond Index, which means that passive investors will be forced to sell their holdings of SA government bonds, which could amount to between $9bn and $13.5bn, according to Old Mutual economist Johan Els.

The big question is how much will be bought by other investors who hold “junk”-rated bonds.Support to ailing state-owned enterprises was identified in the Budget as one of the main risks to its forecasts, with Treasury pointing out that they have accumulated R759.9bn of debt — of which 62% is guaranteed by the government.

Mariam Isa is a freelance journalist who came to SA in 2000 as chief financial correspondent for Reuters news agency after working in the Middle East, the UK and Sweden, covering topics ranging from war to oil, as well as politics and economics. She joined Business Day as economics editor in 2007 and left in 2014 to write on a wider range of subjects for several publications in SA and in the UK.

This article originally appeared in the 5 March edition of finweek. Buy and download the magazine here or subscribe to our newsletter here.

Publications

Publications

Partners

Partners