Arriving towards a secure retirement is important, but it is equally important to know exactly how the vehicle you use works and the options available. The retirement landscape in South Africa has recently been hit by a wave of renewed scrutiny and criticism regarding the impact of costs on the retirement value

of investors.

This drive has been spearheaded by National Treasury, with financial commentators quick to support those who advocate low costs. Considering these developments, I think it is important to understand the vehicle you use. It is undisputed that high costs, especially those of a recurring nature, have a severe negative impact on investment growth. This negative impact is significantly magnified when these costs are compounded over a long time.

Investment products, especially retirement annuities (RAs), have improved substantially over the past few years. These developments have primarily been driven by the establishment of Linked Investment Platforms (LISPs). LISPs radically changed the way investment products are structured and administered from the traditional product provided by life insurers. In most cases, there is a strong case to be made to transfer existing traditional retirement annuities to a LISP.

Traditional versus linked retirement annuities

Fundamental differences

There are two broad categories of RAs. The first is traditional RAs. They have the form of a legally binding contract between the insurer and the client and offer a policy-based savings solution.

There are commonalities that appear in most of these contracts, but to a large extent each contract has its own particular terms and conditions that apply to the contractual relationship with that client. These include aspects such as the duration of the contract, as well as the underlying fees and costs that will be levied on the investment.

In most cases, these contracts make provision for severe penalties which are applied if the client reduces their recurring contributions or transfers their investment before the end of the contract term – usually set to age 55, and often longer. Very often the reason for a duration extending past age 55 is the higher commission earned by the broker.

The second is a new-generation RA, which is offered by an investment company on a LISP. These investments are not governed by contractual restrictions. These investment vehicles allow you to structure a portfolio from a selection of underlying unit trusts. Clients have flexibility to amend their contributions as they wish and are free to transfer their investments to another platform without restriction or penalties.

A new-generation retirement annuity offers significant benefits when compared to the traditional underwritten RA. Some of these are:

Costs

Traditional RAs have archaic costing structures, which in many cases differ from client to client. This means that in most cases the only way to determine what the client is paying is by consulting the original retirement annuity contract and asking the insurer for an actuarial calculation.

The turnaround time for these calculations is usually two weeks or more. In many cases, the costs applied to these investments are exorbitantly high. This notion is supported by the research done by Treasury in its 2013 discussion paper titled Charges in South African retirement funds. In this discussion paper, Treasury notes that fees on these traditional retirement annuities may be as high as 3.6% per annum. In the example, the paper used a retirement annuity with contributions of R600 a month.

New-generation RAs (LISP platforms) offer clear and transparent breakdowns of the costs incurred by the client. This gives the client insight into the rand value spent towards costs within his investment on an ongoing basis.

These platforms also apply set cost methodologies to each account, thereby ensuring that all clients with the same account characteristics, such as the invested amount and underlying funds, pay the same costs.

Lastly, the Treasury paper notes that the average fee payable on LISP platforms equate to 2.3% per annum. This implies that some clients could save up to 1.3 percentage points per annum in costs when compared with a traditional RA. This translates to an annual cost saving of 36.11% (1.3/3.6%).

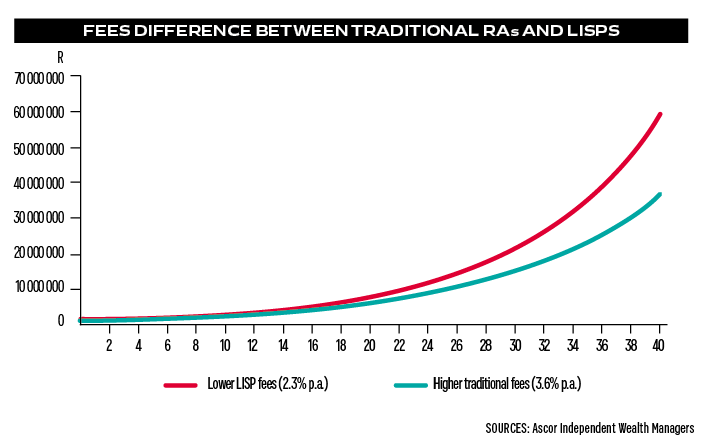

The graph below illustrates the effect that lower fees have over an investment horizon of 40 years. Both portfolios are assumed to start on R1m and grow at a rate of 13% per annum, before the deduction of fees. This means the annual after-fee growth rate of the new-generation (LISP) option is equal to 10.7%, compared to the 9.4% of the traditional option. At the end of the projection, the LISP platform grew to a value of R58 331 727.08, while the traditional product only reached R36?365?777.72. This is a difference of 60.4%.

This graph is merely intended to serve as an illustration of the effect that cost savings has on a portfolio. The impact of costs may differ in your specific case.

Manageability and performance evaluation

One of the biggest concerns surrounding traditional RAs is the difficulty in obtaining performance information and the restrictions to efficiently managing the underlying investment portfolio.

Most traditional retirement annuity products provide no feedback regarding the performance of the underlying investment portfolio. Furthermore, these traditional products have limited funds available for selection within the portfolio and switching the funds is a time-consuming process.

New-generation RAs do not have these limitations. The majority of platforms allow clients access to the account, which allows the client to evaluate his fund value and performance at any time. The reporting process is also robust with detailed performance and transaction statements distributed on a quarterly basis to the client. The portfolio is also much easier to track and manage from an investment advisory perspective, improving the value added to the client by advisers.

More flexible

Traditional RAs generally charge transaction fees when you make changes to your investment. You may also face an early termination penalty should you wish to leave the fund.

New-generation RAs generally charge no transaction fees and offer you the flexibility to amend your contributions or make changes to your investment portfolio as required. There will also be no termination charge should you decide to exit the fund.

Conclusion

If you are contemplating a new retirement annuity investment or wish to increase your current savings rate, consider allocating new contributions to a new-generation RA.

If you are already invested in a traditional RA, you may wish to consider a transfer to a new-generation RA. However, the merits of such a transfer should be weighed up against the potential early termination penalty that may be applicable.

It is also critical to ensure that the retirement annuity you are transferring to is in fact a new-generation product, as small tweaks to old-generation RAs may lead investors to assume that these products are new-generation offerings.

While the product may be slightly improved, the pricing model and the restrictions placed on investors will remain largely unchanged. We urge that you evaluate the features and fee structure of any RA you consider investing in very carefully. Preferably seek advice from a certified financial planner. In next week’s issue, I’ll discuss how to choose the underlying funds to invest in.

Wouter Fourie is a director of Ascor Independent Wealth Managers and the Financial Planning Institute of SA (FPI). He is an award-winning certified financial planner.

This article originally appeared in the 9 February edition of finweek. Buy and download the magazine here.

Publications

Publications

Partners

Partners