Are you tired of paying off someone else’s mortgage? Is the body corporate in your apartment block driving you mad? Or are you stuck with a landlord that moves at a glacial pace when it comes to fixing things in your rental?

Whatever the reason, you have reached the point where you are ready to buy a place of your own and stay settled for at least the next few years. Exciting? Yes. Simple? Not quite.

It’s not a case of finding a property you like, making an offer and moving in if it’s accepted. There are a few hoops to jump through, extra costs and other important elements to consider when it comes to finding the right property, securing the finance and actually successfully purchasing your home.

Be realistic

When you decide to buy your first property, make sure you are realistic about the price range you can afford. This should be based on affordability and not on your dream home, explains Albertus van Staden, head of credit at FNB Housing Finance.

“Merely taking your income into account is not an accurate assessment of your affordability, as there are expenses that will have to be maintained along with your bond repayments.”

Other expenses to consider include furnishing your home, for example, and you will need to budget for municipality rates, taxes, insurances and levies.

Samuel Seeff, chairman of Seeff Properties, says it is important to “buy within your means and consider whether you will be able to cope with any additional expenses such as an interest rate hike or a hike in the cost of basic utilities”.

Don’t see buying a house as a way to make a quick buck. “It is important to remember that property is a long-term investment, and therefore you need to consider the amount of time required to realise equity and capital appreciation,” says Nondumiso Ncapai, head of business development at Absa Home Loans.

Get your finances in order

If possible, when applying for a home loan, try and put down a deposit, no matter the amount, encourages Ncapai. “If you do not have savings that can go toward a deposit, you should start saving now and get in the habit of trying to put some money away each month [towards a deposit].”

As an example, putting down a 10% deposit on a R1m home (R100 000) will save you almost R1 000 a month and just short of R240?000 over 20 years. A minimum of 10% to 15% of the property purchase price should be the target that customers set themselves, she says. “If you can put down more, it will arguably be one of the best financial decisions to make as a homeowner.” And a deposit most certainly positively influences the application’s chance of approval.

Choose the right location

Consider a suburb with good transport infrastructure, good schools, better security, that offers a lifestyle with facilities and amenities, and offers good capital value growth, advises Seeff Properties.

“It is always important to ensure that you buy in an area with sound property value growth, which will be important if the time ever comes that you want to sell,” explains Seeff.

Although house price growth can never be guaranteed, it should definitely form part of location criteria, according to Ncapai. “Ideally you want to purchase in an area that has enjoyed house price growth in the past, and is expected to do so in the years to come.”

Make a suitable offer

Before making an offer on a property, it’s important to do your homework thoroughly by looking at which properties have sold in the area over the last few months and at what prices, advises Seeff. Also look online for similar properties to see whether the prices are at a similar level.

And consider the market at the time of making your offer. “In a buoyant market, sellers can ask higher prices and because there is high demand, are likely to achieve those higher prices. There is then little point in going in too low as you are simply wasting your time. When the market is flat and especially if there are loads of similar properties on the market, you can put in an offer below the asking price. The agent should be able to give you some guidance in regard to the price range that the seller would be prepared to look at,” says Seeff.

Understand the legal implications

When you have decided on the price you are willing to put on the table, you will have to sign an offer to purchase. This is a legally binding document, and once all of the conditions are met, it is very difficult to get out of, explains Seeff. “There is a cooling-down period, but only for properties priced below R250 000.”

The offer to purchase provides security to both the buyer and seller, and ensures there is no uncertainty about the property being sold, its condition and any other important elements.

“Once both parties have signed, both the buyer and seller are required by law to fulfil their responsibilities as set out in the agreement. If the offer expires or the seller has rejected it, the buyer is no longer bound by that offer. Once the offer is accepted though, cancelling the agreement is then only possible should there be a basis in law for doing so.”

So don’t enter into this agreement lightly, because it can cause you a lot of pain down the line if you sign it in haste.

Consider all the extra costs

Should your offer be accepted, remember that you are not only paying the purchase price of the house. There are additional costs that you will incur in order to complete the transaction.

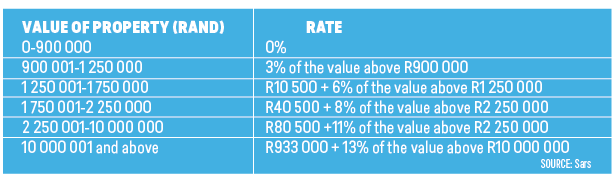

- Transfer duty is payable on properties above R900 000. This is calculated according to Sars guidelines (see table).

- Bond registration fees, transfer fees and attorney’s fees.

- Rates and taxes deposit.

Transfer duty rates

The seller

pays the estate agency commission, as well as for the various clearance

certificates, e.g. electrical and plumbing.

Over and above the transaction costs as noted above, the buyer should also budget for expenses such as electricity deposits, putting in a new phone, satellite TV installation, internet connection, the costs of moving and any cleaning needed, says Seeff.

Buyers should also consider insurance costs on the property, as well as life insurance that would cover any outstanding amount on the bond should they pass away before it has been settled in full.

Take your time

“When someone gets to the stage of buying their first home, practical thinking is sometimes overruled by the excitement,” warns Van Staden. So even if you have reached the point where you are considering taking the leap, patience is truly a virtue.

“Don’t rule out renting completely because it has various benefits. You can save up for a deposit to ensure that when a good deal comes along, you will have a very good chance to secure the mortgage and the house that you really want, in an area that you have thoroughly researched.”

This is a shortened version of an article that originally appeared in the 6 April edition of finweek. Buy and download the magazine here.

Publications

Publications

Partners

Partners