Taking into account that if you retire at the age of say 60 or 65, your retirement years may be almost as many as your working years, and it’s not impossible that you may need 10 to 12 times your final average salary for income purposes.

Medical expenses, including frail care, tend furthermore to rise extensively on retirement, with medical inflation perhaps double that of normal inflation. The American experience, which is probably valid for South Africa too, is that one out of every four people who have reached 65 will eventually require some kind of long-term care.

Old Mutual Investment Group’s Old Mutual Real Income Fund co-manager, John Orford, highlights two specific problems facing people into retirement:

They don’t know how long they’re going to live, which could be another 20 years on average and is getting longer. A retirement age of 65 may not be the right time to retire, but that’s a different question.

They will need to cope with inflation which over the last decade has averaged slightly over 6% per year. Assuming a similar rate of inflation going forward, this means that you need to grow your income by at least 6% to keep pace with the cost of living, and even a little more if your specific inflation rate is higher than the overall inflation rate.

Orford’s Real Income Fund has been designed very specifically to address these issues. The objective is to deliver a return of 1%-2% after inflation and including fees.

This means providing an income that grows in line with inflation while sustaining the level of capital over time and minimising any losses over a 12-month period. The asset allocation is actively managed to take advantage of changing market conditions.

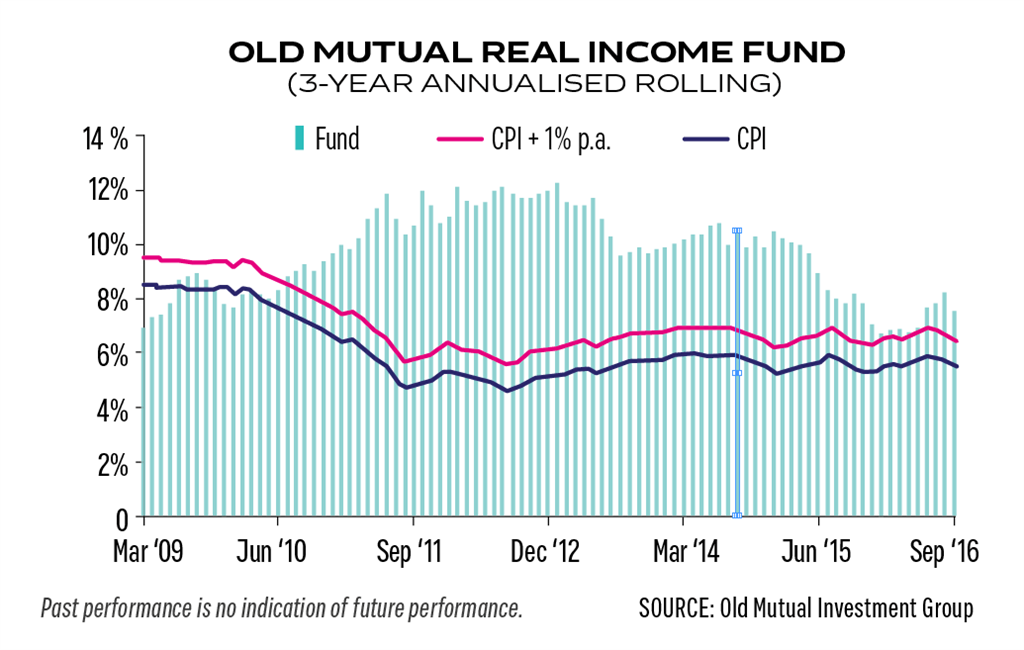

The average annual return has been 9.2% over 10 years; 8.9% over five years; 7.5% over three years; and 6.5% over one year. It’s a top-quartile performer if you compare it with multi-asset income funds over periods of five years or more.

The fund may invest in the full spectrum of fixed-interest investments. This includes a maximum of 25% in selected listed property and up to 10% in equities. Derivatives may be used for risk management purposes.

Immediate prospects

“Its returns during the past two years have been disappointing, but I’m confident that it will generate returns in line with its real target going ahead,” says Orford. “I don’t expect it to go back to delivering the kind of long-term returns that we have seen previously, and that’s simply because I don’t think that we’re in that kind of environment.

“But I do expect the fund over a rolling three-year period to continue to meet its inflation target, and certainly to beat money market funds, which it has done comfortably in the past.”

The current portfolio breakdown shows SA cash 48.1%, nominal bonds 19.2%, international bonds 6.7%, SA property 10.8%, international property 5.1%, and SA equities 4.5%.

“Growth assets aimed at delivering good returns over a period of time are an important feature of the fund relative to other multi-asset funds,” says Orford. “Naturally, it’s well-weighted with fixed-income assets and very much focused on generating income. The yield compares well with those of money market funds, and there’s a quarterly distribution.”

He concedes that the fund is marginally more volatile than its peers, but says that this is compensated for by offering more growth.

The 48% cash component is managed by Old Mutual associate Futuregrowth, and includes money market, deposits and considerable credit. “It’s a productive partnership that gives us access to the best credit manager in the country,” Orford explains.

He says the last two years the fund had too much exposure to the nominal bond market when the duration was a bit long. “But going forward I expect that it will give us some good returns, and, in fact, it has been one of the better performing asset classes the year to date.”

Global bonds are somewhat different, with wide spreads between emerging and developed market bonds. The former are currently looking better than previously, whilst performance on US bonds, for instance, ought to be impacted by the likelihood of higher interest rates shortly.

On domestic property, Orford expects the sector to offer reasonable returns. While operating conditions for South African companies are likely to remain tough over the next 12 months, interest rates should come down next year. This should benefit local property companies which are reasonably priced. Growthpoint, for instance, offers a forward yield of about 8% and with some growth in dividends should deliver a return of 10% or more per annum over the next couple of years.

This article originally appeared in the FundFocus supplement in the 8 December edition of finweek. Buy and download the magazine here.

Publications

Publications

Partners

Partners