When discussing long-term wealth creation, the amount of money you have has little to do with what you earn, but rather what you spend. I deal with clients regularly that earn well over R1m a year and have little to show, while people who earn less are better off.

In South Africa, where funding of your future pension obligations is not mandatory, it is more likely that people would be insufficiently funded to cover their commitments in fulfilling their pension obligations.

Well-served in retirement

Enjoying your retirement even on a small income is possible, provided you are willing to work hard and save consistently. It’s a common dilemma – people want to invest but don’t know where, how or what is best for them.

The difference between being prepared or unprepared for your retirement has more to do with early awareness. For most, the clear lesson to seek advice from an expert on investment options and finding solutions comes too late. Before investing your money into anything, learn the basics. You can do it yourself but it is far more risky if you don’t have a thorough knowledge or understanding of the financial markets or the different available asset classes.

Most South African’s aren’t sure what type of investment has performed the best over time, and when asked to choose from a basket of property, cash, bonds, shares and others; their perception, likely fuelled by the conditions around the current economic recession, is that property has outperformed other asset classes.

*Keep in mind that historic returns may not recur or be achieved in the future.

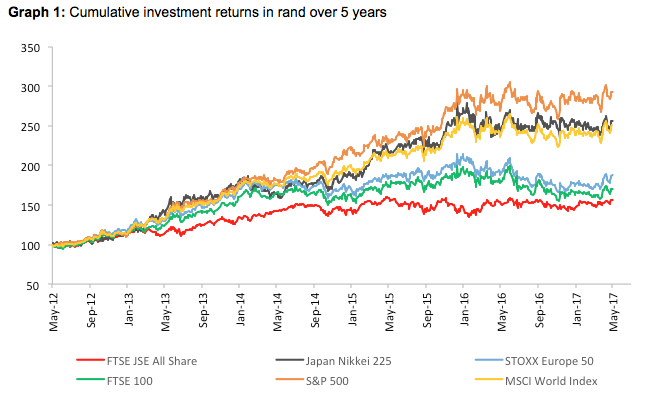

Market performance for the FTSE JSE All Share was 56%, Japan Nikkei 225 returning 156%, STOXX Europe 50 returning 87%, FTSE 100 returning 70% S&P 500 returning 193% and MSCI World Index returning 150%.

Despite a strong draw back in the rand from its high of R16/$, the JSE in rand terms has still underperformed.

However, for many South Africans, investing for the long term, is just too hard; more than two-thirds of our population believe investing is so difficult and requires seemingly endless research and monitoring. It’s a general lack of knowledge about platforms, products and taxes, which turns potential investors away or – even worse – delays their entry to long-term planning, becoming detrimental to both their pre-retirement and post-retirement happiness.

Others find investing too costly, with many people less likely to invest because it requires hard work and sacrificing money upfront on a regular basis. People generally lack awareness regarding the impact of retirement investing, believing it’s too hard, too costly and too far out of their expertise.

Albert Einstein - ‘Compound interest’ the world best invention

The earlier you begin to prepare for your retirement, the more you are able to take advantage of compounding interest. This is what I mean:

- R500 a month invested from age 25 to age 65 at a 10% return = R3 162 039

- R500 a month invested from age 35 to age 65 at a 10% return = R1 130 243

- R500 a month invested from age 40 to age 65 at a 10% return = R 379 684

It is seldom luck or inheritance or advanced degrees or even intelligence that enables people to amass fortunes. Wealth is more often the result of a lifestyle of hard work, perseverance, planning, and, most of all, discipline.

Income alone does not make one rich. It helps, of course, to build wealth, but the financially prepared look to their salaries as a means to an end, which is financial independence.

Many investors often say the journey to riches was far more fun than the reaching the goal – a journey that is about willingness to invest in the long term and wait it out. Most take the long-term approach to investing because they’re working at being financially independent. When they retire, they will know exactly how much they need to live on.

Recommendations for a prepared retirement:

- Live below your means: People with high incomes, who spend all their money, are not rich – they’re reckless.

- Plan: That means plan for today, tomorrow and years in retirement. Take time to understand and time to monitor it regularly. Use a budget and stick to it.

- Diversify: Allow for exposure to asset classes that aren’t related to each other.

- Reduce use of credit: Debt for luxury purchases or extravagant vacations will hinder your path to riches.

- Have access to cash: Six months worth of living expenses is ideal.

- Educate your children: Though talking about money with children ranks as one of the most dreaded conversations, it’s important for them to be well informed from an early age.

Publications

Publications

Partners

Partners